In last month’s commentary, we highlighted the seasonal adage, “Sell in May and go away.” Adding to our concern this month is a bearish signal from an important measure of investor sentiment: the recent surge in the growth of margin debit balances. Debit balances are the total amount of money owed by the customer to a broker or other lender for funds borrowed to purchase securities. Broad investor willingness to borrow money to buy securities is a sure sign of over optimism and a warning markets may be setting up for a correction.

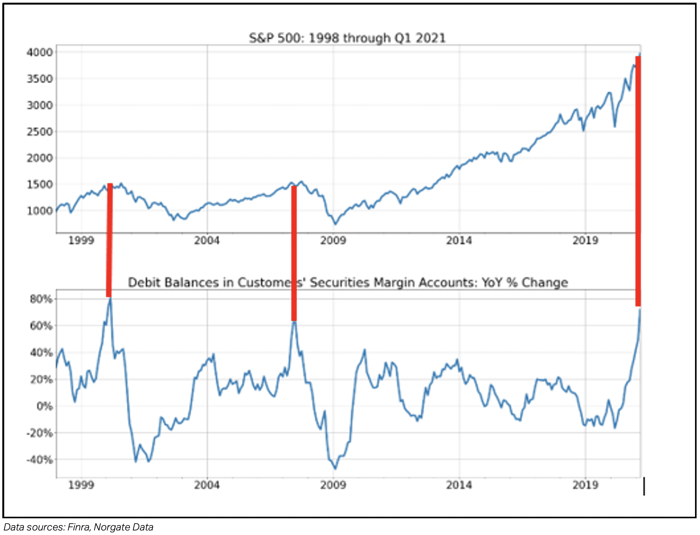

Historically, an extreme (60%+) year-over-year change in margin debt is a rare occurrence, as illustrated by the chart below. Notice the red lines connecting the points in time when the year-over-year increase exceeded the 60% threshold. The prior two incidences preceded the last two major bear markets. The most current reading suggests it may again be time for a more defensive stance going forward.

The concern that investor sentiment may be reaching a bullish extreme is also supported by other anecdotal evidence: the growing trend of retail fondness for so-called “meme” stocks, cryptocurrencies, call options and other higher-risk offerings. Together with more fundamental reasons for caution in the form of rising interest rates and the possibility of major tax increases ahead suggests the need for a more tactical investment approach such as Kensington’s model-driven process, which has always sought to mitigate losses during significant market downturns.

Best regards,

Bruce P. DeLaurentis

Kensington Asset Management, LLC.