January Recap:

- The Economy: Strong numbers continue to print as the US economy expands. Quarter over quarter GDP growth was significantly higher than expected for December (6.9% actual vs 5.5% consensus), and the labor market remains robust, although tight, with a lower than expected unemployment rate (3.9% actual vs 4.1% consensus) and higher than expected average hourly earnings (4.7 % actual vs 4.2% consensus).

- Inflation: The global supply chain remains gridlocked, especially in shipping. According to the supply chain experts Project44, “Delays are likely to continue well into 2022 as Covid breakouts continue throughout supply chains and consumers continue to buy at a healthy rate.” This, combined with rapid economic expansion, helped drive December’s inflation rate to 7%, topping November’s reading of 6.8%.

- Monetary Policy: The Federal Reserve continues to communicate a hawkish stance, considering its mandate of maintaining price stability in the face of high inflation. In the FOMC press conference, Chair Powell emphasized that the Federal Reserve plans to be “humble and nimble” and did not explicitly rule out the possibility of hiking the policy rate at every meeting this year. Market participants are expecting one 25bp hike in March, with at least four for the year.

- Geopolitical Unrest: Russia’s actions near the Ukrainian border threaten international stability as it amasses troops in what appears to be preparation for invasion. This marks the greatest escalation in the ongoing conflict between the two countries since 2014. In response, the US and NATO member nations are threatening harsh sanctions should Russia intensify its aggression.

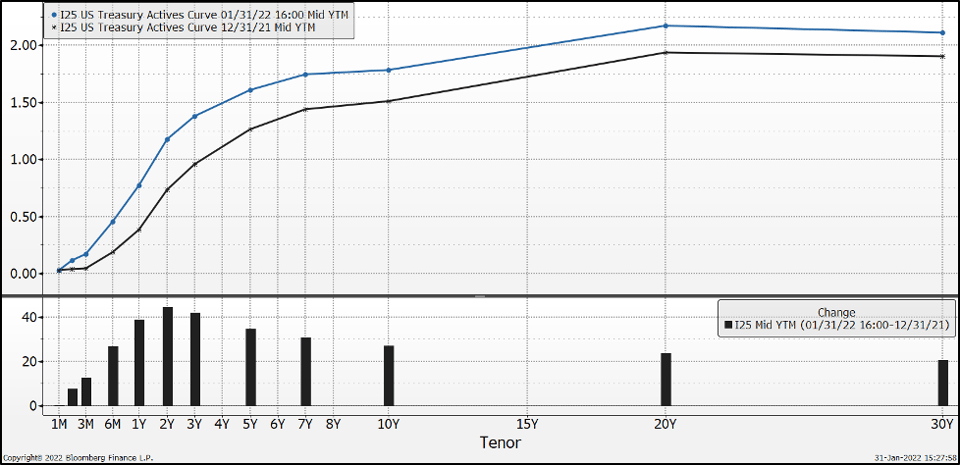

- Asset Class Performance: Despite the growing economy, expectations for hawkish monetary policy led to a tough month for US equities. The S&P 500 Index fell over 5%, while the tech concentrated NASDAQ 100 Index fell more than 8%. Bonds also suffered, with the entire Treasury yield curve shifting upwards over the month, pushing prices down, as shown in Figure 1. Generally, in inflationary environments with tight monetary policy, stock-bond correlation tends to be more positive, thus providing headwinds for diversification.

Figure 1. US Treasury Active Curve. Data provided by Bloomberg Financial L.P.

