Geopolitics: With the coming of spring also comes the well-publicized Ukraine counter offensive and an uptick in global geopolitical tensions. Russia has already increased its bombardment of Ukrainian territory to fortify their positions for the coming onslaught and to degrade morale. The success of this offensive will be crucial to the outcome of the war. As reported in the New York Times, Alexander Vershbow, a former U.S. ambassador to Russia and senior North Atlantic Treaty Organization (“NATO”) official, states that, “Everything hinges on this counteroffensive.” He added, “Everybody’s hopeful, maybe over-optimistic. But it will determine whether there is going to be a decent outcome for the Ukrainians, in terms of recovering territory on the battlefield and creating much more significant leverage to get some kind of negotiated settlement.”

Meanwhile, President Xi Jinping called Ukrainian President Volodymyr Zelensky to find common ground and open a pathway to peace. If China were to play an outsized role in resolving the conflict (as Henry Kissinger recently suggested) it would greatly reduce global tensions and elevate China’s standing within the global community. However, a proxy war between the U.S. and Russia serves many purposes for China, including spurring further discussions around the dominant role of the dollar in global commerce. While it would be foolhardy to suggest the dollar is in any danger of being supplanted as the world’s reserve currency, it’s clear China is pushing for a world in which other currencies will play a more important role in trade over time.

Stock market: Large-cap stocks continued to outperform in April, with the S&P 500 Index advancing 1.46%. In contrast, both mid-cap and small-cap indexes registered losses, with the S&P 400 Midcap index down -0.78% and the Russell 2000 Index falling -1.86%. International stocks were the best performers for the month, with the MSCI EAFE Index up 2.28%.

Year-to-date three sectors have outperformed the S&P 500 Index return of 8.59%: those being information technology, communication services and consumer discretionary. Given information technology and consumer discretionary sectors are considered cyclical (their constituent companies being more sensitive to the business cycle), the outperformance in 2023 has caught those calling for an imminent recession offsides.

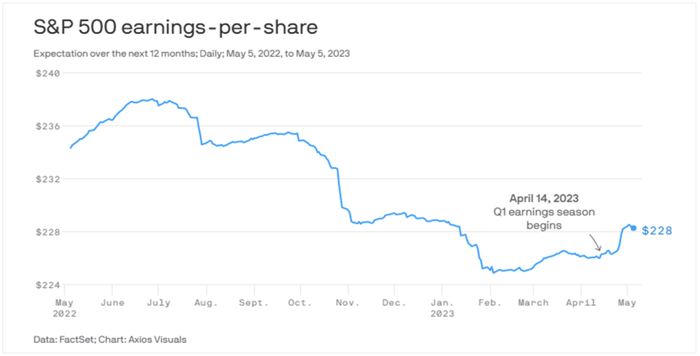

This month, investors were primarily focused on two areas: Q1 earnings and the fallout from the regional banking sector crisis. With regards to the former, reported earnings have handily beaten expectations. With 420 companies having reported at press time, the aggregate results are 7.2% higher than expected. Surprisingly, earnings expectations for the S&P 500 over the next 12 months are rising after having bottomed in February.

This is not to say we have reached the bottom in this cycle. As can be seen in the chart below, over the past year, earnings have declined in stair step fashion (analysts adjusting their numbers downwards after each earnings report) and logic would dictate the pattern should continue repeating itself until the Fed ceases its efforts to slow the economy. It will be more a matter of degree rather than direction.

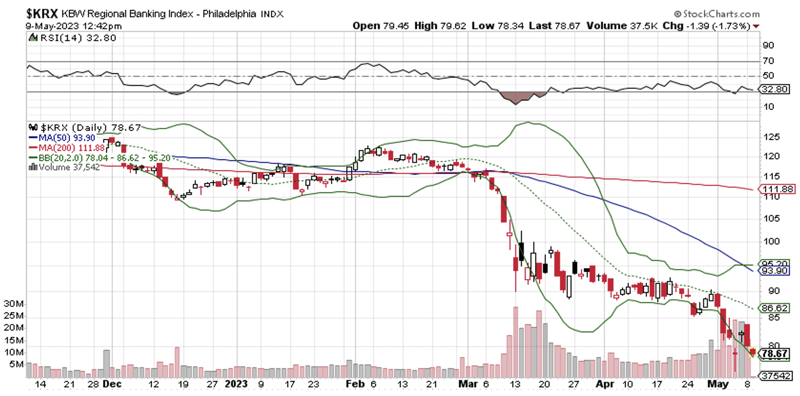

Turning to the banking crisis, investor panic appears to have subsided for now as the Federal Reserve (“Fed”) stepped in and provided liquidity to banks seeing unusually high withdrawals. Still the KBW Regional Bank Index continues to trade far beneath the levels seen before the crisis erupted, hardly indicative of the bank sector’s troubles being behind us.

