Kensington Market Insights - December 14

Market Insights is a piece in which Kensington’s Portfolio Management team will share interesting and thought-provoking charts that we believe provide insight into markets and the current investment landscape.

Prepare for Landing

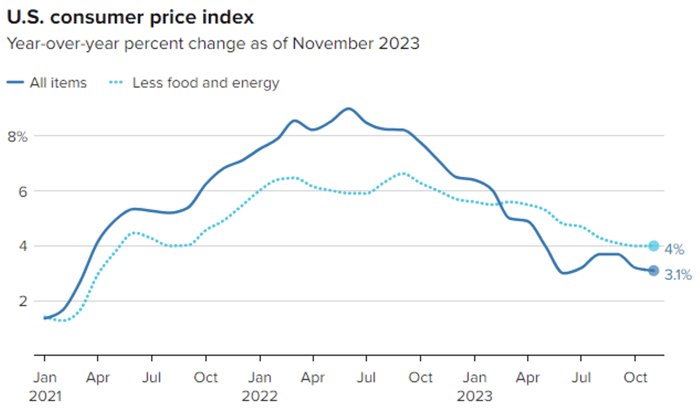

This past Tuesday we received an updated read on inflation, as the Consumer Price Index (CPI) increased 0.1% m/m or 3.1% y/y, in line with consensus, continuing the trend down since June 2022, when CPI registered at 9.1% y/y (chart below). On Wednesday, the Federal Reserve announced they would hold the benchmark rate at 5.25% for the third meeting in a row. In comments following the release, Chairman Powell noted that the economy has slowed since Q3 2023 and median projections from the Fed now show three rate cuts in 2024.

Investors now are left to contemplate how the economy and markets will behave heading into 2024. Most observers will agree that the 2024 outlook rests on which of two outcomes proves accurate: a soft or hard landing as the economy cools.

Chart: Gabriel Cortes / CNBC

Source: U.S. Bureau of Labor Statistics

Data as of Dec. 12, 2023

Soft Landing Hopes

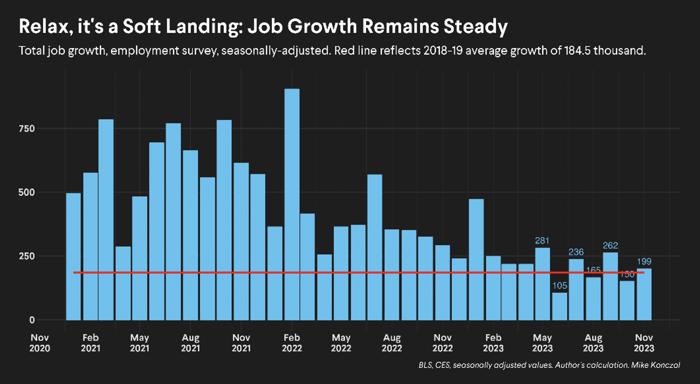

A soft landing is the goal of a central bank when it seeks to raise interest rates just enough to stop an economy from overheating and experiencing high inflation, without causing a severe downturn. It’s a difficult needle to thread, as rising rates have historically had a very meaningful impact on the economy, particularly employment. However, after 11 straight rate hikes through July 2023, the jobs market has responded admirably. The November employment report showed the nation’s employers added a solid 199,000 jobs last month and the unemployment rate fell to 3.7% (from 3.9%), fresh signs the economy could achieve an elusive 'soft landing' whereby inflation could return to the Fed's 2% target without causing a steep recession.

Source: x.com/mtkonczal

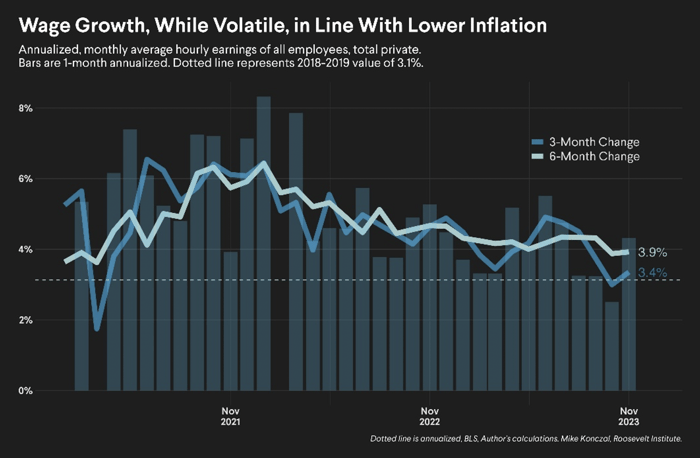

A softening in hiring (chart above), income growth (chart below), and consumer confidence, which as measured by the Conference Board Consumer Confidence Index rose to 77.8 in November from 72.7 in October, all point to reduced consumer and business spending, and a soft landing scenario should these metrics continue to ease without significant drop off. This is, of course, the Federal Reserve’s goal and a scenario that could avoid recession altogether in 2024.

