March Recap:

Geopolitics: The war in Ukraine rages on with unusually blunt language being used to describe the actions and intentions of world leaders, indicating a widening geopolitical rift between East and West, with long lasting implications. It, at the very least, indicates global risk premiums have ratcheted higher. The move by the West to sanction Russia and truncate its access to the global financial system (what the Financial Times terms the “Weaponization of Finance”) will be viewed as a momentous one. In response, Russia, China and others are motivated to seek alternatives to the dollar, both in their reserve currency portfolio mix and as a day-to-day means to finance trade. While such realignment is likely to occur over a period of years, the dollar’s position as the world’s dominant reserve currency isn’t threatened in the near term.

Equities: The stock market rebounded strongly in March, erasing some early quarter losses but still ended the first quarter in the red. The S&P 500 Index’s total return fell -5.0% while the tech laden Nasdaq Composite was down -9.1%. The wide difference in declines between the two indexes can be attributed in part to the longer duration nature of growth companies - whose cash flows lie farther out in the future – and the underperformance of smaller cap stocks. While the market found its year-to-date low on February 24th, it spent the next two weeks backing and filling before launching a double-digit rally. The most compelling explanation for the reversal higher lies in investor positioning. Sentiment in early March was extremely negative and investors in the options and futures market were heavily hedged. Given how much option activity has grown over the past few years, it can now exert an outsized impact on prices in the short term. When prices found some stability and a bid appeared in the market, market makers quickly reduced their own hedges, accelerating the move upwards.

Fixed Income: Fixed income markets proved to be extremely volatile in March with the benchmark 10-year yield rising from 1.72% at the beginning of the month to 2.32% by month’s end, a rare 60 basis point move. The increase was driven by the highest inflation numbers in decades, the anticipated retreat by the Fed as an active bond purchaser, and the fallout from higher commodity prices. Even the threat of a widening war in Europe and a widely expected flight to safety in Treasuries had little effect. The result was the worst monthly performance since 2004 (Bloomberg US Treasury TR Index). At the same time the 10-year was selling off, shorter-term Treasuries sold off even harder, resulting in an inversion in parts of the yield curve (i.e., short-term rates exceed longer-term rates as expressed, for example, in the 2-10 yield spread). Yield curve inversions immediately engender cries of an oncoming recession, but history suggests the onset of recession could be months away and sometimes problematic. In fact, one of our favorite recession indicators, high yield credit spreads, have actually tightened recently, suggesting the market is more concerned about price levels than the pace of economic activity.

Monetary Policy and the Federal Reserve: The Federal Reserve met this month and announced a 25-basis point hike in the Fed Funds rate with as many as six more hikes to come in 2022. It also forecasts four more rate hikes in 2023, which would push the rate up to 2.8% or higher. As experienced monetary observers know, the market moves in advance of such policy actions and the 2-year Treasury note is already yielding 2.4%, 220 basis points above where it traded as recently as last September. The Fed’s intent is to drive interest rates higher in order to slow the economy, thereby reducing pricing pressures. The hope is that a reduction in aggregate demand will relieve stress on stretched supply chains and input prices, without pushing the country into recession. On top of these moves, the Fed will be announcing in April its plan for reducing the size of its balance sheet. Markets are increasingly jittery about the size and rapidity of the program, as a similar effort in 2018 produced a significant stock market selloff before Fed Chairman Powell capitulated and reversed policy.

Managed Income Strategy

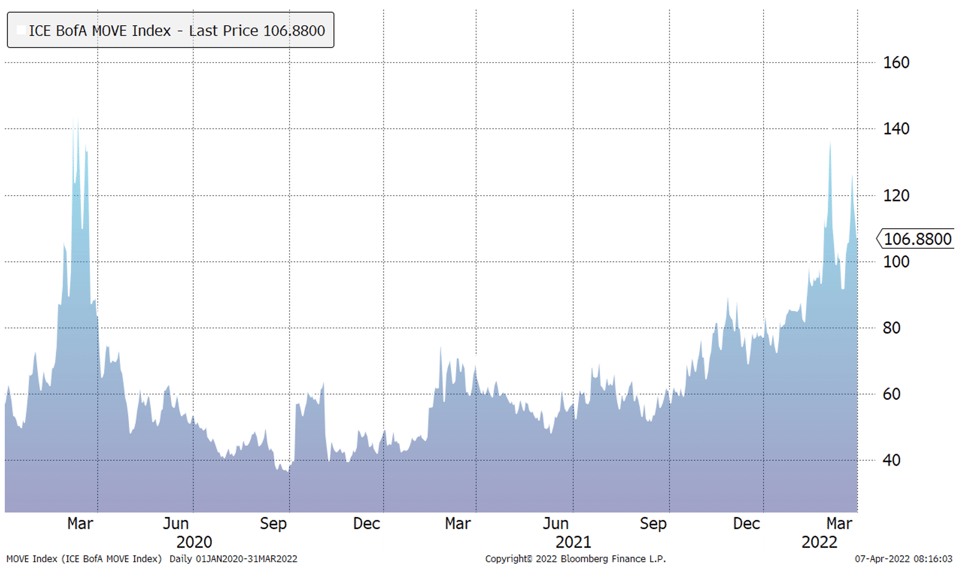

Kensington’s Managed Income Strategy remained risk-off through the end of Q1 as bond prices ratcheted down and volatility spiked throughout the first quarter. The degree of volatility we saw, as evidenced by the ICE BofA MOVE Index (“MOVE”) which measures bond market volatility, was striking (see chart), moving above 120 twice in the quarter, a level not seen since Q1 2020 at the onset of the pandemic. Fortunately, our Managed Income Strategy has sidestepped the significant decline in fixed income markets since the beginning of the year, preserving capital until an appropriate re-entry point is determined.

Dynamic Growth Strategy

Despite the ongoing conflict in Ukraine, elevated commodity prices and the Fed raising their target rate by 25 bps in mid-March, we saw major U.S. equity markets rebound to close the quarter with the S&P 500 up 3.6% in March, clawing back more than half its losses from the lowest point of 2022. Volatility subsided in the second half of March, with the VIX closing the quarter at 20.56 after hitting a 52-week high of 38.94 on March 7, 2022.

The Dynamic Growth model responded to stronger performance and dampened volatility by triggering a Risk-On signal mid-March and we re-entered the equity market at that time. Our Risk-On posture remains in place at quarter-end, but we remain cautious and ready to exit if our model warrants. While our primary objective is risk avoidance, we are happy to participate in positive market trends when they present themselves.

Best regards,

Kensington Asset Management Team