Kensington Brief: The Impact of Limited Market Liquidity

Market liquidity is rarely a topic at the top of investors’ minds when discussing portfolio risk, but it’s a rising risk in today’s environment that requires attention. When market liquidity is limited, it can have a significant impact on markets by increasing volatility and be a catalyst for quick and substantial drawdowns.

Liquidity in U.S. financial markets has been on a downward trajectory for more than a decade, but recently the problem has intensified, leading to market vulnerability. With the Fed’s recent rate hikes and launch of their Quantitative Tightening initiative, which is expected to reduce money supply in our economy by $9 trillion, the problem is likely to get worse before it gets better. In this Brief we will examine why liquidity is decreasing, its potential impact on markets, and how we at Kensington manage our portfolios to navigate this landscape.

What is Market Liquidity?

Market liquidity reflects how quickly and efficiently a security can be bought or sold at the current market price without impacting value. It is to some extent the lifeblood of capital markets. Historically, market liquidity has not been a concern in the U.S., where markets have traditionally been the deepest and most liquid in the world. But liquidity has been slowly draining from various markets to the point where in May the Federal Reserve, in their 2022 Financial Stability Report, warned that this deterioration could represent a significant risk for markets.

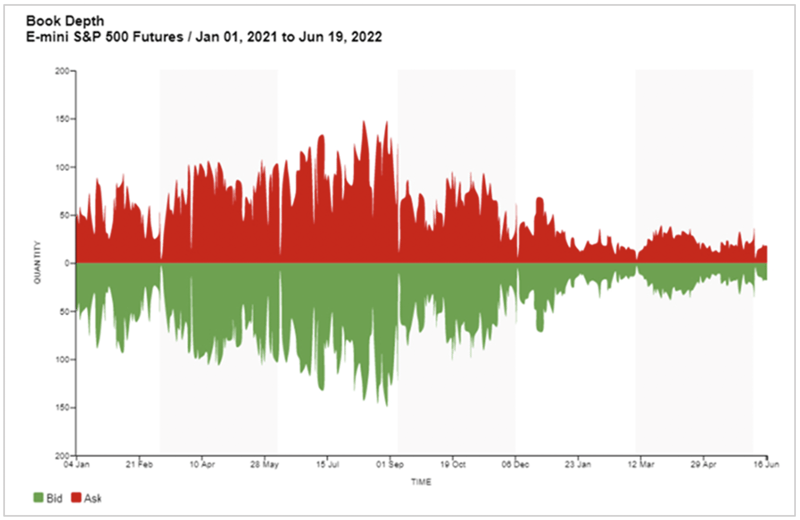

Market liquidity can be measured several ways. In the stock market, these include Average Daily Volume (“ADV”), Top of Book Size (how many shares or contracts are on the bid and offer) or Book Depth (total number of shares or contracts below the bid and above the offer for a given market or security). Looking at the Book Depth of E-Mini S&P 500 Futures, which investors use to gain exposure to the U.S. stock market, we see a worrisome trend developing (Exhibit 1).

Exhibit 1

Source: CME Group

E-Mini S&P 500 Futures depth has shrunk considerably over the past year. These futures historically trade about $50 million of notional value at any given time. That number fell to around $2 million in late January and has averaged around $5 million since, well below historical levels. This lack of liquidity leads to inefficiency in pricing and can have severe implications for market participants.

Why is Liquidity Decreasing?

The reality is market liquidity has been decreasing for years. There are many reasons for why liquidity has declined, starting with regulations in the stock market that have reduced the willingness of market makers to post bids and offers, particularly in times of heightened volatility. More recently however, the decline in liquidity can be tied to the Fed’s tightening monetary policy, by raising interest rates and shrinking its almost $9 trillion balance sheet. This, combined with elevated inflation numbers, contribute to higher levels of volatility, which as noted, has an inverse relationship to liquidity.

The Impact of Low Liquidity

Markets can be affected by low liquidity in several ways and create myriad challenges for investors. Below are a few of the more meaningful impacts we see today:

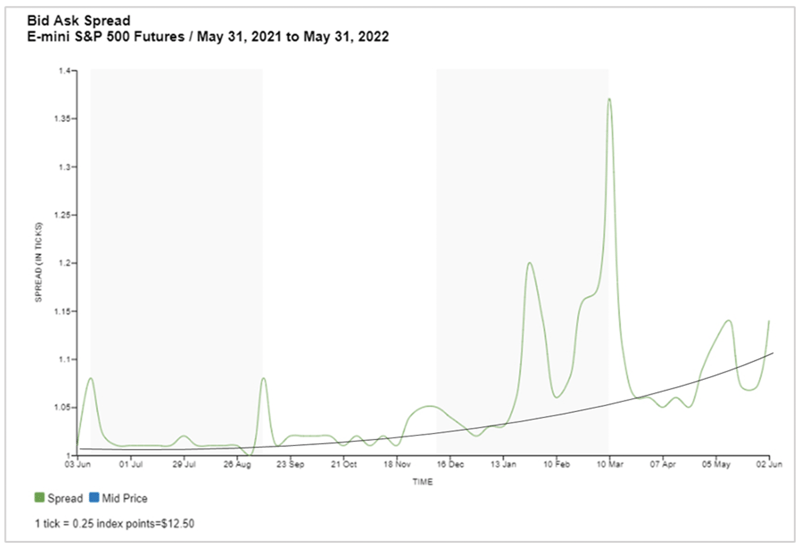

Bid/Ask Spreads: Perhaps the most direct impact liquidity has on markets is to bid/ask spreads. In a very liquid market, bid/ask spreads on stocks and major indices are close together, allowing for quicker transactions and more efficient pricing. As shown in Exhibit 2 below, spreads have been widening since the beginning of the year, with several large spikes amongst an overall increasing trendline. When these spreads widen out, it’s costly to investors as the price at which they must buy or sell a security moves away from the security’s intrinsic value.

