Market Insights is a piece in which Kensington’s Portfolio Management team will share interesting and thought-provoking charts that we believe provide insight into markets and the current investment landscape.

Interest Rates In Focus

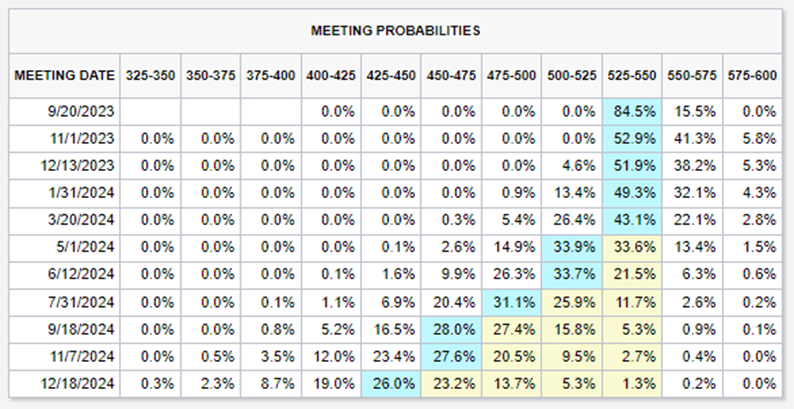

At Chairman Powell’s upcoming speech at the Jackson Hole Economic Symposium this Friday, investors will look to glean any indication of the Fed’s viewpoint on the current state of the economy and if we can expect further rate hikes in the months to come. As of Wednesday, the CME FedWatch Tool (below) showed an 84.5% probability of no hike in September, a 41.3% chance of a 0.25% hike in November, and rate cuts not expected until well into 2024 (33.9% chance in May 2024).

Asset Managers Disagree

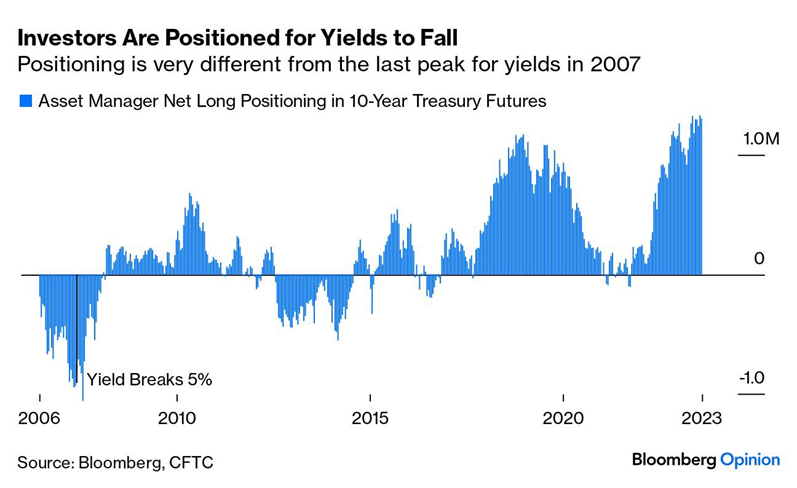

These probabilities can and often do change quickly, but are a useful tool for gauging how investors view the market in real-time. Another useful gauge is to evaluate how investors are positioned in their portfolios. As you can see from the chart below from Bloomberg, Asset Managers on aggregate seem to have a differing viewpoint, positioned for yields to fall, seemingly believing a Fed pivot in the short-term is more likely than what the FedWatch Tool is forecasting.

Uncharted Waters

There are several reasons why this might be. For one, some managers may not believe rate cuts are coming, but rather that rates will stabilize, allowing them to take advantage of higher prevailing yields. Others may in fact be expecting a downturn in the economy, which could force the Fed to pivot and cut rates, although the likelihood of recession seems to be lessening. Last week, the Atlanta Fed GDPNow forecast of real GDP growth was revised upward to 5.8% from 4.0%. Another factor may simply be that the recent 37-month long upward correction relative to the 15-year downtrend in rates is overextended and asset managers expect a reversion to the mean (see the chart below).

