Kensington Market Insights - March 21

Market Insights is a piece in which Kensington’s Portfolio Management team will share interesting and thought-provoking charts that we believe provide insight into markets and the current investment landscape.

The Troubles Facing Commercial Real Estate

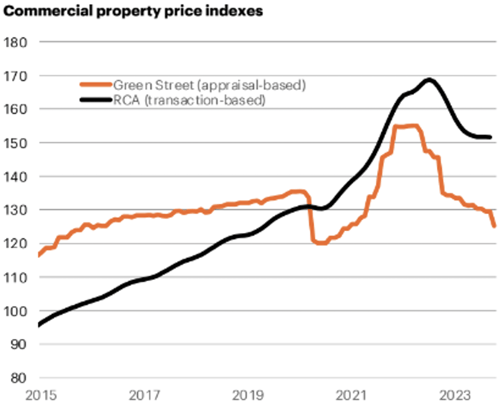

The US commercial real estate (CRE) market is facing turbulent times. Since mid-2022, property values in the US CRE market have declined by -10% to -20%, varying across sectors and indices. This decline, coupled with a significant reduction in transaction activity, marks a stark contrast to the booming CRE environment witnessed in the preceding years. The rapid rise in interest rates has transformed what was once a favorable investing climate into a considerable headwind for the industry.

Source: Green Street, MSCI Real Capital Analytics, as of October 31, 2023

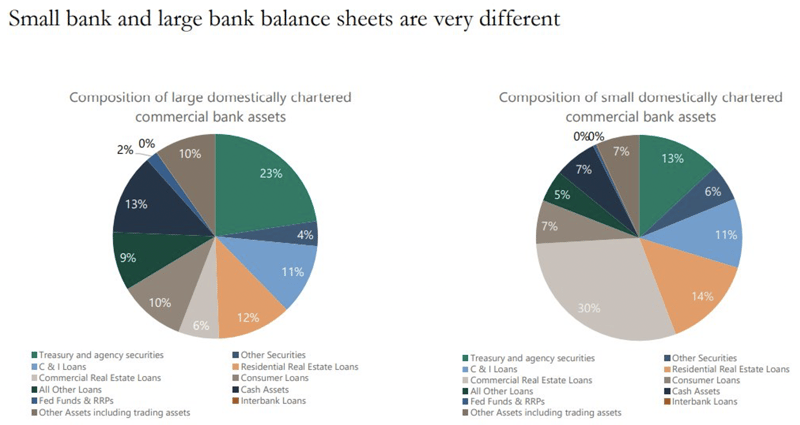

The resilience of the economy has thus far cushioned the market from more severe consequences. However, Federal Reserve Chair Jerome Powell recently acknowledged the challenges facing commercial real estate and the fallout we might see from it, indicating, “The CRE problem will be something the Fed will be working on for years,” noting that “There will be bank failures, but not the big banks.” (2/6/2024) Powell highlighted small banks for a reason. Approximately 70% of the $2.8 trillion in bank CRE loans are held by banks outside the top 25 in total assets and, as the chart below indicates, small bank balance sheets are on average made up of 30% CRE Loans, compared to just 6% for large banks. This disproportionate exposure suggests that smaller institutions may face heightened risks in the event of widespread loan defaults.

Source: Torsten Slok, Apollo Global Management as of February 29, 2024

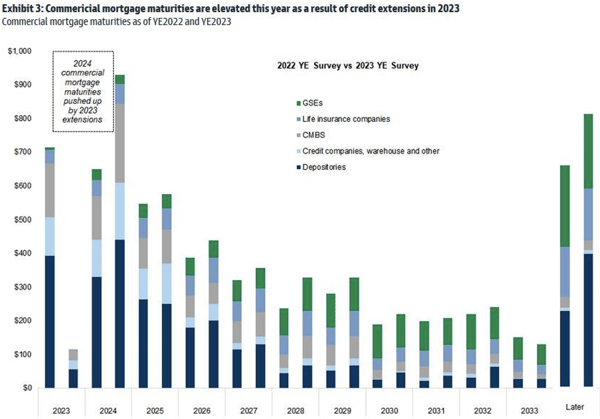

Unfortunately, a rise in defaults is likely on its way. For many properties, the rising cost of debt has yet to have a material impact because they are financed with long-term fixed-rate debt. That will change. Commercial mortgage maturities are set to pick up in the second half of 2024, with almost $1 trillion in CRE mortgages set to mature in the second half of 2024, which will have to be refinanced at now much higher interest rates.

