Geopolitics: The 20th National Congress of the Chinese Communist Party closed on October 22 with the coronation of President Xi Jinping as the nation’s ruler. From 1982 to 2018, the country’s constitution had stipulated a President could not rule for more than two consecutive terms of five years each, but the term limits were removed effectively rubber stamping Xi as President for life.

Some political pundits speculated the moves to consolidate power by President Xi might be a precursor to the country’s invasion of Taiwan in the not-too-distant future. Such speculation was tempered by Xi’s public pronouncement he is willing to work with the U.S. for mutual benefit and press reports officials are working to arrange a face-to-face meeting between President’s Xi and Biden at the G-20 meeting in Bali, Indonesia.

China’s economy is still struggling with the harsh Covid lockdown and a real estate sector whose bubble has burst. Recently, though, rumors have spread that China plans to relax its Covid policy over the next few months allowing the country to partially reopen. If such an easing does take place, it will certainly help shore up demand at a time when the global economy is flagging and further ease supply chain issues.

Turning to the Ukraine war, there have been recent press reports that the Biden Administration’s national security adviser, Jake Sullivan, has held undisclosed talks with Russian counterparts to minimize the odds of nuclear escalation and keep the lines of communication open between the two countries. It was also reported the Administration made a request of Ukraine to signal to Russia it is open to peace negotiations, something President Zelenskyy has refused to do so long as Putin remains in power.

Stock Market: The stock market rebounded strongly in October with the Dow Jones Industrial Average up 13.95%, its best performance in 46 years. The S&P 500 gained nearly 8% while the small cap Russell 2000 index rose 10.94%. Notably, technology stocks didn’t fare nearly as well with the megacap tech stock-laden Nasdaq 100 up only 3.96%. As we’ve pointed out numerous times, high P/E stocks are quite duration sensitive (although less and less so as stock prices fall) and with interest rates rising during the month, it’s unsurprising this sector has lagged. Many of these technology companies are also seeing their revenue and earnings growth flag and at the same time customers are growing increasingly cautious about the macro environment. As orders slow, these companies are experiencing the negative leverage of excessive employee growth and stock-based compensation.

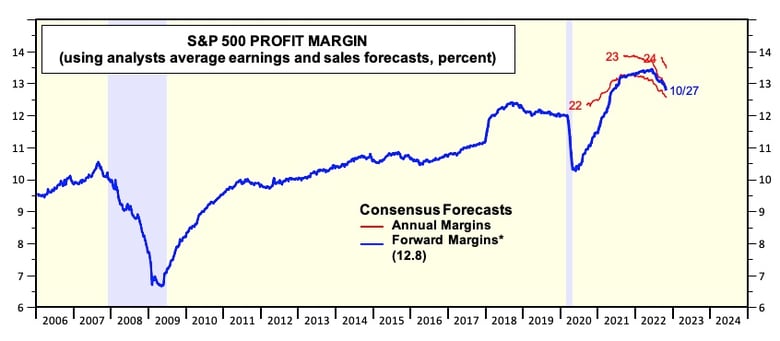

The stock market rally was principally in reaction to investors’ overly pessimistic outlook for the economy, inflation and by association corporate earnings. While input costs, including employee compensation, are rising, companies’ revenues are also increasing, driven by price hikes. So, while the quality of earnings may be deteriorating (see below), for now, profit margins remain at near record highs and supportive of positive, albeit slowing, earnings growth. Eventually the slowdown in the economy will stymie unit sales growth and revenue growth won’t be able to keep up with expenses, but at least in the short-term the earnings picture turned out to be more sanguine than many bearish forecasters envisioned.

The market also rallied on hopes the Fed would begin to slow the pace of rate hikes on the basis of peak inflation. While this is now becoming a bit of a perennial war cry for the bulls, prices are beginning to roll over as demand shrinks, particularly in the manufacturing sector. ISM manufacturing prices in October fell to 46.6 from the previous month’s 51.7 and far beneath consensus forecasts of 51.6. Durable goods orders ex-Transportation fell -0.5% month over month, a negative surprise relative to consensus expectations of 0.4% growth.

