Geopolitics: China’s economy continued to struggle in November as its population remained in partial lockdown in its now three-year attempt to rid itself of COVID. The populace is growing increasingly frustrated with how the government is administering the program, resulting in demonstrations throughout the country. In response, authorities have acted to ease financial conditions and recently ratcheted back its disease prevention policies.

Last month The People's Bank of China announced a 25-basis-point reduction in the nation’s banks' mandatory reserve ratio – a move that frees up liquidity and will stimulate lending. This is the highest liquidity injection by the PBOC in 18 months. Together with the ECB’s softening in its policy language, weaker oil prices (West Texas Crude has dropped ~40% from its peak in June) and a falling dollar, the global liquidity picture is beginning to brighten. In addition, there is thought the Federal Reserve will be acting to reduce its Reverse Repo Facility injecting deposits into Treasury Bills. The net effect is to bring these reserves back into the financial system which will have a meaningful effect on liquidity and, albeit with a lag, financial markets.

Stock market: November ended with a bang as the S&P 500 index rose 3.09% on the last day of the month to cap a broad rally across equity indices. The S&P 500 finished the month up 5.38%, the tech-centric Nasdaq 100 was higher by 5.48% while small capitalization stocks lagged with the Russell 2000 advancing 2.15%. International and emerging markets strongly outperformed for the first time in many months on the back of a weakening dollar with the MSCI EAFE (Europe, Africa and the Far East) index up 6.8%.

The rally was spurred by a relatively benign headline Consumer Price Index report that showed year-over-year prices rising 7.7%, well below consensus forecasts of 8.1%. The core month-over-month inflation rate was even more positive, rising only 0.3%, significantly less than the market’s expectation of 0.5%.

The market is now at a crossroads as it deals with the conflicting forces of a strong but slowing economy (the Atlanta Fed’s latest GDPNow forecast for real GDP in Q4 is 3.4%) and a Federal Reserve intent on reigning in inflation chiefly by reducing aggregate demand and tightening financial conditions. The question now for equity investors is how high and how long will the Fed choose to tighten and what impact will that have on corporate earnings. Bulls are betting the Fed will be forced to slow its rate increases earlier than the market currently forecasts while bears believe it will take higher rates for longer before inflation is under control resulting in a deeper recession than the consensus expects. This push and pull among market participants is triggering frequent price whipsaws as new data is digested, resulting in a difficult environment for even the most experienced manager and calls for disciplined risk management.

Turning to the profit picture, Street consensus expectation is for an 8% drop in earnings in 2023. But Wall Street analysts are perennially overoptimistic and top-down strategists project a far dourer outlook. One highly respected strategist, Mike Wilson of Morgan Stanley, forecasts S&P 500 earnings will decline to $195 in 2023, a drop of 11% and 16% below the Street consensus. He also points out that since P/E multiples usually shrink in bear markets, the combination of lower earnings and lower multiples may pose a treacherous environment for investors going forward. At the same time, looking at multiples by capitalization reveals a more nuanced valuation picture. While the S&P 500 Index is trading at ~17x current earnings, the mid- and small cap indexes are trading at far lower multiples, 13.5x and 12.5x respectively. With the exception of 2008, that’s as cheap as they’ve been in years.

