Kensington Brief: Navigating Equity Markets in the Face of Volatility

While tensions between Russia and Ukraine have been the most recent driver of stock market volatility, many expect inflation, uncertainty over monetary policy and stretched valuations to keep stirring asset prices this year, even if geopolitical fears subside. With market uncertainty here and likely to stay, let’s take a closer look at volatility, what it is, what it could mean for equity returns going forward and, most importantly, where investors can turn to help navigate through it.

What is stock market volatility?

Stock market volatility is a measure of how much the stock market's overall value fluctuates up and down. Often an investment’s volatility is measured by “standard deviation,” which measures how much the price of an asset varies around its average over a given period of time. While standard deviation can be a useful statistic when evaluating an investment’s historical volatility, it may not capture how volatile an asset is today or expected to be going forward. Volatility can pick up quickly when external events create uncertainty. For example, while the major stock indices typically don't move by more than 1% in a single day, those indices routinely rose and fell by more than 5% each day during the beginning of the COVID-19 pandemic. No one knew what was going to happen, and that uncertainty led to frenetic buying and selling.

To evaluate current market volatility, many investors turn to the CBOE Volatility Index, commonly referred to as the “VIX.” The VIX has come to be known as Wall Street's "fear gauge” and is typically viewed as the standard measure for overall “real-time” U.S. equity volatility. By the end of February, the VIX was trading around 30, almost 12 points higher than its historical median. In fact, the VIX remained elevated above 20 throughout the entire month of February 2022, the first time that has occurred in over a year. The VIX can move rapidly and often spikes in short bursts, but volatility futures, which project expected market pricing in the future, anticipate increased stock market volatility for the remainder of the year.

What does it mean for equity market returns?

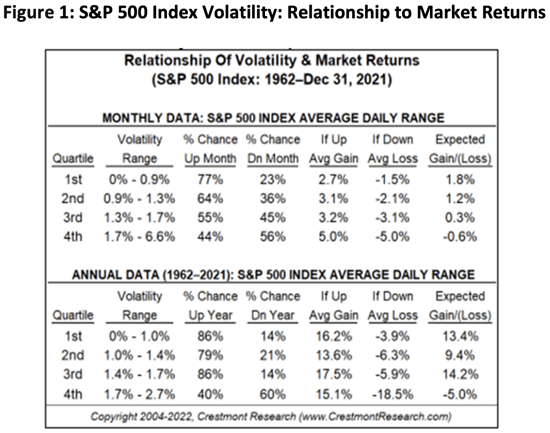

With stock market volatility expected to remain elevated, let’s examine how increased levels of volatility have impacted stock market returns historically. In a 2022 report, Crestmont Research studied the historical relationship between stock market performance and volatility. For its analysis, Crestmont used the average range for each day to measure the volatility of the Standard & Poor's 500 Index (S&P 500).

Their research found that higher volatility corresponds to a higher probability of a declining market, while lower volatility corresponds to a higher probability of a rising market. Evaluating the period from January 1962 to December 2021, Crestmont notes that when the average daily range of the S&P is most volatile (daily range of 1.7% or higher), 56% of the time the Index delivered a negative monthly return, with an “Expected Loss” of -0.6% for the month, far worse than when volatility is muted. When evaluated on an annual basis, the results are even more grim, with a 60% chance of a down year and an expected loss of -5.0%. Certainly, these trends do not always result in negative returns, but they create a potential challenge for investors.

Active management

Not all equity strategies are managed the same and, more importantly, not all equity strategies perform the same during times of heightened volatility. At Kensington, we believe that the best way to generate steady, above-average positive returns in these types of environments is to employ an active investment methodology that has the potential to recognize and measure consistent and repeating behavioral patterns in the financial markets in an effort to avoid periods of significant drawdowns while participating in market gains.

A distinctive attribute of Kensington's active approach to managing equity portfolios is the reliance upon a systematic investing process, incorporating a blend of proprietary trend and counter-trend technical indicators, intended to identify and avoid market exposure when deemed unfavorable and to take advantage of opportunities that volatility may create.

Although this approach adds a level of complexity to the decision-making process, it serves to improve the robustness and risk management of final trading decisions. We believe this methodology is unique to overcoming the challenge of trying to navigate and recognize market conditions that, on their surface and to most observers, appear to exhibit a great degree of chaotic variability from one timeframe to another.

Kensington Dynamic Growth

Kensington’s 5-Star Overall Morningstar® Rated equity strategy, Kensington Dynamic Growth, has been navigating equity markets since 2015, utilizing a proprietary trend following system to identify and act on prevailing market sentiment. The system provides weekly signals to guide the Strategy’s allocation. Dynamic Growth rotates between two investment modes:

Risk-On: When markets are generally trending upward, Dynamic Growth allocates to equity index ETFs and / or mutual funds. This allows the Strategy to participate in the equity markets when the Strategy’s trend-following approach observes favorable conditions in the equity markets.

Risk-Off: When the trend reverses to one of decline or high volatility, Dynamic Growth shifts into U.S. Treasuries, money market funds and/or cash. The goal is to protect principal and mitigate drawdowns at times of adverse market conditions.

The premise of the Dynamic Growth Strategy is to navigate volatility by identifying “bullish” and “bearish” market environments, in part based on implied market volatility, and then position the Fund accordingly. When the model determines downside volatility is likely (bearish), the strategy moves to its “Risk-Off” posture, transitioning to a defensive posture as previously outlined. When the system indicates a higher likelihood for a “bullish” environment, the strategy re-allocates to equity exposure in order to participate in upward market movement.