Fed Monetary Policy and the Economy: At their latest FOMC meeting, the Fed raised interest rates another 25 basis points and removed from their policy statement the language, “The Committee anticipates that some additional policy firming may be appropriate.” Instead, they opted for a more dovish tone, stating that such firming would now be data dependent.

The Fed’s concern is justified regarding the potential negative effects of the regional banking crisis on the overall economy. Many of these institutions have significantly impaired balance sheets, and at the same time, they contend with a tidal wave of commercial real estate (CRE) maturities coming due over the next two years. According to Morgan Stanley strategists, about $1.5 trillion of CRE debt will come due by the end of 2025.

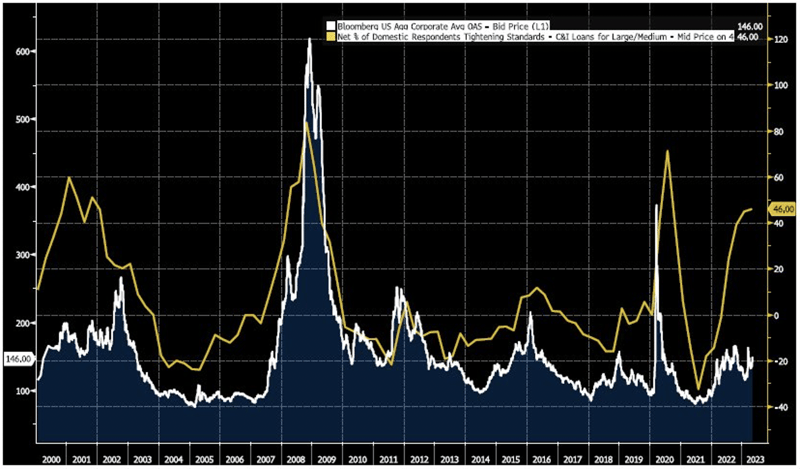

The Fed’s quarterly survey of bank lending conditions, SLOOS (Senior Loan Officer Opinion Survey) indicates an impending credit squeeze. Whether it will lead to an outright credit crunch remains to be seen. However, if history is any indication, the outlook is at the very least unsettled, and could quickly turn negative if fear once again grips bank depositors.

While Powell certainly doesn’t want to upset the financial system any further, he also has to address the issue of inflation, which is slowing but continues to run hotter than desired. Wage growth remains strong, and there is risk of a potential wage-price spiral leading to higher inflation expectations if not addressed. The Fed must tread a fine line, especially given how quickly confidence in banks can unravel, along with their solvency.

Moreover, the economy remains surprisingly resilient, with robust wage growth and employment numbers. Construction spending and employment have risen to new records this year, boosted by government outlays for infrastructure, a domestic manufacturing renaissance, and a wave of apartment building that got off to a slow start but has since rebounded.

Credit Markets: Bond market returns were positive in April, with the high yield sector leading at 1%. Following closely behind were investment grade corporates, which gained 0.77%, 10-year Treasuries up 0.72%, and mortgage back bonds advancing 0.52%.

In contrast to the stock market, bond investors are growing increasingly concerned about the outcome of debt limit discussions. Nowhere was this more evidenced than in the Treasury Bill market, where the yield spread between bills maturing before and after the debt limit deadline widened considerably.

Putting aside the debt limit, we have pointed out in the past the market is anticipating a series of rate cuts later this year. While most observers view this as a positive sign that inflation will drop to a level that allows the Fed to reverse course, a more ominous take is it portends a potential credit event due to a Fed policy mistake, leading to credit dislocation. Taking that one step further, one would expect to see a widening in credit spreads, which may be purely a matter of timing, as suggested by the chart below.

Source: Saba Capital Management as of April 30, 2023

Managed Income Strategy

The Managed Income Strategy shifted to a Risk-On posture at the beginning of April, as trends in US High Yield broke to the upside after market turbulence in March stemming from fears surrounding the regional banking sector. The Strategy is positioned predominately in US High Yield, with some investment grade credit exposure to mute pricing volatility if high yield credit exhibits higher volatility. Prices remained relatively range-bound throughout the month, allowing the Strategy to take advantage of elevated yield levels in the high yield category.

