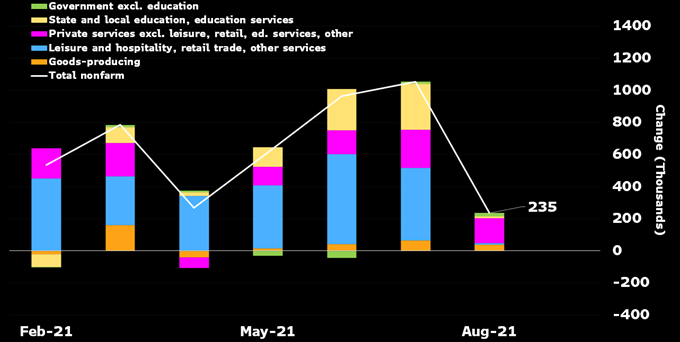

It has been largely expected by market participants that the Fed would soon announce the start of tapering (reduction of asset purchases). However, the weak Nonfarm Payroll print on September 3rd has clouded the outlook for a taper timeline. Although the labor market has made substantial progress during the recovery, fears of the Delta COVID variant may have been a likely driver for the miss in job gains for August (235K actual against a 725K consensus estimate). As shown in Figure 1 below, job growth in high contact, Covid-sensitive sectors suffered the most.

Figure 1. Monthly job growth by sectors. Sources: BLS, Bloomberg

Employment growth has been a focus of the Fed, so the disappointing job statistics suggest the Fed could push back the taper timeline and remain more accommodative until the desired improvement in labor statistics is achieved. On the other hand, the more hawkish Fed members argue that higher-than-expected wage growth and other factors are driving inflationary pressures and therefore warrant that tapering begin sooner rather than later.

Despite these concerns and an uncertain outlook, prices of financial assets continued to rise, notwithstanding some turbulence in the month of August. There are some similarities with the current macro environment to the few years prior to 2016, albeit occurring in a more compressed time period. Equities continued to perform well through 2013 and 2014, even in the face of tapering and a rising 2-year Treasury yield. It wasn’t until 2015 that equity returns faltered at the announcement of a rate hike occurring at a time of slowing economic growth and an energy crisis driven by an oil supply glut. Currently, the 2-year has started to rise from levels earlier this year, and the discussion of tapering is at the forefront, but the timeline of rate hikes is far from imminent.

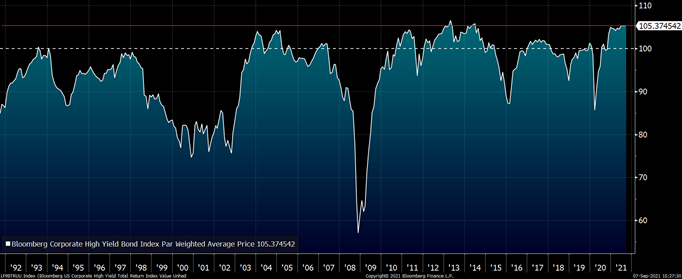

One of the more sensitive asset classes to the economic cycle is high yield bonds. The recent surge in demand for lower quality credit has driven the par-weighted average price of the Bloomberg High Yield Corporate Bond Index to a level not seen since the 2013-2014 period. As can been seen in Figure 2 below, high yield is now trading at a historically high premium above par value. Although this would suggest tempered upside expectations, it is important to remember that economic growth remains strong. This was not true at prior valuation peaks. Should economic growth remain steady and default rates low, the high yield asset class may not be as adversely affected by the prospect of tapering.

Figure 2. Bloomberg High Yield Corporate Bond Index Par Weighted Average Price. Sources: Bloomberg

At Kensington Asset Management, we are always cognizant of the economic backdrop and its implications for the price trends of risk assets. We also recognize that markets rarely behave in line with intuitive expectations. That’s why we adhere to a strict model-driven process to tactically protect our clients’ investment principal, while striving to participate in rising market uptrends. In the face of a difficult market environment plagued with negative news and uncertainty, we are pleased that our process has successfully kept us appropriately positioned in a bullish mode, which has enabled our clients to benefit from the continued advance in asset prices.

Best regards,

Kensington Asset Management Team