May Recap:

Geopolitics: The proxy war in Ukraine continues with neither side ready to concede. Reports the Biden administration was preparing to send long-range rocket systems to Ukraine have heightened tensions, although the Administration quickly issued assurances such weapons would not be used to attack targets inside Russia itself. On the ground, Russian forces in the eastern part of the country appear to be slowly advancing at a heavy cost to both men and material. In a blow to Putin’s erstwhile goal of protecting its western flank from what it considers an increasingly aggressive West, Finland and Sweden announced their intentions to join NATO in a reversal of their previous neutral stance.

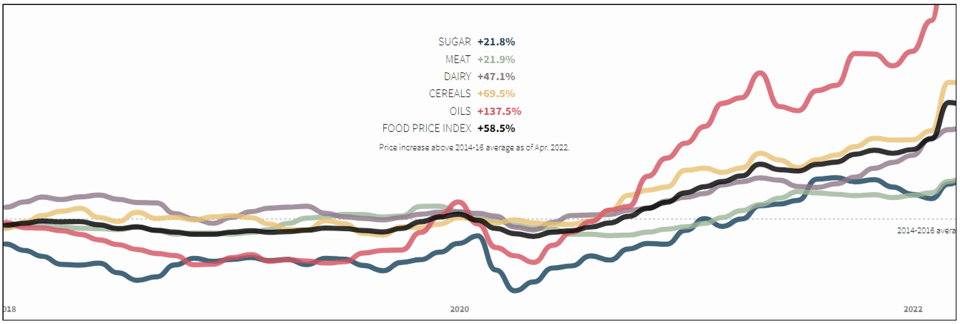

Resource markets, particularly oil, fertilizer and foodstuffs, have advanced strongly in reaction to prices reaching new highs for the cycle. Russia and Ukraine supply 28% of globally traded wheat, 29% of the barley, 15% of the maize and 75% of the sunflower oil. With exports from the two countries severely reduced or halted altogether, government officials around the world are growing increasingly more fearful of dwindling food supplies in their own countries.

Source: Reuters

Over the month of May, China remained in lockdown in its effort to stamp out Covid (recently rolled back). The shutdown continued to roil supply chains worldwide with negative repercussions for global growth. Authorities did act by easing monetary policy in an effort to stimulate economic activity in time for the 20th National Congress of the Communist Party to be held later this year.

Stock Market: The S&P 500 finished flat for the month (+0.18%) and is now down -13.03% for the year. The Nasdaq 100 ended May in the red -1.53% and is now down -21.98% for the year. Major indices hit new lows in the month before rebounding dramatically in the last six trading days of May. The S&P 500 approached falling into a bear market (traditionally defined as a decline of 20% or more from peak to trough) while the Nasdaq 100 was down over -30% at its low.

As equities searched for reprieve over the course of the month, a sharp reversal in Treasury yields was concurrently taking place, driven by investor perception that the growth in year over year inflation had or was in the midst of peaking. If a slowdown in future price increases were to materialize, it could alter the speed and size of the Fed’s tightening program. At a minimum, the lower risk-free rate represented by Treasuries, and a still benign earnings backdrop, have provided ballast for the market.

Corporate earnings growth, while slowing due to increasing macro headwinds, remains positive overall. At the end of 2021, analysts estimated S&P 500 earnings of $216.14 for the year ahead. At the end of May, that had increased to $228.03. The combination of lower stock prices and better earnings reduced the index’s price-earnings ratio to the 17-18x range, a substantial decline from the low 20s P/E ratio seen in the 4th quarter of last year.

Bond Market: While the benchmark Treasury 10-year yield topped earlier in the month, investment grade bonds were not as quick to respond and lower grade bonds even less so, with high yield bond prices not bottoming until the 20th of the month essentially in tandem with equities. For the month, the Bloomberg Aggregate Bond index returned 0.64%, with investment grade corporates faring slightly better (0.93%) and lower grade high yield bonds a bit worse (0.25%).

The market wrestled most of the month with a global economy that was clearly slowing in the face of significant macro headwinds (Fed tightening, China lockdown, war in Ukraine impacting European growth, higher consumer costs). Investor uncertainty was apparent in lower corporate issuance overall, with many lower grade offerings being pulled entirely for want of buyers amid widening credit spreads.

At the margin, though, the market was slowly improving as evidenced by the decline in the MOVE index, a measure of bond market volatility. The combination of relative lower yields and greater price stability eventually set the stage for a snap-back reversal in the last week of the month. The reversal was particularly acute in high-yield spreads, which dropped 72 basis points over the span of five trading days.

Monetary Policy and the Federal Reserve: The Federal Reserve announced a 50-bps point hike in early May and indicated it may need to make several more hikes before it is able to bring inflation down to its target long-term rate of 2%. In addition, it will allow $47.5 billion in Treasury and agency bonds to mature in each of the next three months, with that amount increasing to $95 billion in September. In the FOMC minutes released late in the month explaining its actions, the Committee said it expected robust growth in consumption spending, driven by strong household balance sheets and an extremely tight labor market, offset by higher price pressures. It is hopeful that tighter monetary policy, together with an easing of supply bottlenecks, a further rise in labor force participation, and the waning effects of pandemic-related fiscal policy support could help reduce the supply–demand imbalances in the economy and lower inflation over the medium term.

It did note the employment cost index of hourly compensation in the private sector – an important gauge of structural inflation in the system – rose 4.8% over the 12 months ending in March; this gain was much larger than the corresponding 12-month changes posted in each of the preceding four years and was the largest 12-month increase since 1990.

Dynamic Growth: Much ink has been spilled on whether the recent stock market advance is the start of a new phase in this long-term secular bull market or merely a rally in a bear market. At Kensington Asset Management we believe such debates are of little use, and focus instead on quantitative tools to determine market supply and demand, and whether the time is right to invest. Our model moved to a risk-on posture in the second half of May allowing us to capture the late month equity rally.

Managed Income: As mentioned, the bond market’s price improvement over the course of the month first evidenced itself in higher Treasury prices, before flowing through to investment grade securities and ultimately lower grade offerings. This migration is to be expected, particularly during times of market stress, as cautious investors first seek out safer securities before venturing forth into higher risk debt as confidence increases. Our Managed Income model tracks such behavior along with price dynamics in other related markets and triggered a buy signal at the end of the month.