Dynamic Growth Strategy

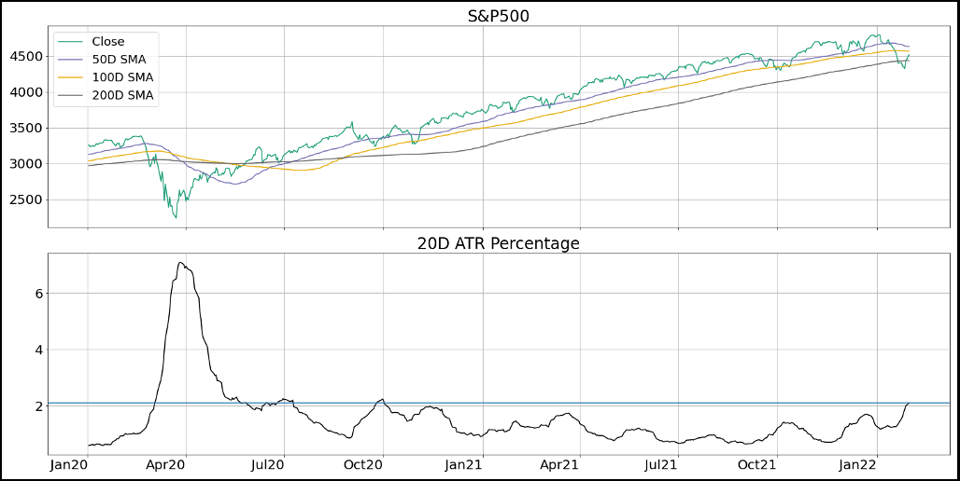

Because of the risk-off positioning maintained by the Dynamic Growth Strategy since early December, the strategy was able to sidestep the decline in equities during January. Volatility continued to expand throughout the month as trading ranges became stretched for the index, as measured by average true range as a percentage (“ATR Percentage”), as shown in Figure 2. This measure reached levels not seen since October 2020. Generally, because levels of volatility tend to be persistent, we can expect to see larger movements (both up and down) in the upcoming weeks as the market searches for areas of liquidity.

Figure 2. Data From Norgate Data. Calculations performed by Kensington Asset Management.

Managed Income Strategy

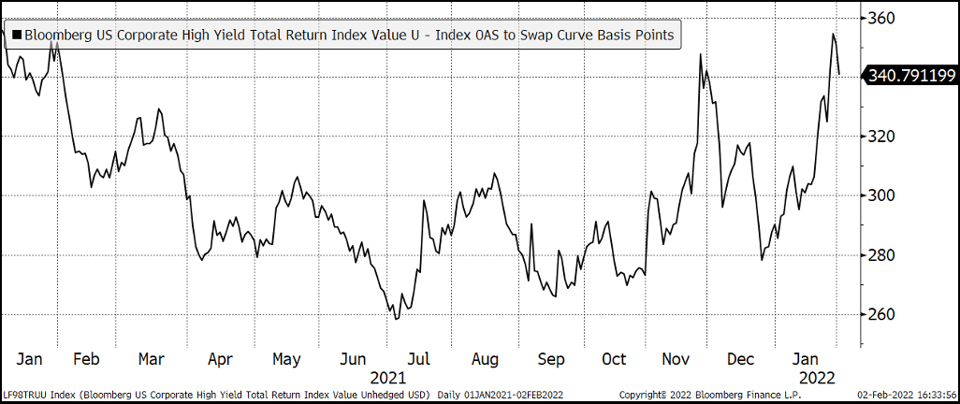

Since the end of December, high yield spreads seem to be on the rise again and have surpassed November 2021 levels, shown in Figure 3. Despite the current strong economy and projected low default rates, market participants are worried that the Federal Reserve will be forced to tighten policy conditions more aggressively than expected to combat inflation. If this happens and the economy slows down, default rate expectations could readjust upwards and adversely affect high yield bond prices. Our Managed Income Strategy has maintained a risk-off posture since the end of November. If high yield spreads continue to rise, our model will likely keep positioning risk-off.

Figure 3. Data provided by Bloomberg Financial L.P.

Kensington Asset Management

Considering the Federal Reserve’s hawkish stance, we at Kensington Asset Management believe that active management of investments will be crucial in navigating the current macroeconomic environment. At Kensington, we have utilized quantitative methodologies to tactically capture trends and mitigate drawdowns in times of stress for our clients over the past 30 years. As this year progresses, we will be vigilant and adhere to our process, and we thank our clients for their trust in us.

Best regards,

Kensington Asset Management Team