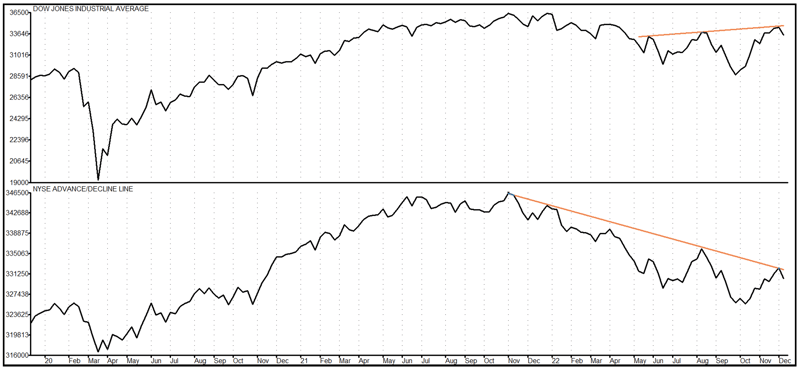

From a technical standpoint, the rebound in share prices has produced an interesting longer-term divergence that bears are watching. As the chart below shows (and at the time this Commentary went to press) we are at important resistance points in both the Dow Jones Industrial Average price level and the NYSE Advance Decline Line. While these resistance levels would suggest a pause of some kind, it carries a potentially more ominous warning in that the trajectory of the A/D line is trending downwards even as the DJIA has broken out to three-month highs. The topping of the A/D line back in November of last year presaged the bear market of 2022 and continues to argue the need for caution.

Source: Kensington Asset Management

Bond market: The relatively benign inflation reports last month resulted in a strong rally across the board in bond prices. Leading the pack were investment grade corporates which were up strongly, advancing 5.18% in the month. Treasuries in aggregate gained 2.68% while the more credit sensitive high yield sector returned 2.17%.

Looking forward, all eyes will be on the CPI report in early December with prices expected to continue their slow decline from this year’s peak. The Fed has already signaled it intends to slow the pace of rate hikes in December to better assess their impact on the economy and ensure markets are functioning properly. A factor in their signaling was the recent upset in the U.K. gilt market which without the intervention of the Bank of England might well have pushed some investment funds into insolvency. The experience was a reminder of how quickly markets can unravel in a leverage unwind and as a result, the goal of financial stability has taken on greater importance for Central Banks as they navigate a global economy slowdown.

The closely watched 2-year Treasury yield, the market’s own prognostication on the future direction of Fed rate policy, peaked at 4.73% on November 3rd before falling dramatically on the positive inflation news releases, ending the month at 4.34%. While the drop was substantial, it was less than the even more pronounced fall in the 10-year yield, resulting in the 2-10 year spread widening to multi-decade highs. It’s important to note that dating back to 1978, the time between a yield inversion and the start of a recession can be quite long. The median period, excluding the 2020 recession, is 76 weeks. The current inversion began on March 31, 2022, so if history is a guide, a recession is still a ways off.

In his address to the Brookings Institute on November 30th, Powell laid out his thoughts on inflation and labor markets. He pointed out there is an immense labor force shortfall of roughly 3-1/2 million in the U.S., due to in the Fed’s opinion: 1) excess retirements - retirements in excess of what would have been expected from population aging alone and 2) a steep drop in immigration and the surge in mortality from the pandemic. Because none of these causes can be easily (if at all) reversed, they suggest wage pressures (and their accompanying impact on overall inflation) will be with us for a while. The overall picture is of a labor force that has changed dramatically since the pandemic and in a fashion that suggests the long-term secular decline in inflation and interest rates is likely over.

Managed Income Strategy

The Managed Income Strategy remained Risk-Off through the month of November. Despite modest gains in the high yield fixed income sector since mid-October, negative longer-term trends held the strategy in a Risk-Off posture, as it has been for most of 2022. Thankfully, negative price action throughout the year has driven yields higher and we are able to garner yields north of 3.5% for our cash positions while Risk-Off.

Dynamic Growth Strategy

The Dynamic Growth Strategy entered its 5th Risk-On trade in mid-November in response to the positive reversal in equity markets that began in October and remained Risk-On through the end of the month. However, despite the recent rally, equity markets began to soften toward the end of the month, with just two positive days since the Thanksgiving holiday. Continued weakness and potential escalation of volatility, which has been on a downward trajectory since early October, could result in a change in posture to Risk-Off in the coming weeks. Given the longer-term negative trend in equity markets through 2022, Dynamic Growth remains in a cautious posture with focus on protecting the downside.

Active Advantage Strategy

The Active Advantage Strategy was defensively positioned throughout November, primarily allocated to cash. The Strategy has taken on slight equity exposure in November for similar reasons outlined above in Dynamic Growth. At the end of the month, the strategy was positioned with approximately 20% exposure to equities, with the balance defensively positioned in cash and cash equivalents.