Market Insights is a weekly piece in which Kensington’s Portfolio Management team will share interesting and thought-provoking charts that we believe provide insight into markets and the current investment landscape. In the wake of the Federal Reserve’s recent rate hike and the markets’ current speculation around future hikes, let’s evaluate a few charts discussing how future Fed action may shape the markets and economy in 2023.

If the Fed were to Stop Now

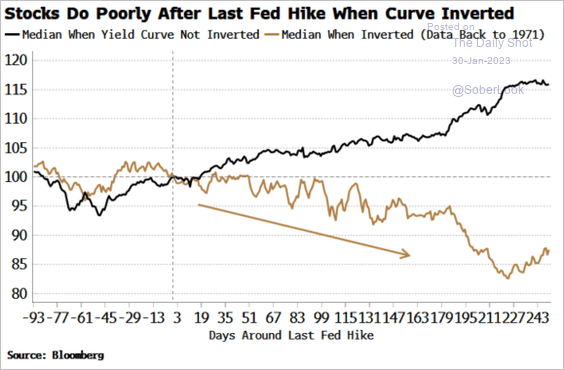

Historically, when the Fed is done hiking rates at a time when the yield curve is inverted (as it is today), stocks have tended to perform poorly post hikes (see below). Keep in mind however, historically when this has occurred rate hikes stopped because the economy was already in a recession.

Quantitative Tightening

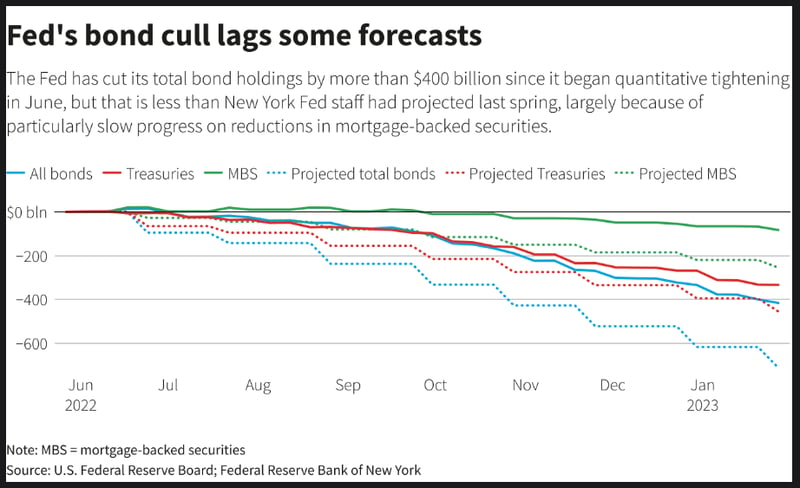

Regardless of future rate hikes, it’s clear the Federal Reserve is still on a quantitative tightening path, cutting its bond balance sheet by approximately $420 billion since June 2022. However, as shown below, the tightening pace is still significantly behind projections from the New York Fed. This is supportive of a viewpoint that there could be more monetary policy tightening still to go before any Fed pivot.

According to Dallas Fed President Lorie Logan, there is plenty of bond inventory left to run off to assist the Fed in its inflation fight, and “[e]xactly how long that is will depend on a careful assessment of the financial environment.” Although the pace of tightening trails original expectations, don’t expect Fed Chair Jerome Powell to feel the need to play catch up. In November 2022, Powell made it clear the Fed did not want to pull liquidity too tightly, which could risk control over short-term rates.

Soft Landings vs Hard Landings

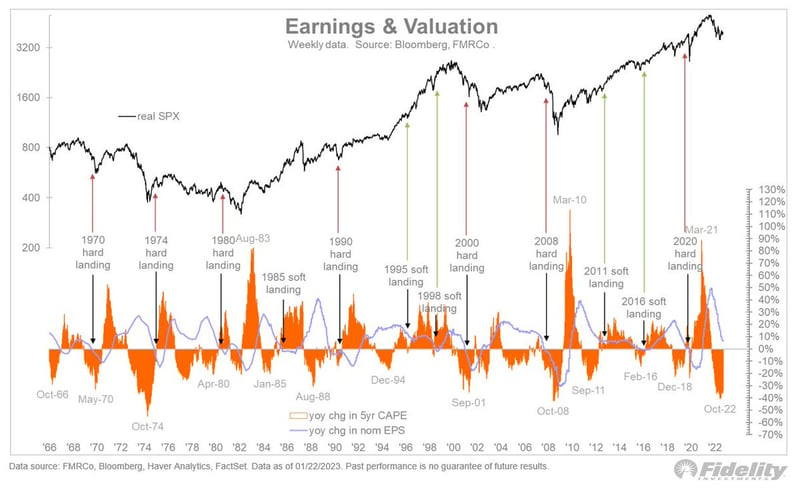

There is a lot of debate about whether the Fed is going to achieve a soft-landing vs hard landing in its fight against inflation. In simple terms, a soft-landing sees recession avoided and no major drop in earnings, while a hard landing features recession, earnings contraction, and generally steeper drawdowns in stock prices.

So far, the bear market in stocks has arguably been mostly about monetary shocks and valuation resets, leaving the economic/earnings aspect an open question.

All of this might be a moot point, however, as inflation remains well above the Fed’s target of 2%. As famed investor Stanley Druckenmiller pointed out in an interview this week, “Once inflation goes above 5%, it has never come back down without the Fed Funds Rate exceeding the CPI”. Inflation, at this level, tends to be persistent and is difficult to bring down quickly. With the latest CPI coming in at 6.5% for December 2022, for this historical metric to remain true we would be in store for several more hikes in the quarters to come.

Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. This market insight is for informational purposes only and should not be construed as a solicitation to buy or sell, or to invest in any investment product or strategy. Investing involves risk including loss of principal.