Despite the unlikelihood of a return to anywhere near normal economic activity anytime soon, the ongoing advance of risk assets continues to defy conventional wisdom. Many pundits find the juxtaposition of the worst recession since the Great Depression and elevated stock prices as bewildering which is perfectly understandable. We were cautious as well. However, the Fed’s massive liquidity injection into financial markets and direct underwriting of the federal government’s fiscal spending has been sufficient to turn investor sentiment and prices upward.

As markets rose, our technical indicators eventually became overwhelmingly bullish, leaving us no choice but to become fully invested. That was the right decision as Kensington’s Managed Income strategy over the last couple of months has been decidedly positive.

Experienced investors know markets are forward looking. For now, investors are willing to look past the current severe economic slowdown and focus on the government’s willingness to support consumer and business spending until a vaccine is developed. One can argue about the correctness of this policy but for now financial markets, the stock market in particular, are signaling a more positive outcome than most forecasters believe.

The reason we pay significant attention to the stock market is due to the high degree of correlation between equity and high-yield bond prices. That interrelationship is understandable, since high yield debt sits just above equity in the capital stack, and the valuation of both are, over the long run, driven by future expectations of corporate profitability.

So far, the stock market advance has been overwhelmingly powered higher by a select group of familiar technology names: Facebook, Apple, Amazon, Netflix and Google (known as the FAANG stocks). Although these continue to push ahead, it's interesting to note our work is suggesting the broader stock universe, which has been languishing since June, is now showing evidence of starting another leg up. For example, the Russell 2000 Index which is broadly representative of smaller companies, broke above its June high on August 5 on increasing relative strength. The Dow Industrials, which is made up of larger companies, is about to follow suit. This broadening price strength is reason for encouragement.

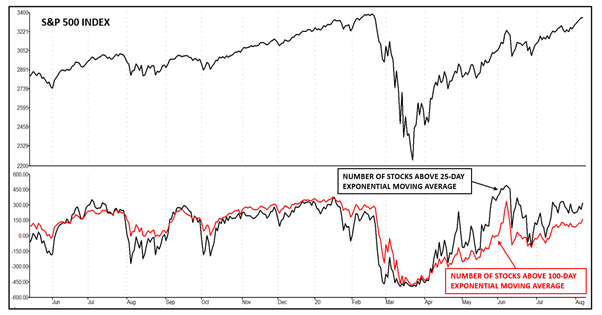

The following chart compares the daily close of the S&P 500 Index to the number of stocks above their 25-day (in black) and 100-day (in red) exponential moving averages. The black line crossing below the red line is a sign of weakening internal technical strength and a precursor to an overall market decline. At present, the black line is above the red line, which is a sign of strength and supports our expectation the market still has room to advance.

The advance from the March lows will come to an end at some point and when it does, we remain confident our exit will be timely enough to keep any loss within the tolerance level of most risk-averse investors. That confidence is based on a model that has successfully navigated numerous up and down cycles since 1992. Until then, we remain fully invested.

Best regards,

Bruce P. DeLaurentis

Kensington Asset Management, LLC.