Investing in High Yield in a Rising Rate Environment

Monetary Policy Headwinds Ahead

Since the start of the coronavirus pandemic, the Federal Reserve has implemented several trillion dollars worth of stimulus measures to combat the damage resulting from the massive and sudden halt to the economy. These measures have largely succeeded in their goals, as can be seen by a resumption of robust economic growth. However, the recovery is now plagued with the side effect of high inflation, which has recently surged to an annual rate of 7%, the highest in 40 years. Consequently, inflation and the inevitable rate hikes are at the forefront of most investor concerns.

Most market observers expect several rate hikes from monetary policymakers. In a January 10th report, Goldman Sachs opined that they estimate four interest rate hikes in 2022, with the Fed starting to reduce its balance sheet in July. The tone present in FOMC member press conferences seems to support the expectation of tighter monetary policy. According to St. Louis Fed President James Bullard, "The FOMC could begin increasing the policy rate as early as the March meeting in order to be in a better position to control inflation." Chair Powell himself has stated that "It is really time for us to move away from those emergency pandemic settings to a more normal level."

With such widespread expectations of multiple rate hikes, especially in the face of historically high risk-asset valuations, investors must carefully think about preparing their portfolios for this new environment. In doing so, we encourage investors to embrace an active approach, especially with regard to their fixed income holdings. Tactically investing in high yield debt can provide value in a rising rate environment, while mitigating the risk of large drawdowns.

High Yield is Different

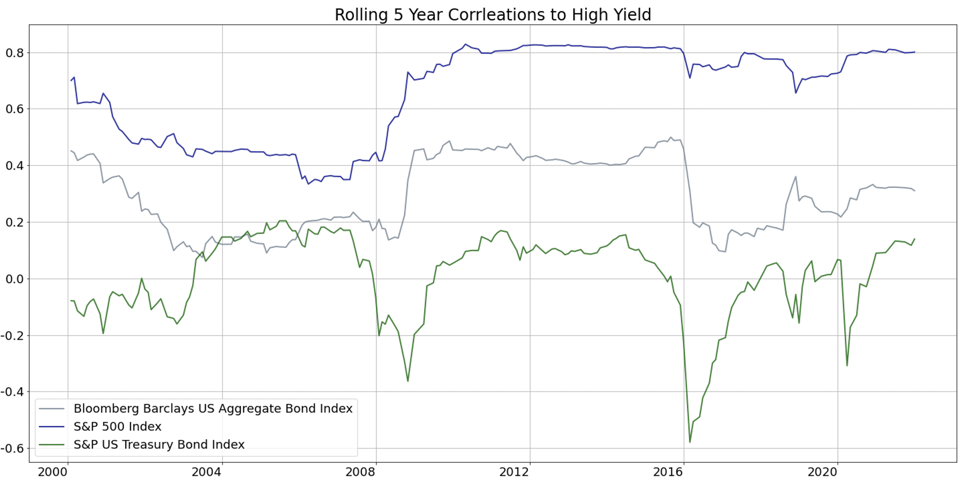

Most fixed income investors are keenly aware that rising interest rates are detrimental to bond prices. However, this relationship isn't so clear with high yield bonds. That is because while the largest portion of the bond market is driven primarily by interest rate risk, high yield bond prices are more dependent on credit risk (the probability of default), which reflects the earnings fundamentals of the companies that issue them. So although high yield is classified as fixed income, its returns are more correlated to equities. In Figure 1, we can see that over the last two decades, the five-year rolling correlations of monthly returns between the S&P 500 Index and the ICE BofA High Yield index have been above 0.60. On the other hand, the correlation between the total bond market, represented by the Bloomberg Barclays U.S. Aggregate Bond index, has ranged from 0.15 to 0.40. The correlation to U.S. Treasury securities is even lower, remaining negative over most of the period.

Earnings fundamentals and credit risk are closely tied to the economic cycle. Despite the headwinds that rising rate environments pose, they often coincide with economic expansions when default rates are lower, such as the current period we are in. According to a January report released by Fitch, the high yield default rate fell to a record low of 0.5% by the end of 2021. Fitch added that they project a 1% default rate on high yield bonds for 2022 and between 1% to 1.5% in 2023. When juxtaposed against the historic non-recessionary 2.2% default rate, high yield bonds could be more attractive than other fixed income areas given the yield they offer and their lower sensitivity to rising rates. Additionally, they are much less volatile and subject to lower drawdowns than equities, since they are more senior in the capital stack.

Figure 1. Rolling five-year correlations of monthly returns. Data provided by Bloomberg Financial L.P.

and St. Louis FRED. Calculations performed by Kensington Asset Management.

