The Backdrop: A Quick Summary

- Omicron: The recent rise of the COVID-19 Omicron variant poses a potential threat to economic growth, with the possibility of slowing labor market participation and intensifing supply-chain disruptions. Early reports about the new variant have been mixed, with fears of immune escape pitted against hope of milder symptoms.

- Inflation: Pandemic-related supply and demand imbalances, longer-lasting supply chain problems, and increasing energy and rent prices have led inflation to run well above the Fed's 2.0% long-term target. The Consumer Price Index (CPI) rose 6.2% year-over-year in October, the sharpest increase since 1990.

- Federal Reserve: On the heels of Fed Chairman Powell’s comment that “it’s probably a good time to retire that word (transitory) when discussing inflation”, concern has grown in financial circles over implications of a sustained higher level of inflation. Chairman Powell’s hawkish statement prompted immediate selling of equities for the remainder of the trading period.

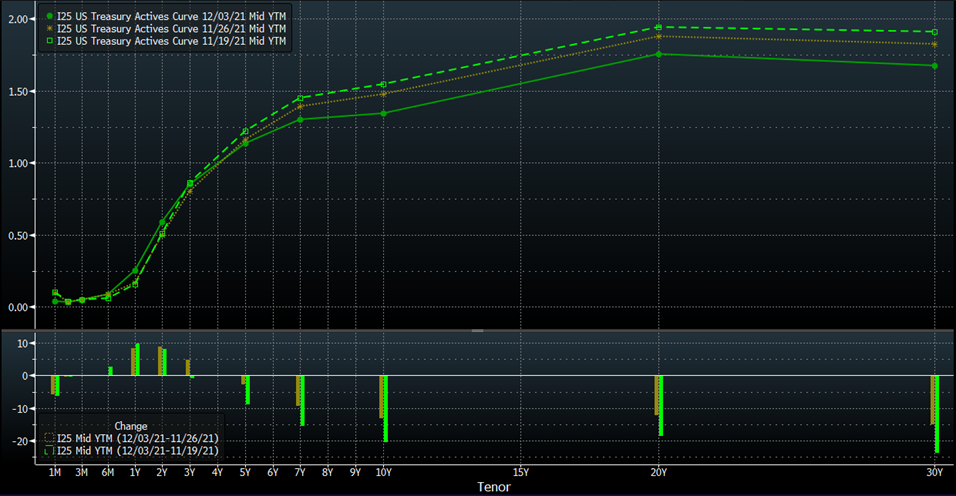

- Yield Curve: Chairman Powell’s comments also led to a recent flattening of the yield curve, with longer-term expectations of slowing growth and increased hawkish expectations in the short term (Figure 1). In addition to the Fed’s comments, investor market positioning also helped push the curve down, as investors bought longer-duration Treasuries while selling out of equities.

Figure 1. Bloomberg Professional L.P.

Managed Income Strategy

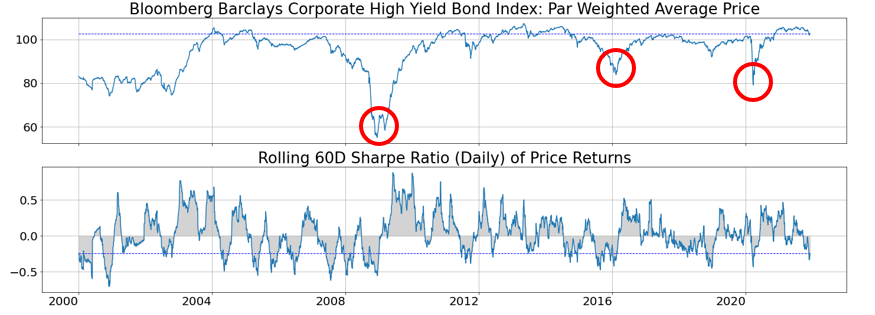

Our Managed Income Strategy moved to a risk-off posture during Thanksgiving week, our first such move since the first half of 2020. High yield fixed income securities have performed well relative to most fixed income classes in 2021, but the asset class has been trending down for the past two months, with the yield component propping up returns as prices declined. Our high yield trend-following system generated the “risk-off” signal on the heels of this sustained decline and allowed us to miss the brunt of the Friday sell-off that week.

Figure 2 below demonstrates the potential vulnerability we are seeing in high yield bonds at current price levels. The upper chart shows the Par Weighted Average Price of a high yield index back to the year 2000. The lower chart shows 60-day risk-adjusted performance. Historically, when prices move above “par” (100 on the left axis), there is little room for upward price movement and a much higher probability for meaningful drawdowns (circled in red).

Figure 2. Data from Bloomberg Professional L.P. Calculations performed by Kensington Asset Management.

Dynamic Growth Strategy

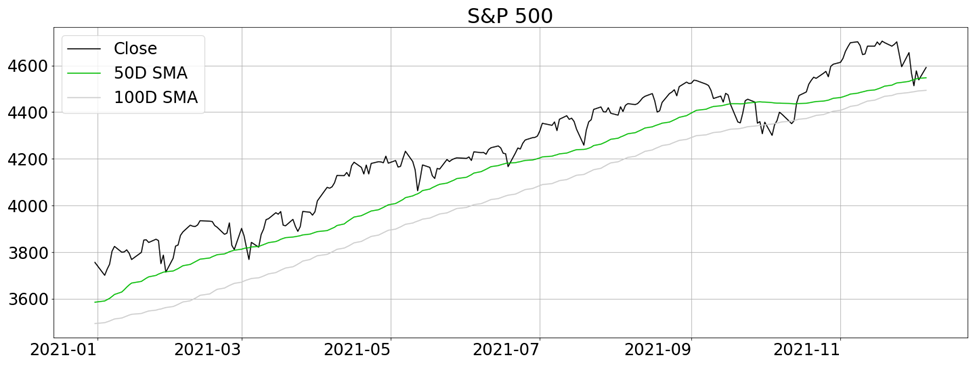

With many investors overweight equities at a time of historically high valuations, volatility spiked in late November in response to Fed hawkishness and the continued pandemic uncertainty outlined above. The market sell-off beginning November 19th through month-end was abrupt, resulting in a negative price return for the S&P 500 (down 0.83%) in November, a month that historically has benefited from seasonal tailwinds.

As the price trend continued to falter through month-end, our equity trend-following system signaled a “risk-off” posture in early December. From a technical perspective, the S&P 500 crossed its 50-day moving average and is nearing its 100-day moving average at the time of this writing, a historically bearish indicator for price movement. While our proprietary system does not incorporate these specific indicators, they are helpful in illustrating the critical decision boundaries in investor psychology that are prominent in today's narrative. This year investors have reflexively "bought the dip" at these levels; however, this recent move coupled with the weakness experienced in late September equates to an elevated level of risk under the current economic context.

Figure 3. Data from Norgate Data. Calculations performed by Kensington Asset Management.

Kensington Asset Management

In light of the recent risk-off posturing of both of Kensington Asset Management's strategies, it is essential to remember that although we provide the context of current events to relate to trading decisions, we adhere strictly to our systematic investment methodology. More so than ever, in an environment with both left and right tail movements, it's crucial to maintain a methodical and tested approach to mitigate downside exposure, while positioning our portfolios accordingly to capture positive trends.

Best regards,

Kensington Asset Management Team