Market Insights is a weekly piece in which Kensington’s Portfolio Management team will share interesting and thought-provoking charts that we believe provide insight into markets and the current investment landscape.

Bankruptcies on the Rise

The past week has been inundated with discussion of “disinflation” and a potential economic soft landing

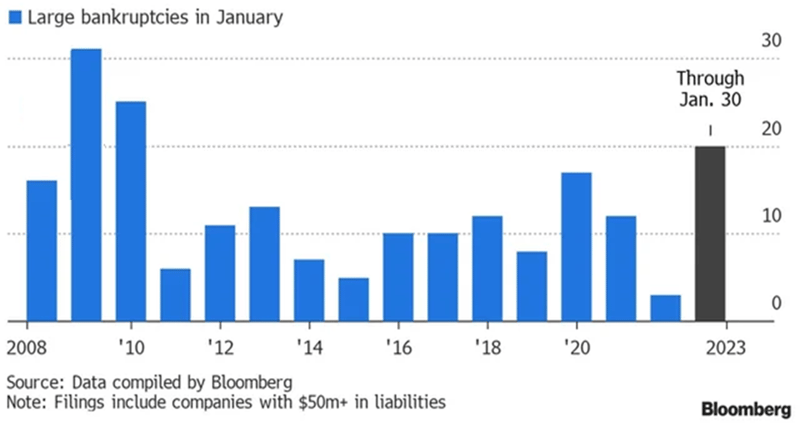

in the wake of Fed Chairman Powell’s comments at the February FOMC meeting. As investors try to assess the coming months, one data point we are monitoring is the rate of bankruptcies in the US as an indication of corporate and market health. In January, large bankruptcies (defined as companies with $50m+ in liabilities) surged to their highest level since 2010, as seen in the chart below from Bloomberg.

High Yield Spreads

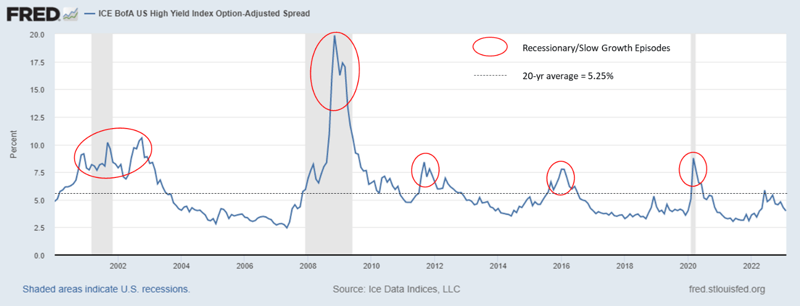

While it is only a single month, it’s a data point amongst a growing number of data points that seem to be telling

a similar story. Regardless of if it’s officially a recession or a more palatable period of slower/slowing growth,

a downturn remains likely. Historically in these types of periods, particularly when bankruptcies are on the rise, US

high-yield credit spreads have expanded out to the 700-1000 bps range (as companies that issue higher yielding debt are more likely to face bankruptcy concerns). Currently, however, the High Yield Option Adjusted Spread is subdued around 400 bps, well below its 20-year average of 5.25%.

If bankruptcies continue to mount, a meaningful spike in yields (and drop in prices) may be approaching for high yield.

While this would be bad in the short run for passive high yield investors, these types of yield blowouts can create attractive buying opportunities post capitulation for tactical managers as yields revert back to the historical average, driving bond prices higher. The key is identifying when to step to the sideline and when to jump back in. A model driven decision-making process can help identify these environments to compliment fundamental decisions.

Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. This market insight is for informational purposes only and should not be construed as a solicitation to buy or sell, or to invest in any investment product or strategy. Investing involves risk including loss of principal.