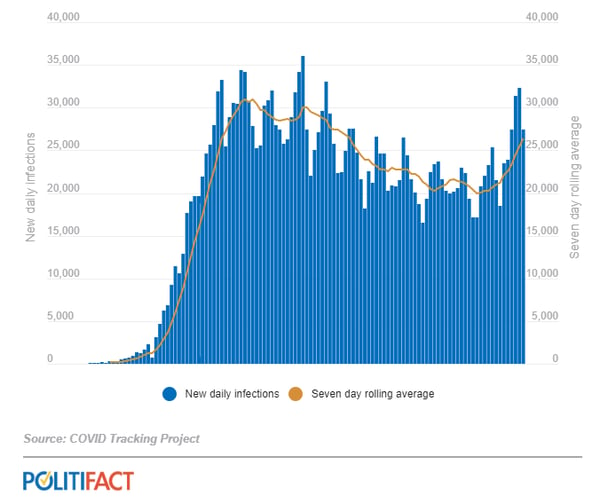

The elevated economic uncertainty that has persisted since the onset of the Covid 19 pandemic has yet to abate. Several regions of the country are now seeing a resurgence in infections, apparently in response to a slowly opening economy (although increased testing may also be a factor). This is raising investor fears that a “second wave” is upon us and economic activity will remain depressed for an extended period. The chart below starkly illustrates that nationwide cases have started to increase after a long period of decline.

New daily infections and seven day rolling average from February 29 to June 21, 2020

The virus’s negative impact on the economy has been exacerbated by the widespread protests that turned violent in many urban areas of the country. Passive responses from authorities have resulted in substantial economic losses for many small businesses.

Needless to say, suppressed economic activity extending for months into the future is problematic and will likely push more and more companies over the edge and into bankruptcy. Already, many small business have closed and are not likely to reopen. According to the American Bankruptcy Institute, there were 560 commercial Chapter 11 filings in April, a 26% increase from last year. Some of the more high profile bankruptcies include JCPenney, Neiman Marcus, J. Crew and Hertz.

Temporarily offsetting the dramatic fall in economic activity is the continuing commitment of the Federal Reserve and Treasury to provide massive amounts of liquidity to consumers and businesses. Direct purchases by the Fed of a broad cross section of corporate debt have helped limit defaults and served to buoy high-yield corporate bond prices. Given the enormous size of government support to debt markets, we continue to maintain exposure to the asset class, but in a more conservative manner than would be the case if the economy was in a healthier state.

Today, risk-averse fixed income investors are faced with an unprecedented dilemma. Interest rates are at an historic low and many investors are seeing their certificates of deposit come up for renewal at rates that make absolutely no sense, especially when taxes and inflation are taken into account. When looking at fixed income alternatives, such as corporate bonds, the problem is compounded because the fragility of the economy has introduced an unprecedented and unpredictable level of default risk, even to some of the most recognized corporations in America.

In response to this dilemma, many conservative investors are forced to invest in higher yielding, but much less secure fixed income instruments or increase exposure to even higher risk equities to have any chance of achieving their investment goals. Doing so, however, can dramatically elevate one’s risk profile and lead to substantial losses if the economy fails to rebound. Does it make sense to venture into these riskier asset classes in the midst of such economic uncertainty without a safety net? The answer to that question should be obvious and is the exact reason why Kensington’s Managed Income strategy makes more sense than ever.

Our goal has always been to generate attractive returns over an entire market cycle and, importantly, limit principal drawdowns during adverse market conditions. By following the guidelines of our disciplined and time-tested investment methodology, Managed Income has been able to successfully navigate the ups and downs of the high-yield bond market over the past 28 years. The avoidance of significant losses during the sharp market decline earlier this year underscores that message.

We continue to emphasize the need for patience in recognition of the investment and economic challenges we face. More turbulent price action may yet lie ahead so we must remain diligent. Eventually though, and perhaps sooner than people expect, the current state of uncertainty will subside and more favorable economic conditions will unfold. We expect to be well positioned to take advantage of the opportunities that a return to normality will provide.

Best regards,

Bruce P. DeLaurentis