Market Insights is a weekly piece in which Kensington’s Portfolio Management team will share interesting and thought-provoking charts that we believe provide insight into markets and the current investment landscape.

Cracks in the Foundation

On February 22nd, with shockingly little fanfare, office landlord Columbia Property Trust, which is controlled by PIMCO, defaulted on about $1.7B of mortgage notes on 7 buildings across the US. This followed a default by Brookfield Properties on $784 million worth of loans tied to two LA office towers earlier this month.

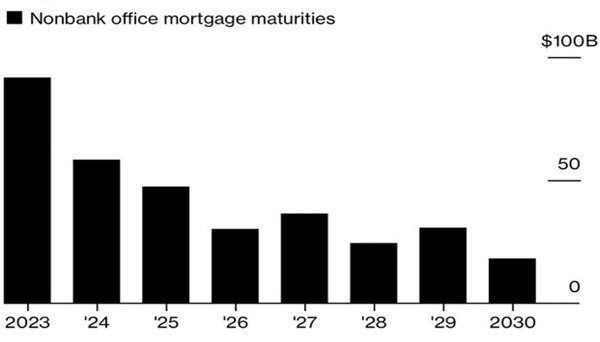

These defaults are likely just the beginning. After the Great Financial Crisis, many US commercial real estate loans were extended and are now coming due (below) and a staggering 48% of the 2023 loans are on a floating rate, meaning payments have skyrocketed over the last year as rates have risen.

Looming Maturities

Nearly $92 billion of nonbank office debt is set to mature this year

Source: Mortgage Bankers Association

Meanwhile, last week Blackstone fulfilled only 35% of redemption requests in February or $1.4B for its flagship $69 billion REIT, the Blackstone Real Estate Income Trust (BREIT). This marks the fourth month in a row they have limited withdrawals for the REIT. These are serious signs of potential trouble ahead, and it doesn’t stop with commercial real estate.

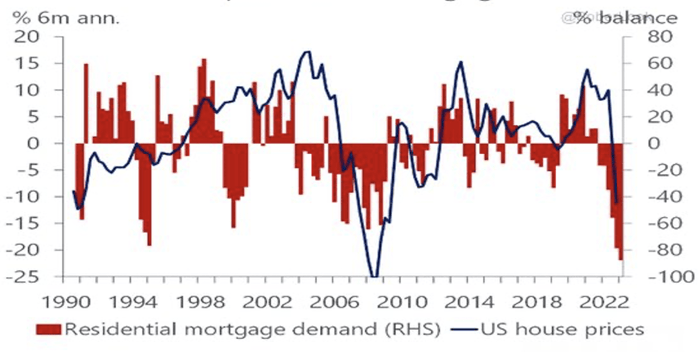

Residential Regression

Residential real estate is also flashing warning signs. Last week, the U.S. Mortgage Bankers Association noted that mortgage applications are down 44% over the last year and are currently at a 28-year low. Meanwhile, the drawdown in median new single-family home prices over the past three months through February, which is down approximately -14%, has been the worst drawdown on record.

US: Real House Prices and Mortgage Demand

Source: Oxford Economics / Haver Analytics

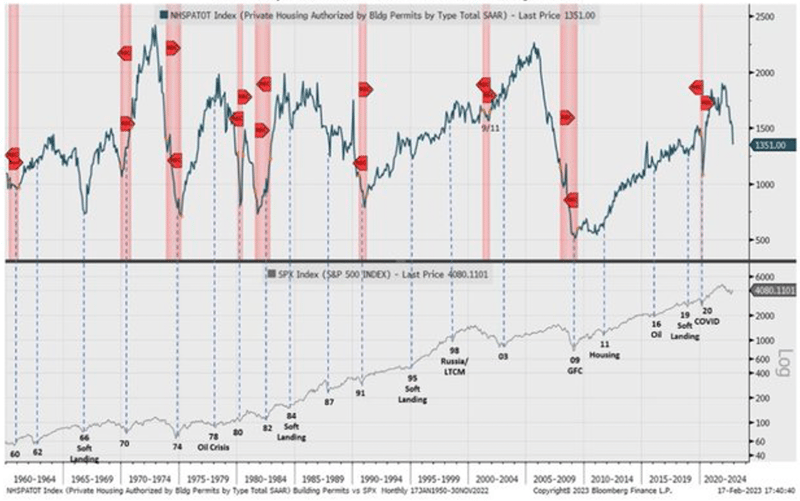

Market Implications

What does it mean for the market? Well, historically as real estate goes so goes the market. As the chart below shows, when the housing market drops the equity markets tend to follow. If we see continued downward pressure across real estate, which seems likely given prevailing rates, it could have significant implications for equity markets as well.

Historically, Market Bottoms Coincide with Housing Bottoms

It’s still unknown if these warning signs will ultimately result in significant market pain, but it’s a good reminder that rising rates have implications for all markets, and in some form or fashion each of these markets (equities, fixed income, real estate) are dependent on each other. Either way, a tactical investing approach may play a critical role in navigating what are sure to be interesting times ahead.

Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. This market insight is for informational purposes only and should not be construed as a solicitation to buy or sell, or to invest in any investment product or strategy. Investing involves risk including loss of principal.

Click below to subscribe to our Insights!

Receive email notifications when new articles are published