Exhibit 2

Source: CME Group

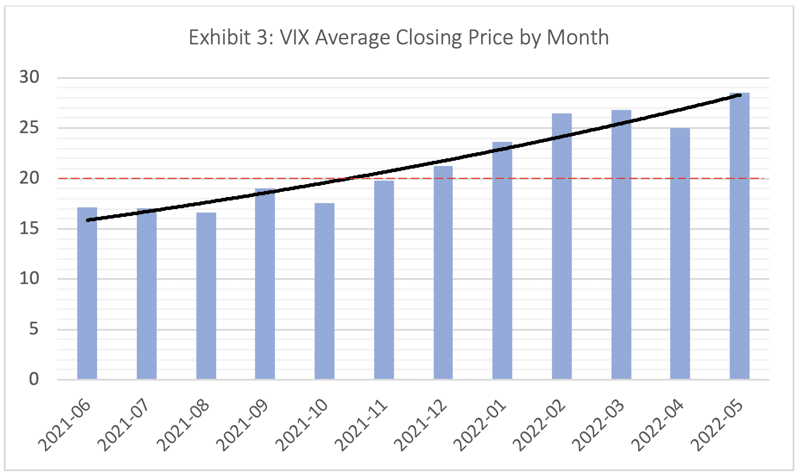

Volatility: As previously noted, liquidity has an inverse relationship to volatility. One can argue whether low liquidity drives volatility or vice versa, but regardless, when liquidity is low, we typically see volatility spike, and 2022 has been no exception. As seen in Exhibit 3, the VIX Index, which is typically regarded as a measure of stock market volatility, has been steadily increasing month over month for the last year, peaking with a May 2022 average daily close of 28.5. Readings above 20 are considered “elevated”, which it has been for each calendar month in 2022.

Exhibit 3

Source: Bloomberg

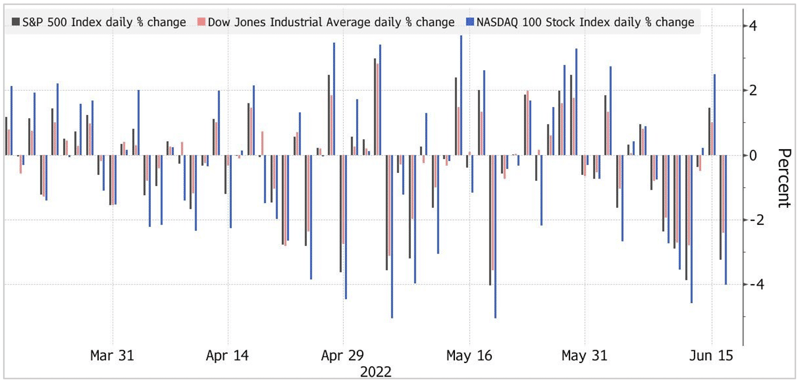

Drawdowns: Low liquidity exacerbates market swings and makes it harder for investors to execute buy and sell orders at a desired price. Periods of scarce liquidity contributed to extreme market gyrations in March 2020, when the S&P 500 fell by about a third, peak-to-trough, as investors worried about an economic shutdown related to COVID-19. We’re seeing a similar impact today as liquidity continues to be scant. The last several months are full of large down days as deleveraging and tightening financial conditions drain liquidity out of financial markets, leading to significant day-to-day volatility (Exhibit 4).

Exhibit 4

Source: Bloomberg

Positioning Portfolios in Today’s Environment

Unfortunately, liquidity is likely to remain depressed for the foreseeable future as the Fed continues to unwind their balance sheet and inflation persists. The good news is there are several ways to insulate your portfolio from higher volatility and persistent drawdowns as a result of the limited liquidity environment.

At Kensington, we utilize an active management approach, guided by our quantitative methodology, to navigate markets in times of increased volatility. Our models seek to identify periods of heightened volatility and avoid significant drawdowns in the market while participating in uptrends through the use of our "Risk-On" and "Risk-Off" indicators.

This philosophy is implemented through a methodology we refer to as "risk pivoting". We've designed each of our strategies with the flexibility to dial up or down exposure to markets and, when deemed appropriate, neutralize our exposure altogether until a more favorable environment is perceived to exist.

As a result of this process, Kensington’s strategies have demonstrated an ability to not only navigate higher volatility markets and avoid precipitous drawdowns, but also provide low correlation to markets and long-only investment vehicles. Incorporating investments with low correlation to a diversified portfolio has proven to lessen portfolio volatility and provide higher risk-adjusted returns.