However, the services side of the economy is still in expansion mode offsetting the slowdown in manufacturing. The ISM Non-Manufacturing PMI came in at 54.4 in October with prices actually increasing month over month. Since the non-manufacturing sector makes up nearly 70% of the economy and core inflation and labor markets continue to show surprising strength, the outlook for a slowdown in the pace of Fed tightening rests more on their desire to pause to gauge the effects of tightening steps taken to date rather than any convincing price data.

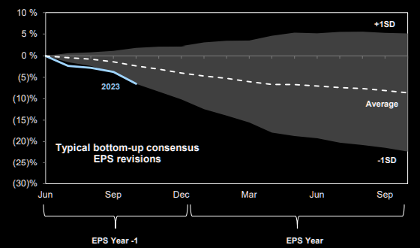

Shifting to earnings, analysts are cutting their 2023 estimates at a historically rapid clip as evidenced in the chart below.

Source: Goldman Sachs Group, Inc. – November 3, 2022

The driving force in these downward revisions is the sharp forecasted drop in profit margins. Supply chain issues and rising wages are raising costs at the same time that a Fed-induced economic slowdown is sapping demand. While this interplay is typical of tightening cycles and can be expected to reverse once the economy slows, it is a matter of intense discussion whether long-term profit margins have peaked. Analysts point to structural headwinds in the coming years in the form of deglobalization / reshoring, reversing the tremendous cost savings companies have enjoyed over the past two decades. A change in the power dynamics between capital and labor and the rise of populism will only accentuate the trend reversal.

Source: Yardeni Research, Inc. – November 3, 2022

Monetary Policy and the Fed: The Fed raised rates another 75 basis points at their latest FOMC meeting, a highly anticipated move given the continuing stickiness of price increases. Fed Chairman Powell made it clear it’s far too premature to think of a pivot away from tightening program, but he also suggested (along with other Fed governors) there may come a time to pause and evaluate outcomes in the not-too-distant future.

The Fed desperately wants to see a slowdown in hiring which would slow aggregate demand and reduce price pressures. Unfortunately, labor markets continue to be surprisingly strong: the four-week average of unemployment claims is hovering around 219,000 and while the unemployment rate ticked up to 3.7%, both nonfarm payrolls and average hourly earnings were higher than expected.

From a longer-term perspective, labor force participation remains far below pre-Covid levels. While some of this can be attributed to older workers, many of whom have taken early retirement, the number of 20–24-year-olds returning to the labor force is far below what one would expect at this point. (Workers aged 25 to 54 have returned in numbers close to pre-pandemic levels.) Without greater work force participation, labor markets can be expected to remain tight. Overall, there was nothing in the data the Chairman could point to as a reason to downshift in any meaningful way.

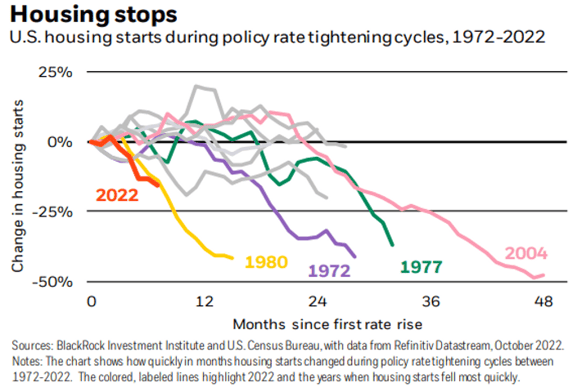

One area where Fed policy is having an impact is on the interest sensitive sectors of the economy. Housing starts are falling at the fastest rate in 50 years, surpassing the drops seen in past aggressive rate hike cycles in the 1970s and early 1980s and even the real estate crash in the mid-2000s. Residential investment makes up ~18% of GDP, so the slowdown in housing will have a significant impact.

It is important to keep in mind, though, the overall economy is much less interest rate sensitive than in previous cycles. Regulatory changes emanating from the Great Financial Crises have made the economy more resilient in the face of rising interest rates and asset prices through less reliance on variable rate home loans, less leverage and higher bank capital ratios. These changes have increased the financial stability of the economy but also mean the Fed will likely need to raise rates higher for longer to bring inflation down to its desired level. Of course, this also runs the risk of something “breaking” in the meantime, similar to what was seen last month in the U.K. gilt market.

