Market Insights is a weekly piece in which Kensington’s Portfolio Management team will share interesting and thought-provoking charts that we believe provide insight into markets and the current investment landscape.

Credit Crunch is Upon Us

Earlier this week, IMF chief economist Pierre-Olivier Gourinchas said Tuesday, “Below the surface, financial market turbulence is building, and the world economic situation is quite fragile.” What Mr. Gourinchas was referring to is the likely “credit crunch” our nation (and others) are likely to experience, or might already be experiencing. Let’s examine what is happening and what the potential implications could be going forward.

What is a Credit Crunch?

A credit crunch refers to a decline in lending activity by financial institutions brought on by a sudden shortage of funds or tightening of conditions required to obtain a loan. The primary issue fueling current credit issues is an increase of deposit withdrawals (shortage of funds) in the wake of the Silicon Valley Bank (SVB) failure and the corresponding reaction from banks (tightening loan requirements).

We have seen a decline in deposits across US banks dating back to when the Fed began raising rates in 2022, but withdrawals have significantly escalated in the wake of the SVB failure. According to Bloomberg, more than $900B in deposits have left the banks since April 2022, with a staggering $290 billion in withdrawals in the last three weeks alone.

Source: Bloomberg, Christophe-barraud.com

Tightening the Belt

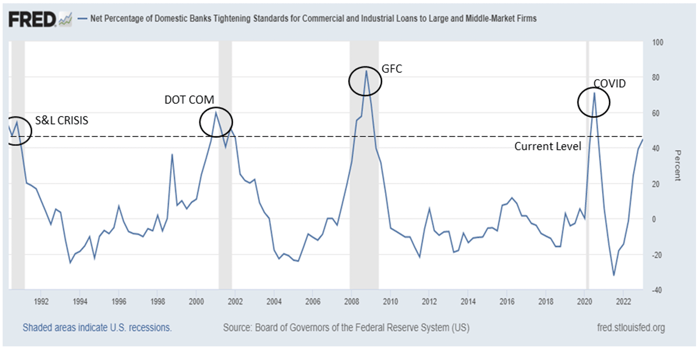

Banks have responded to outflows by tightening their lending standards. Lending standards have been slowly increasing for over a year (corresponding with outflows), but a sharp jump in recent weeks have pushed standards to levels approaching those seen during the COVID Crash, the Great Financial Crisis (GFC), the Dot Com bubble and the Savings and Loan Crisis (below).

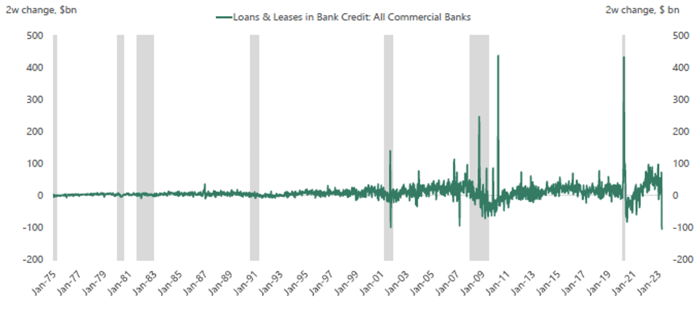

The natural result of this tightening is a decrease in the volume of loans being issued (see chart below). Since the collapse of SVB, we’ve seen the largest 2-week cutback in bank lending in at least the last 50 years, down over $104 billion in the last two weeks.

Source: Federal Preserve Board, Haver Analytics, Apollo Chief Economist

Impact on Businesses

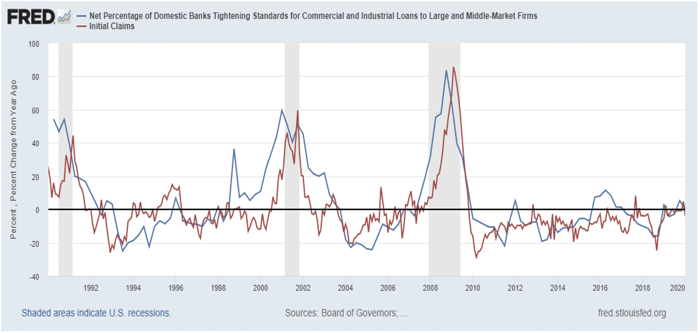

The repercussions of this type of bank tightening can be significant. Businesses need credit to operate. When credit goes away, businesses resort to cost-cutting measures, which includes employee layoffs. As you can see in the chart below, US Initial Jobless Claims correlate closely to restricted lending standards on roughly a quarter delay.

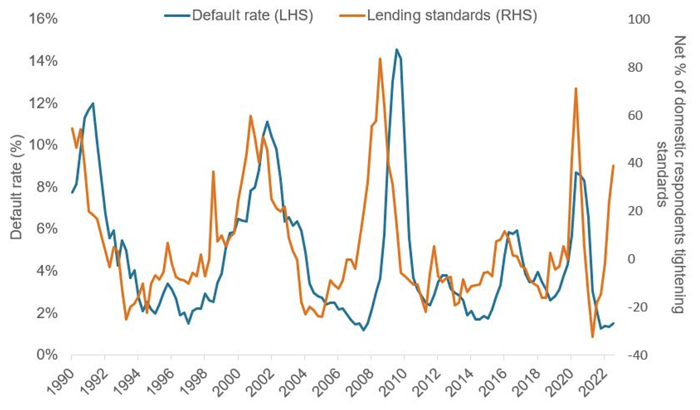

As you might expect, tightening lending standards are also linked to default rates. Once companies have exhausted all cost cutting measures (including reduction of labor force), the last resort is to default on their debt (see chart below), something we are already seeing signs of in early 2023.

Source: Janus Henderson

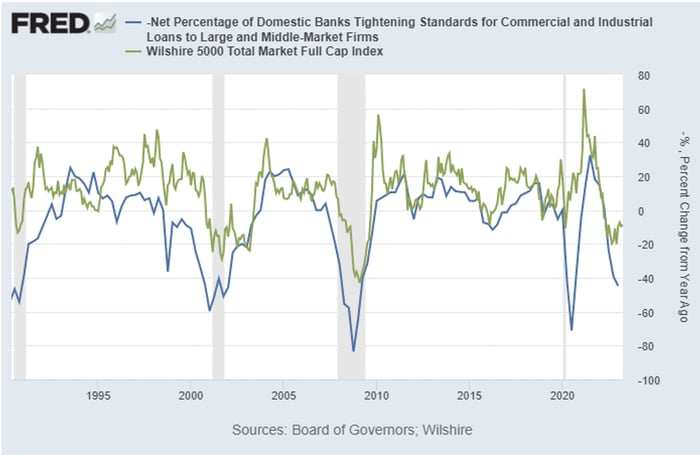

Ultimately, and predictably, if credit availability does not improve, it would be expected to impact companies’ ability to operate and grow, and the equity markets would suffer. The chart below shows the Wilshire 5000 Total Market Cap Index against tightening credit standards (inverted), and clear correlation exists.

Every facet of our economy and market is intrinsically linked to bank lending activity. With all this unfolding, the Fed is faced with a very tight needle to thread, trying to balance their inflation mandate with the impact further rate increases will have on bank lending and ultimately the market and overall economy.

Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. This market insight is for informational purposes only and should not be construed as a solicitation to buy or sell, or to invest in any investment product or strategy. Investing involves risk including loss of principal.

Click below to subscribe to our Insights!

Receive email notifications when new articles are published