Actively Managing For Risk in High Yield

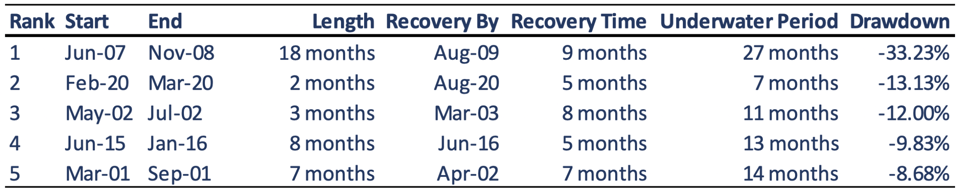

Despite their advantages, high yield bonds are not without substantial risk. If inflation remains high, there is the likelihood that the Federal Reserve might be forced to tighten policy more aggressively than previously expected, which would be detrimental to economic growth. If that happens, repricing in expectations could cause high yield bonds to suffer from drawdowns larger than other fixed income classes. The most significant five drawdowns in recent history are shown in Table 1, with the smallest being 8.68%.

Table 1. The largest five drawdowns on a monthly basis for the ICE BofA High Yield Index since 2000.

Data provided by Bloomberg Financial L.P. and St. Louis FRED. Calculations performed by Kensington Asset Management.

As one can see, “buy and hold” high yield bond investors can suffer periodic double-digit drawdowns at times of market stress. Fortunately, active management has the potential to remedy this shortcoming. According to independent investment research firm Morningstar, high yield has historically been one of the best markets where actively managed funds can beat the index and add value.

Active managers can identify opportunities in this asset class because it sees far lower trading volumes than investment-grade corporate bonds or most equities. That lesser volume causes larger bid-ask spreads and less liquidity, leading to price movement that trends more than the other asset classes. Using quantitative methods to spot and analyze the direction of trends, active managers can tactically pick and choose when to buy and sell based on liquidity flows – or lack thereof.

Control Drawdowns and Returns Will Follow

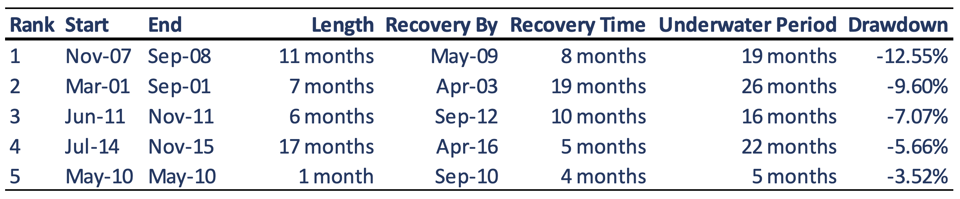

To illustrate the power of active management applied to high yield, we can implement a very naïve strategy to illustrate how drawdowns can be reduced while not sacrificing return. Table 2 shows the top 5 drawdowns over the same period from 2000 through 2021 on the ICE BofA High Yield Index using one simple end of month (EOM) rule:

- Own the index if the current EOM is greater than the average between current EOM and previous EOM price.

- Stay in cash otherwise.

Table 2. The largest five drawdowns on a monthly basis using a simple active strategy on the ICE BofA High Yield Index since 2000.

Data provided by Bloomberg Financial L.P. and St. Louis FRED. Calculations performed by Kensington Asset Management.

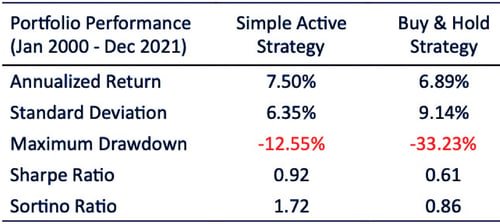

One can see the reduced magnitude of drawdowns compared to buy and hold in Figure 1. As seen in Table 3, in this example the Simple Active Strategy would have also produced a higher annualized return, lower standard deviation and higher risk-adjusted performance compared to the Buy and Hold Strategy, making it apparent that reducing the risk of drawdowns can help provide better performance.

Table 3. Performance statistics using a simple active strategy vs buy and hold strategy on the ICE BofA High Yield Index

since January 2000. Data provided by Bloomberg Financial L.P. and St. Louis FRED. Calculations performed

by Kensington Asset Management.

Kensington Asset Management

In short, even with the strong prospects of increasing interest rates in the weeks and months ahead, investors should not conclude that they must avoid bonds. We at Kensington Asset Management believe that high yield bonds have a place within most investor portfolios, as long as a reliable overlay of active management is in place. By applying a thoughtful, active approach, Kensington has used its quantitative methodology to navigate through several rising rate environments over the past 30 years, capturing above-average yield while protecting principal and substantially reducing drawdowns.

Best regards,

Kensington Asset Management Team