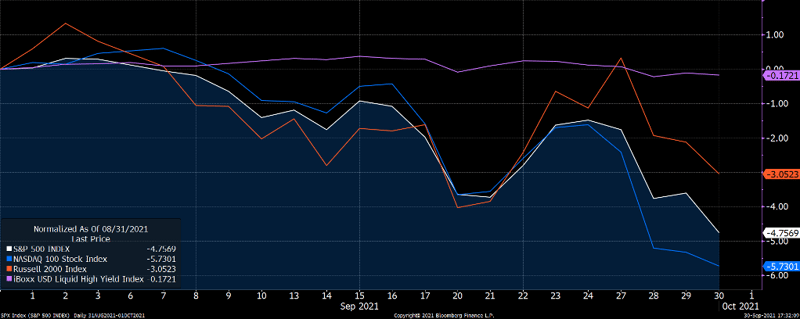

Although the stock market adage, “Sell in May and go away” is often quoted, there is another seasonal pattern that has plagued the U.S. equity markets in recent decades. The “September Effect” refers to the tendency for the month of September to exhibit weak stock market returns. In fact, September has been the worst-performing month for the S&P 500 over the last twenty years and is the only month to show negative average returns over this period. This September, seasonal headwinds struck again, causing the S&P 500 to have its worst monthly performance since March 2020. On a total return basis, the S&P 500 ended a streak of seven consecutive positive months, declining 4.7%.

On the other hand, despite the pullback in equities and a late month rise in the 10-year US Treasury yield of 18 basis points to 1.475%, high yield bond prices held up relatively well as default rates remained low through the end of the 3rd quarter.

All Eyes on the Fed

Leading into September, investors were focused on the September 22nd Federal Open Market Committee (FOMC) meeting, anxious to see if the Fed would convey any policy change to their monthly asset purchase program, (which begin in March 2020 in response to the economic impact of the COVID-19 pandemic) or provide any guidance to short term interest rates, which have been at zero percent for that same period.

Initially many market participants expected the Fed to announce a “taper,” or reduction in asset purchases, in September, but weaker than expected employment numbers early in the month suggested that the tapering announcement might get delayed, which we discussed in our last commentary.

Reactions to the meeting were a bit mixed, as no formal announcement was made, but the Fed’s Chair, Jerome Powell, indirectly indicated that asset purchase tapering could start by the end of this year (possibly as soon as their next meeting in November) and set expectations for it to conclude sometime in the middle of 2022. In recent months, all indications have been that the test for tapering is centered around “maximum employment” and the Fed’s inflation targets. Powell stated that, at least in his view, both tests have essentially been met.

This guidance comes despite the continued adverse impact on growth from the COVID-19 Delta Variant and ongoing supply chain bottlenecks impacting global production.

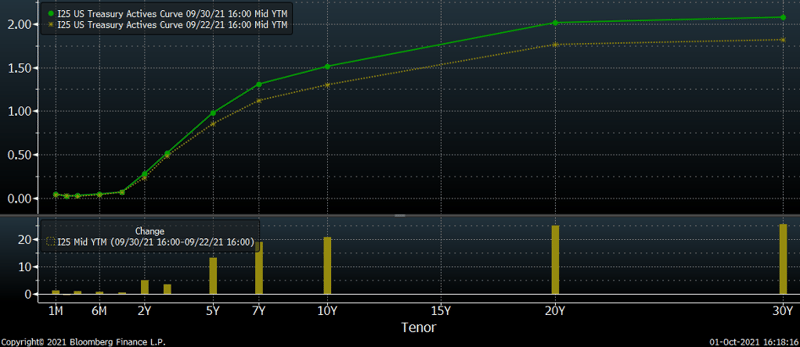

Regarding potential rate hikes, despite no formal decision, investors took notice of the Fed’s interest rate projections for the next several years, with a consensus expectation that rates could increase to 1.75% by the end of 2024. Chairman Powell did indicate that any potential rate hikes would likely not commence until after the taper process is complete, which would likely extend through mid-2022. Yet, despite the lack of immediate action, fixed income markets reacted, causing a rise across all tenors in the days following the announcement.

Leading up to the November FOMC meeting, investors will look to interpret the employment numbers released on October 8th, the health of the global supply chain and ongoing U.S debt ceiling discussions.

Closing

While it is important to be aware of current events, in times of fundamental uncertainty in markets we believe that the best way to generate steady, above-average positive returns with low volatility and downside exposure is to employ an investment methodology that has the potential to recognize and measure consistent and repeating behavioral patterns in the financial markets. With that goal in mind, we have developed clearly defined quantitative decision models that strive to minimize subjectivity and eliminate “noise” in the decision-making process to achieve our goals. This process helped us to navigate the month of September especially well, as it dictated a reduction in risk ahead of some of the worst days of the month in both our equity and fixed income strategies. We will continue to monitor fundamental developments across markets, but we have and always will strictly adhere to our disciplined model-driven process to manage risk in challenging market environments in order to protect client principal.

Best regards,

Kensington Asset Management Team