The Neutral Rate of Interest

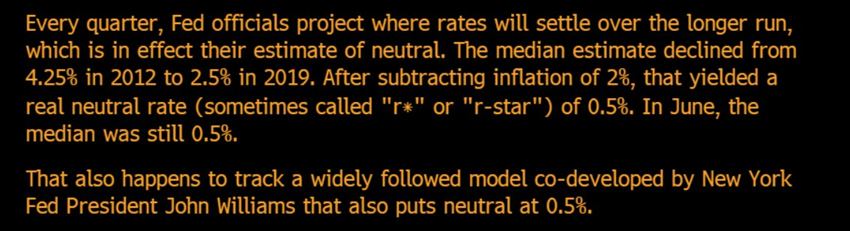

Conversely, this week’s Wall Street Journal article by Nick Timiraos questioned “whether rates will ever return to the lower levels that prevailed before 2020.” The premise being that the “neutral rate of interest,” the rate at which the demand and supply of savings are in equilibrium, has shifted post-pandemic and will cause rates to remain higher, even if target inflation of 2% is reached. The Federal Reserve has not acknowledged this possibility, at least not officially (article excerpt below).

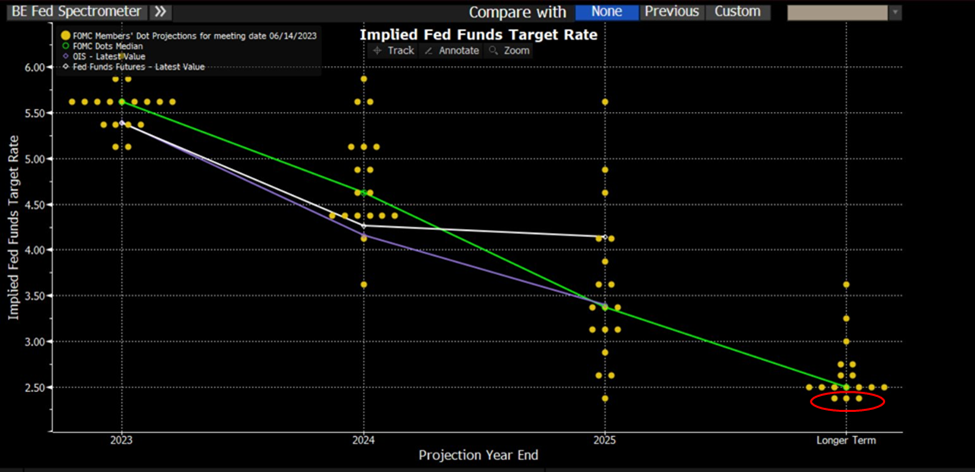

Yet we might be seeing signs of a shift in position by the Fed, reflected by their often scrutinized “dot plot” chart shown below, in which Fed officials offer their best estimate of long-term interest rates. While the median estimate has remained steady at 2.5%, progressively fewer officials are forecasting rates below the median (from 8 members to 3 in just the last year).

The median estimate of long-term interest rates has remained steady at 2.5% throughout the pandemic (6/2019-present), yet debt outstanding has increased by +40% (below). It’s not unreasonable to think the neutral rate has changed as a result of this and other factors, and that the median long-term dot plot will shift higher.

This is not to say that fixed income investment will suffer long-term as a result. The last four decades have conditioned us to believe that fixed income returns must primarily be driven by price appreciation, yet if the neutral rate of interest shifts higher, it could simply mean that the yield component of fixed income investments is a larger contributor to fixed income total return in the years to come. The impact on other sectors, however, such as real estate and equities, particularly those dependent on borrowing to fuel growth, may feel the brunt of this if it comes to pass.

We certainly won’t get answers to all of this from Chairman Powell’s comments in Jackson Hole, but we may at least get a glimpse of what to expect in the coming months.

Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. This market insight is for informational purposes only and should not be construed as a solicitation to buy or sell, or to invest in any investment product or strategy. Investing involves risk including loss of principal.

Click below to subscribe to our Insights!

Receive email notifications when new articles are published