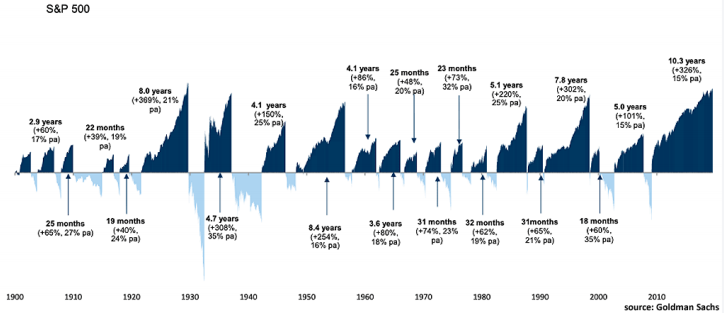

The bear market that ended in March of 2009 was one of the worst in history. Now, over 10 years later, it’s being followed by the longest bull market in history. To put it another way, it’s the longest stretch without a 20% correction since 1900, as illustrated by the chart below.

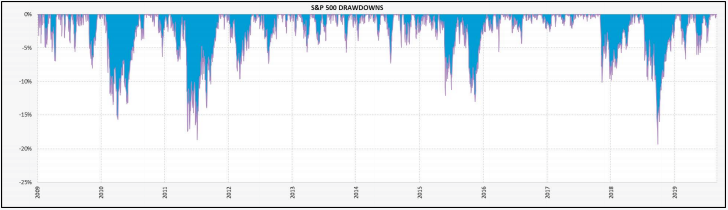

That’s not to say because there hasn’t been a 20% correction in the decade-long bull market it’s been a smooth ride. The next chart shows there’s been an average of about two 5% or more corrections per year since the bull market began. Most investors have been unable to stay 100% invested through these declines, especially when the media harps on each drop as the possible start of a bear market.

The end result is that the majority of investors have failed to fully benefit from this bull market.

In contrast, Kensington’s Managed Income strategy focuses on higher-yielding debt securities as opposed to equities. These securities are inherently less volatile and thanks to the strategy’s adept timing, our investors have not experienced a single drawdown of more than 5% since inception in 1992, making it far easier for them to remain invested. Over that time, Managed Income’s returns have roughly matched those of the major equity indices with only a fraction of the risk.

At some point in the future, this bull will turn into a bear and equities will have their comeuppance. The strength of Managed Income is that it has protected us from the ravages of every bear market for the last 28 years. It’s important to bear this in mind, especially given the maturity of the current bull market and historically high valuations.