Source: x.com/mtkonczal

Slowly at First, Then all at Once

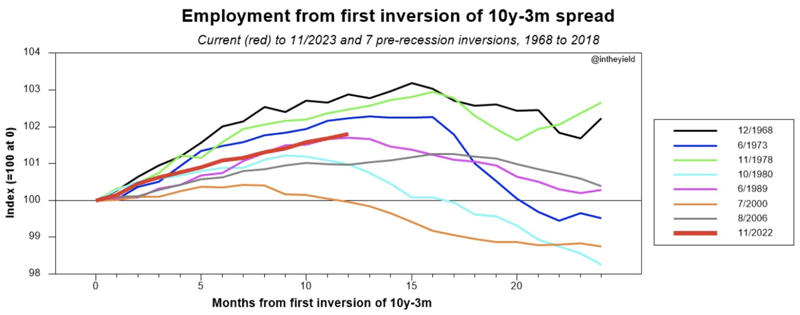

A hard landing is characterized by a pronounced contraction of economic activity, leading to recession. What makes the line between a soft and hard landing so difficult to pinpoint, is that they typically start in the same manner. The chart below shows historical employment trends from the first inversion of the 10y-3mo interest rate spread forward. The current trend (red) is in line with previous examples back to 1968, all of which resulted in eventual recession. The employment trend looks good now but can and does change quickly.

Source: x.com/intheyield

Warning Signals Ahead

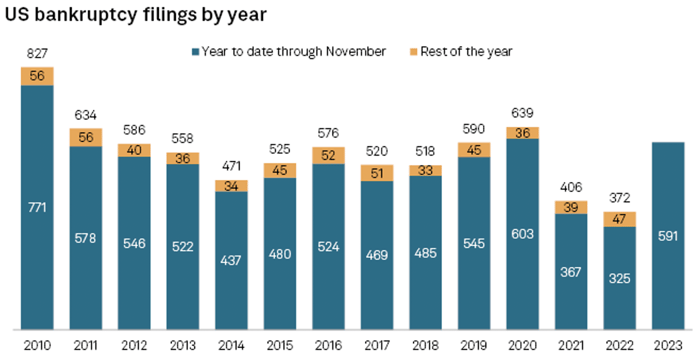

Employment aside, there are other areas of the economy that are flashing warning signs. We previously covered the rising US debt burden at the consumer level which could meaningfully cut into growth prospects. US corporations also face challenges that could play a role in the soft vs hard landing debate. Through November, the U.S has seen 591 corporate bankruptcy filings year-to-date (chart below). The two most recent times we’ve seen this number of bankruptcies through November were either during a recession (2020) or in the wake of a recession (2010).

Includes S&P Global Market Intelligence-covered US companies that announced a bankruptcy between Jan. 1, 2010, and Nov. 30, 2023.

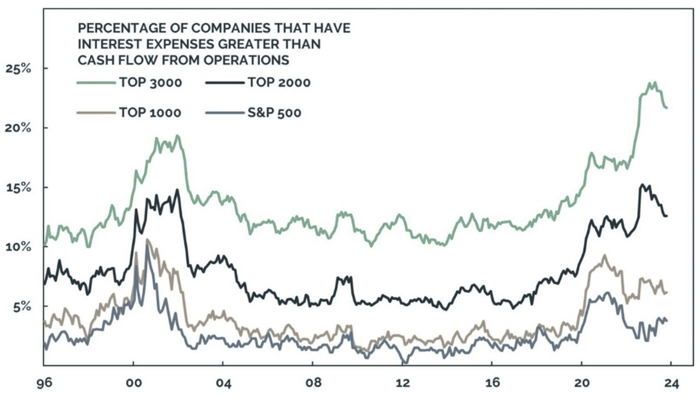

While the number of monthly bankruptcies has fallen three months in a row, companies’ ability (or inability) to service existing debt, or refinance maturing debt, could wreak havoc on markets and the economy in 2024. Approximately 50% of Russell 2000 companies are unprofitable and 20% of the top 3000 companies' interest expenses are greater than cash flow from operations (chart below). If the economy slows even a little, this could further impact companies’ abilities to continue to operate.

Source: S&P Global and BCA Calculations

Soft vs Hard – What to Expect

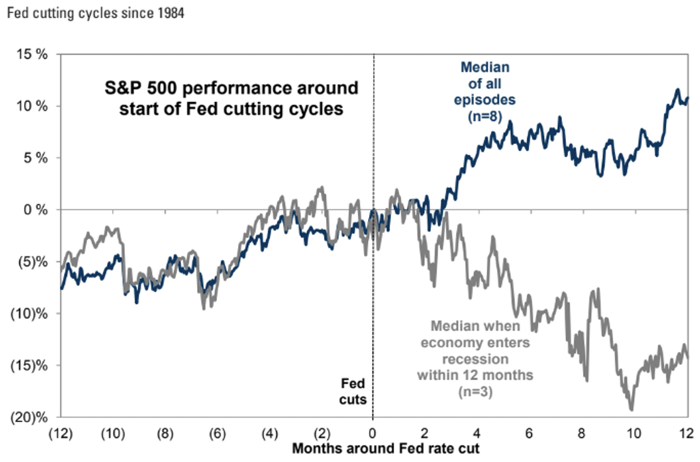

The reason the soft-landing vs hard-landing debate currently dominates headlines and business news channels is that the difference between hard and soft has historically meant very different outcomes for the market. The chart below, which looks back to 1984, illustrates the stark difference in performance by the S&P 500 post a Fed rate cutting cycle. Twelve months after the Fed’s first rate cut the difference in average returns between recession vs. no recession is approximately 25%.

Source: Goldman Sachs Global Investment Research

As it stands today, both scenarios remain in play, and could result in extremely different outcomes for client portfolios. With such a wide range of potential outcomes entering 2024, it is as important as ever for investors to evaluate tactical strategies that can adapt to an ever-changing landscape.

Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. This market insight is for informational purposes only and should not be construed as a solicitation to buy or sell, or to invest in any investment product or strategy. Investing involves risk including loss of principal.

Click below to subscribe to our Insights!

Receive email notifications when new articles are published