Bond Market: The bond market suffered another difficult month with the Barclay Bloomberg Aggregate falling -1.3%, the U.S Treasury Composite down -1.39% and the U.S. Corporate Investment Grade Index down -1.3%. Bucking the trend - not surprisingly given the positive bias in equities - was the U.S. Corporate High Yield Index, which returned 2.6%. From a term structure viewpoint, short-term bonds fared relatively worse than longer duration maturities with the 2-10 Treasury yield curve further inverting to a cycle low at -52 basis points.

Pressure on the bond market has emanated from numerous sources aside from the Fed’s own QT program. Foreign countries who feel politically vulnerable have been persistent sellers since the imposition of financial sanctions on Russia. Others who have seen meaningful falls in their currencies vis-à-vis the dollar have sold their Treasury holdings in an effort to support the value of their own currencies. In addition, the Treasury Department’s QRA (Quarterly Refunding Announcement), which details how much new issuance the Treasury expects to issue in the upcoming quarter (Q1 2023), came in at $300B, far higher than expected. This additional issuance will be focused on the short end of the curve for now, putting further pressure in turn on leveraged bond buyers.

While rates markets pushed higher, credit spreads peaked and actually finished lower by month’s end. This decline was particularly notable in the high yield sector in a general risk on move. While this spread tightening certainly signaled an improvement in overall market tone, there was little follow through in the way of actual activity. Corporate issuance in October was a paltry $91B, matching September’s poor showing, and further confirmation credit markets remain in the doldrums.

Ultimately, interest rates should correlate (inversely) with the direction of overall price levels as bond investors will demand a higher return to offset the loss of purchasing power from inflation. Measuring those price levels from the perspective of various timeframes, though, can render much different answers about inflation pressures. Taking the consumer price index as an example, it is most often quoted in annual terms. In the month of October, the CPI rose 8.2% year-on-year, well above the Fed’s target of 2%, sounding a discouraging note about how little progress has been made to date. However, if we narrow the aperture and take a snapshot of inflation using only a three month look back, the picture changes markedly.

Marketwatch examined inflation by converting month to month changes into an annual rate (the manner in which the CPI is reported to the public) and then used a three-month smoothed average of those annualized monthly changes to measure inflation. As we can see in the chart below, from July through September, the CPI rose at a 2% annual rate in line with Fed policy. That was far below the three-month average of 11% seen for the March to June period and the year over CPI print. While not conclusive, this approach may be a sign that perhaps the inflation story isn't as dire as some suggest.

Source: Bureau of Labor Statistics via Haver Analytics - October 15, 2022

Managed Income Strategy

The Managed Income Strategy shifted to a Risk-Off posture in late August and has remained defensive through the end of October. As bond prices continue to slump in the face of ongoing rising rates there have been few opportunities to gain in the sector. Yields, in particular for higher yielding securities, are at very attractive levels (ICE BofA US High Yield Effective Yield was above 9% much of October), setting up what may be an attractive opportunity in the weeks and months to come. Until we can achieve price stabilization, however, we will continue to posture defensively and take advantage of improving yield levels in cash equivalents and shorter duration Treasuries.

Dynamic Growth Strategy

Despite the run up in equities in late October, the Dynamic Growth Strategy remained Risk-Off through the end of the month. Dynamic Growth primarily tracks the NASDAQ Index to determine price trends and, as noted above, the tech-heavy index has lagged other equity markets, keeping the Strategy defensive. If equity strength continues into year-end, we may have an opportunity to re-enter the markets, but we remain cautious of further potential downside pressure.

Active Advantage Strategy

Following suit, the Active Advantage Strategy also remained Risk-Off through the month of October but shifted to a Risk-On balanced position between fixed income and equity at the close of the month. It is a good reminder that while Active Advantage draws from similar models and logic to Managed Income and Dynamic Growth, it can and does key on other factors and can operate on a slightly different cadence from the other two. End of month strength in both equities and the high yield market tipped the strategy into the Risk-On market. Nevertheless, we have positioned the Strategy conservatively during this period given the risk of potential downside pressure.