Kensington Market Insights - February 15

Market Insights is a piece in which Kensington’s Portfolio Management team will share interesting and thought-provoking charts that we believe provide insight into markets and the current investment landscape.

CPI

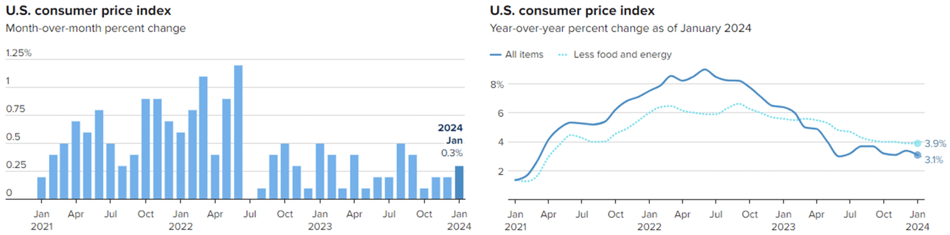

On Tuesday, the Bureau of Labor Statistics provided an inflation update, with the January Consumer Price Index (CPI) showing an increase of 0.3% for the month and 3.1% year-over-year (y/y), down from 3.4% in December. Markets tumbled on the news, as consensus estimates were for just a 2.9% y/y increase. The report, coupled with robust economic data for January, essentially closed the door on a potential rate cut in March, something that had already been in doubt since the January Federal Open Market Committee (FOMC) meeting.

Source: CNBC, Bureau of Labor Statistics as of January 2024

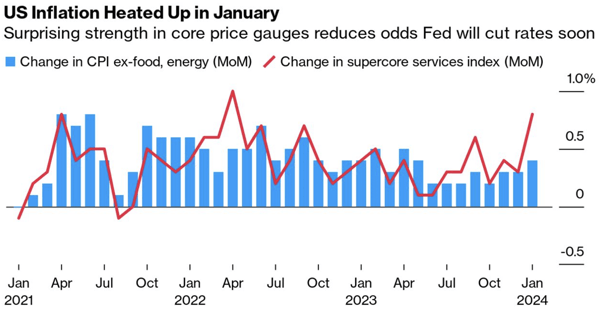

The "Core" CPI, which excludes food and energy costs, increased by 0.4% from December, more than expected and the most in eight months. Additionally, "Supercore" CPI, which further excludes shelter from the calculation, soared to 0.7% m/m and up 4.4% y/y, its highest reading since May 2023.

Source: Bureau of Labor Statistics, Bloomberg

Supercore services prices exclude housing and energy

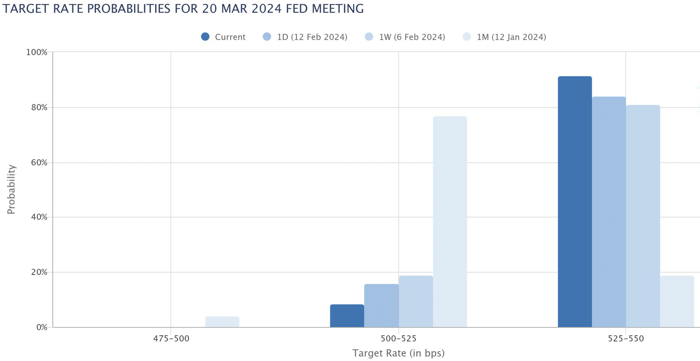

With this news, the market probability of a rate cut in March fell to just 8.5%, a number that had been as high as 77% in mid-January and was a leading cause of the bond rally in November and December. Yields have begun to creep back up as expectations for a Fed rate cut have diminished. Only the high yield segment of the US fixed income market registered a flat or positive return in January, as its higher yield offset negative pricing pressure.

