In our previous monthly commentary, we noted the dominance of the high-profile market leaders (Apple, Facebook, Tesla, etc.) was beginning to wain and a broadening of the market advance was needed to sustain the bull market. This transition is occurring without too many bumps and bruises as evidenced by the advance since the September 24, 2020 low in the stock market. As of this writing, the NASDAQ 100 Index is up 6.0%, while the Russell 2000 Index, a broad index of small-cap stocks, has gained 12.2%.

Furthermore, the NYSE Advance-Decline Line, a measure of strength in all stocks listed on the NYSE, has just broken into new all-time high ground. Prior occurrences of leading strength in this indicator are usually followed by higher equity prices.

A strengthening stock market bodes well for high-yield bonds, which are extremely sensitive to the economic cycle. The biggest fear of a high-yield bond investor is the threat of insolvency. Naturally, such occurrences of insolvency increase at times of recession. That’s why, despite the “Risk-On” status of the Managed Income model, the COVID 19 recession has caused us to temper our bullish enthusiasm. Thankfully, the full impact of the recession has been largely offset by massive monetary stimulus from the Federal Reserve.

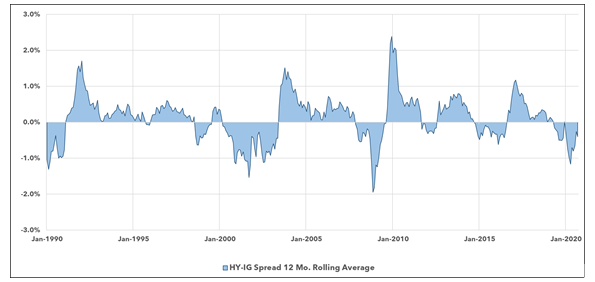

Another reason for our cautious stance is reflected by the chart below, showing the relationship between high-yield and higher quality investment-grade debt, on a 12-month rolling basis. When the shaded area is below the zero line, as is the case now, investment grade is outperforming high-yield debt. Note, though, how the indicator has strengthened in recent months. A crossing by the indicator into positive territory would be an encouraging sign.

Source data: https://research.stlouisfed.org/. Calculations byKensington Asset Management, LLC.

Lastly, many investors are nervous as the Presidential election approaches. The comfort of relying on Kensington’s quantitative methodology is that it has been tested by many challenging market environments and disruptive events over the past 29 years. Maintaining a vigilant eye to guard against pitfalls that befall markets in trying times is a hallmark of our process.

Best regards,

Bruce P. DeLaurentis

Kensington Asset Management, LLC.