Dynamic Growth Strategy

The Dynamic Growth Strategy was invested in a Risk-On posture for the entirety of the month. During this time, the Strategy was tilted toward growth equities, which continue to outpace for the year. The equity markets were relatively calm during April, yielding positive returns while trading in a relatively narrow range. The Strategy remains Risk-On as of month end. In the short term, we expect some potential for intermittent Risk-Off trades. While the general outlook remains one of lower volatility for the short term, we remain vigilant and poised to react should volatility increase.

Active Advantage Strategy

The Active Advantage strategy spent the month of April generally invested in a balanced Risk-On posture. During the month, the strategy was invested in a mix of investment grade credit, higher yielding fixed income, and equities. As with the other strategies, Active Advantage remained positioned in this way throughout the duration of the month. Although the strategy is currently positioned in a balanced posture, should volatility increase, we anticipate the model configurations will move the strategy to a more conservative posture.

Click below to subscribe to our Insights!

Receive email notifications when new articles are published

Investing involves risk. Principal loss is possible.

Risks specific to the Managed Income Strategy include Management Risk, High-Yield Risk, Fixed-Income Security Risk, Foreign Investment Risk, Loans Risk, Market Risk, Underlying Funds Risk, Non-Diversification Risk, Turnover Risk, U.S. Government Securities Risk, Interest Rate Risk, Models and Data Risk.

Risks specific to the Dynamic Growth Strategy include Management Risk, Equity Securities Risk, Market Risk, Underlying Funds Risk, Non-Diversification Risk, Small and Mid-Capitalization Companies Risk, Turnover Risk, U.S. Government Securities Risk, Models and Data Risk.

Risks specific to the Active Advantage Strategy include Management Risk, Equity Securities Risk, High-Yield Risk, Fixed- Income Security Risk, Foreign Investment Risk, Loans Risk, Market Risk, Underlying Funds Risk, Limited History of Operations Risk, Non-Diversification Risk, Small and Mid-Capitalization Companies Risk, Turnover Risk, U.S. Government Securities Risk, Interest Rate Risk, Models and Data Risk.

There is no guarantee that the investment objectives will be achieved. Moreover, the past performance is not a guarantee or indicator of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

This is for informational purposes only and should not be construed as a solicitation to buy or sell, or to invest in any investment product or strategy. Investing in securities markets involves risk and the degree of risk varies by the type of investment or strategy. For a complete list of the risks associated with each of our Strategies, please review the Strategy Brochure and Factsheet. Materials such as blog posts, newsletters or commentary may contain information deemed to be correct and appropriate at a given time but may not reflect our current views or opinions due to changing market conditions. No information provided should be viewed as, or used as a substitute for individualized investment advice.

This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact the professional advisor of their choosing.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Kensington Asset Management, LLC (“KAM”). No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by KAM or any other person. While such sources are believed to be reliable, KAM does not assume any responsibility for the accuracy or completeness of such information. KAM does not undertake any obligation to update the information contained herein as of any future date.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular strategy. For example, a strategy may typically hold substantially fewer securities than are contained in an index.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

Definitions:

Equity Securities Risk: The Fund may invest in or have exposure to equity securities. Equity securities may experience sudden, unpredictable drops in value or long periods of decline in value. This may occur because of factors that affect securities markets generally or factors affecting specific industries, sectors, geographic markets, or companies in which the Fund invests.

Fixed-Income Security Risk: The Fund may invest in or have exposure to fixed-income securities. Fixed-income securities are or may be subject to interest rate, credit, liquidity, prepayment and extension risks. Interest rates may go up resulting in a decrease in the value of fixed-income securities. Credit risk is the risk that an issuer will not make timely payments of principal and interest. There is also the risk that an issuer may “call,” or repay, its high yielding bonds before their maturity dates. Fixed-income securities subject to prepayment can offer less potential for gains during a declining interest rate environment and similar or greater potential for loss in a rising interest rate environment. Limited trading opportunities for certain fixed-income securities may make it more difficult to sell or buy a security at a favorable price or time. Changes in market conditions and government policies may lead to periods of heightened volatility and reduced liquidity in the fixedincome securities market, and could result in an increase in redemptions. Interest rate changes and their impact on a fund and its share price can be sudden and unpredictable.

Foreign Investment Risk: Foreign investments may be riskier than U.S. investments for many reasons, such as changes in currency exchange rates and unstable political, social, and economic conditions.

High-Yield Risk: Lower-quality fixed income securities, known as “high-yield” or “junk” bonds, present greater risk than bonds of higher quality, including an increased risk of default. These securities are considered speculative. Defaulted securities or those subject to a reorganization proceeding may become worthless and are illiquid.