Source: MBA, Goldman Sachs Global Investment Research

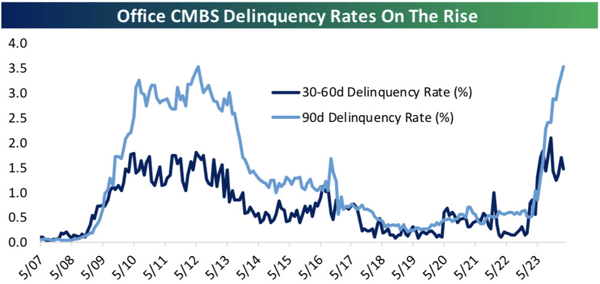

Beyond the challenges posed by rising interest rates, the commercial real estate sector must contend with shifting work environments, particularly in the office segment. Remote work trends accelerated by the COVID-19 pandemic have reshaped the demand for office space, with vacancy rates in the US approaching 20% and the rate of Commercial Office Mortgage-Backed Securities currently at 90-day delinquency is at its highest level since at least 2007, even greater than during the Great Financial Crisis in 2008/2009.

Source: Bespoke as of 2/29/2024

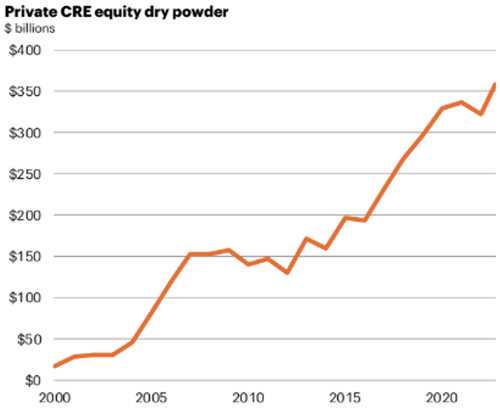

One potential silver lining for the CRE market is that capital remains available. There is more than $350 billion sitting in private real estate funds waiting to be deployed. This availability of capital, both on the equity and debt side, has likely acted to buffer valuations and may act as a backstop for the sector… at least for a while.

Source: Preqin, as of October 31, 2023

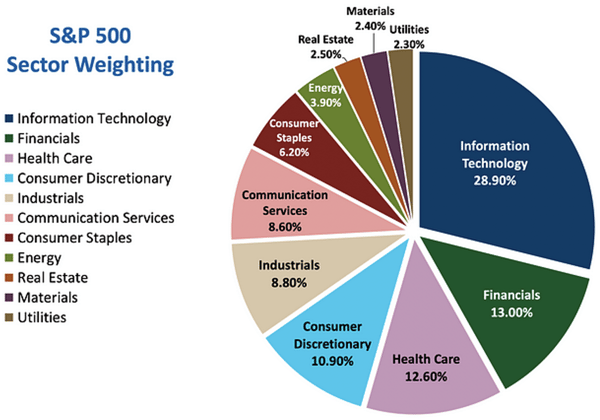

While an injection of capital from private funds may help the CRE market, it doesn’t necessarily help banks, as these investors are likely biding their time for opportunistic investments if and when banks need to unload these assets. The impact to US investment markets is to be determined. While Real Estate as a sector only accounts for approximately 2.5% of the S&P 500 cap weighting, financials (including small banks) account for a much more meaningful 13% of the index. And as we know from the Great Financial Crisis, contagion can have sweeping impacts on markets.

Source: Chris Murphy, Forbes as of December 29, 2023

For now, the key is to remain nimble. With the Federal Reserve again holding rates steady during their March FOMC meeting, we will see what the impact of “higher for longer” has on markets, not just commercial real estate. The current Tech run has insulated (or masked) much of the impact so far, but often changes in interest rates take time to filter through the market. While equity markets have remained resilient to start the year, a tactical approach within your portfolio may provide needed portfolio flexibility in the months to come.

Click below to subscribe to our Insights!

Receive email notifications when new articles are published

Disclaimer

Investing involves risk, including loss of principal. Past performance does not guarantee future results. There is no guarantee any investment strategy will generate a profit or prevent a loss.

This is for informational purposes only and is not a recommendation nor solicitation to buy, sell or invest in any investment product or strategy. Our materials may contain information deemed to be correct and appropriate at a given time but may not reflect our current views or opinions due to changing market conditions. No information provided should be viewed as or used as a substitute for individualized investment advice. An investor should consider the investment objectives, risks, charges, and expenses of the investment and the strategy carefully before investing.

Kensington Asset Management, LLC (“KAM”) relies on third party sources for some of its information that we believe is reliable. However, we make no representation, warranty, endorse or affirm as to its accuracy or completeness. The information provided is current as of the date of publication and may be subject to change. We are not responsible for updating this information to reflect any subsequent developments or events.

Certain information contained herein constitutes “forward-looking statements,” which can be identified using forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results, or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance, or a representation as to the future.

Advisory services offered through Kensington Asset Management, LLC, Barton Oaks Plaza, Bldg II, 901 S Mopac Expy – Ste 225, Austin, TX 78746.