Source: CME Fed Watch as of February 13, 2024

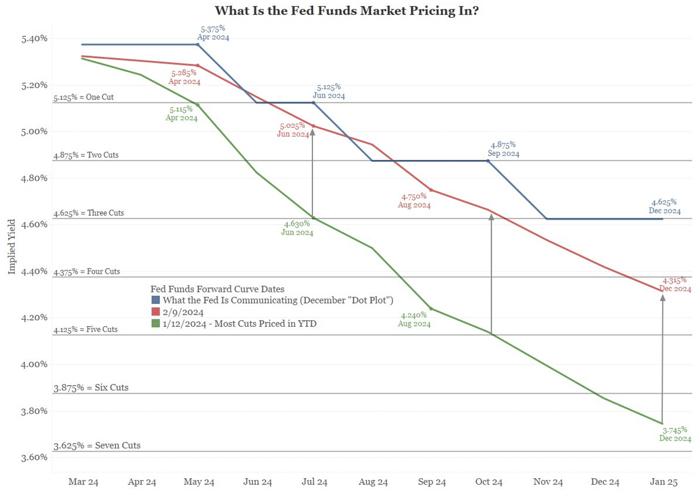

Prior to the CPI report on Tuesday, markets had already begun to walk back 2024 rate cut expectations, which at one point had priced in as many as 7 cuts totaling 163 basis points. As of January 25th, prior to the CPI report, market probability had lowered estimates to just 4 cuts totaling 100 basis points, closer to the Fed’s projection of three 25 basis point cuts for the year.

Source: Chicago Mercantile Exchange, Bloomberg

2024 Bianco Research, LLC. All Rights Reserved

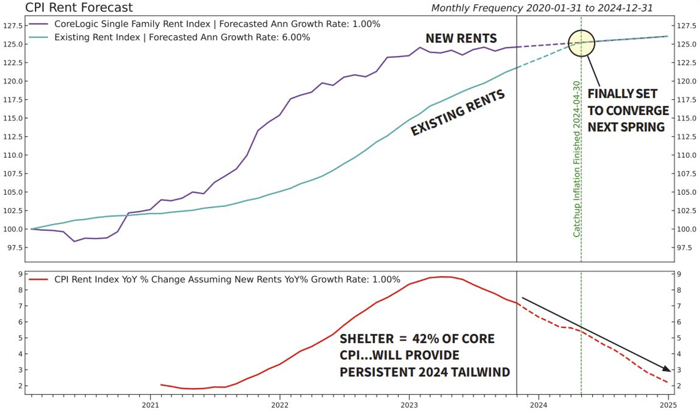

Market participants must now evaluate the prospect of potential re-inflation in the US after more than a year of relatively consistent drops. With the January report, we've now seen three months in a row of flat or increasing month-over-month readings for CPI. Diving into the CPI report, we see that 101% of the y/y CPI increase came from Core Services, of which 66% can be attributed to shelter costs. Shelter alone accounts for 42% of the Core CPI calculation, so it plays a meaningful role in the overall number and, thankfully, may be set to provide some inflation relief in the coming months. As Warren Pies of 3Fourteen Research points out in the chart below, existing rents and new rents are set to converge this spring, which should stabilize overall rents and provide a persistent tailwind for the fight against inflation in the second half of the year.

Source: 3Fourteen Research. As of 12/1/2023

Additionally, while the January CPI number was higher than expected, it was still an improvement from December (3.4%). Inflation is still expected by most to continue its steady march down toward the Fed’s target of 2%. Later this week, we will receive additional data to evaluate as the Producer Price Index (PPI), which tends to serve as a leading indicator for CPI, is set to be released on Friday. Regardless of its result, it appears for now that the Fed’s “higher for longer” rate policy will extend through at least March. Now that the market has walked back rate cut expectations, price stability may be the norm in fixed income markets for some period. Thankfully, for the first time in almost four decades, prevailing yields alone provide an attractive return profile for investors.

Click below to subscribe to our Insights!

Receive email notifications when new articles are published

Disclaimer

Investing involves risk, including loss of principal. Past performance does not guarantee future results. There is no guarantee any investment strategy will generate a profit or prevent a loss.

This is for informational purposes only and is not a recommendation nor solicitation to buy, sell or invest in any investment product or strategy. Our materials may contain information deemed to be correct and appropriate at a given time but may not reflect our current views or opinions due to changing market conditions. No information provided should be viewed as or used as a substitute for individualized investment advice. An investor should consider the investment objectives, risks, charges, and expenses of the investment and the strategy carefully before investing.

Kensington Asset Management, LLC (“KAM”) relies on third party sources for some of its information that we believe is reliable. However, we make no representation, warranty, endorse or affirm as to its accuracy or completeness. The information provided is current as of the date of publication and may be subject to change. We are not responsible for updating this information to reflect any subsequent developments or events.

Certain information contained herein constitutes “forward-looking statements,” which can be identified using forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results, or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance, or a representation as to the future.

Advisory services offered through Kensington Asset Management, LLC, Barton Oaks Plaza, Bldg II, 901 S Mopac Expy – Ste 225, Austin, TX 78746.