LIBOR Risk: Changes related to the use of the London Interbank Offered Rate (LIBOR) or similar interbank offered rates (“IBORs,” such as the Euro Overnight Index Average (EONIA)) could have adverse impacts on financial instruments that reference LIBOR or a similar rate. While some instruments may contemplate a scenario where LIBOR or a similar rate is no longer available by providing for an alternative rate setting methodology, not all instruments have such fallback provisions and the effectiveness of replacement rates is uncertain. The abandonment of LIBOR and similar rates could affect the value and liquidity of instruments that reference such rates, especially those that do not have fallback provisions. The use of alternative reference rate products may impact investment strategy performance.

Limited History of Operations Risk: The Fund has a limited history of operations for investors to evaluate. The Fund may fail to attract sufficient assets to operate efficiently.

Loans Risk: The market for loans, including bank loans, loan participations, and syndicated loan assignments may not be highly liquid, and the holder may have difficulty selling them. These investments expose the Fund to the credit risk of both the financial institution and the underlying borrower. Bank loans settle on a delayed basis, which can be greater than seven days, potentially leading to the sale proceeds of such loans not being available for a substantial period of time after the sale of the bank loans.

Management Risk: The Adviser’s reliance on its proprietary trend-following model and the Adviser’s judgments about the attractiveness, value, and potential appreciation of particular assets may prove to be incorrect and may not produce the desired results.

Market Risk: Overall investment market risks affect the value of the Fund. Factors such as economic growth and market conditions, interest rate levels, and political events affect U.S. and international investment markets. Additionally, unexpected local, regional or global events, such as war; acts of terrorism; financial, political or social disruptions; natural, environmental or man-made disasters; the spread of infectious illnesses or other public health issues (such as the global pandemic coronavirus disease 2020 (COVID-19)); and recessions and depressions could have a significant impact on the Fund and its investments and may impair market liquidity. Such events can cause investor fear, which can adversely affect the economies of nations, regions and the market in general, in ways that cannot necessarily be foreseen.

Models and Data Risk: The Fund’s investment exposure is heavily dependent on proprietary quantitative models as well as information and data supplied by third parties (“Models and Data”). When Models and Data prove to be incorrect or incomplete, any decisions made in reliance thereon may lead to securities being included in or excluded from the Fund’s portfolio that would have been excluded or included had the Models and Data been correct and complete. Some of the models used by the Fund are predictive in nature. The use of predictive models has inherent risks. For example, such models may incorrectly forecast future behavior, leading to potential losses. In addition, in unforeseen or certain low-probability scenarios (often involving a market disruption of some kind), such models may produce unexpected results, which can result in losses for the Fund.

Non-Diversification Risk: As a non-diversified fund, the Fund may invest more than 5% of its total assets in the securities of one or more issuers. The Fund also invests in underlying funds that are non-diversified. The Fund’s performance may be more sensitive to any single economic, business, political or regulatory occurrence than the value of shares of a diversified investment company.

Small and Mid-Capitalization Companies Risk: Investing in or having exposure to the securities of small-capitalization and mid-capitalization companies involves greater risks and the possibility of greater price volatility than investing in larger capitalization and more-established companies. Investments in mid-cap companies involve less risk than investing in smallcap companies. Smaller companies may have limited operating history, product lines, and financial resources, and the securities of these companies may lack sufficient market liquidity. Mid-cap companies often have narrower markets and more limited managerial and financial resources than larger, more established companies.

Turnover Risk: A higher portfolio turnover may result in higher transactional and brokerage costs. The Fund’s portfolio turnover rate may be significantly above 100% annually

Underlying Funds Risk: Investments in underlying funds involve duplication of investment advisory fees and certain other expenses. Each underlying fund is subject to specific risks, depending on the nature of its investment strategy. The manager of an underlying fund may not be successful in implementing its strategy. ETF shares may trade at a market price that may be lower (a discount) or higher (a premium) than the ETF’s net asset value. ETFs are also subject to brokerage and/or other trading costs, which could result in greater expenses to the Fund. Because the value of ETF shares depends on the demand in the market, the Adviser may not be able to liquidate the Fund’s holdings at the most optimal time, adversely affecting performance.

U.S. Government Securities Risk: The Fund may invest directly or indirectly in obligations issued by agencies and instrumentalities of the U.S. government. The U.S. government may choose not to provide financial support to U.S. government sponsored agencies or instrumentalities if it is not legally obligated to do so, in which case, if the issuer defaulted, the Fund might not be able to recover its investment.

Advisory services offered through Kensington Asset Management, LLC.