To be Uncertain is to be Uncomfortable, but to be Certain is to be Ridiculous

What is a Trend Following Strategy?

The title above comes from a Chinese Proverb that can be thought of as the philosophical rationale for trend following investment strategies. The only constant, both in life and in investing, is change. Although markets may seem unpredictable and volatile at times, broader directional patterns across investing cycles are often revealed. A trend following strategy seeks to use these patterns to make investment decisions, with three end goals in mind:

Be invested meaningfully while the trend is positive.

Be invested meaningfully while the trend is positive.

Be defensive and protect principal while the trend is negative.

Be defensive and protect principal while the trend is negative.

Remove subjectivity and emotion from the investing process to meet long-term objectives.

Remove subjectivity and emotion from the investing process to meet long-term objectives.

Kensington’s proprietary quantitative approach takes these trend-following basics and adds advanced analytics, using multiple indicators. The result is a more sophisticated process that strives to reduce trading frequency and “whipsaws,” or rapid price reversals that result in losses from false positive signals.

By having the flexibility to make tactical changes, trend-following strategies may be able to reduce occurrences of extreme negative returns. This also makes them effective diversifiers and complementary to traditional portfolio allocations.

Using Trend-Following in Fixed Income

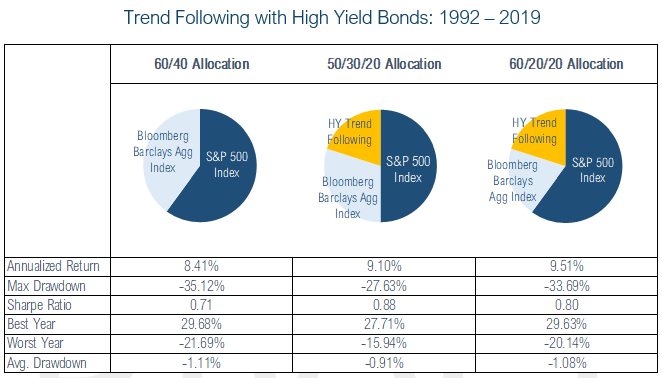

To demonstrate the potential benefits of incorporating a trend-following strategy, Figure 1 illustrates a model portfolio utilizing Kensington Analytics’ proprietary trend-following methodology on Morningstar’s High Yield Bond Fund Category index. This hypothetical trend-following model simply shifts between the High Yield Bond and Intermediate US Treasury Category indices.

Figure 1. Portfolio constructions with a Tactical High Yield Bond strategy utilizing Kensington’s proprietary trend following approach. Tactical allocation decisions are applied to Morningstar’s US High Yield Bond Fund Category and Intermediate US Treasury Indices from 1992 through the end of 2019. These category indices represent average performance of all US High Yield Bond Funds and all Intermediate US Treasury Funds, respectively. The 60/40 portfolio is constructed with the S&P 500 Total Return Index (“S&P 500 Index”) and Bloomberg Barclays US Aggregate Bond Total Return Index (“Bloomberg Barclays Agg Index”) as proxies for the equity and fixed income markets, respectively. Portfolios are rebalanced quarterly It is not possible to invest directly in an index, and indices do not include management fees.

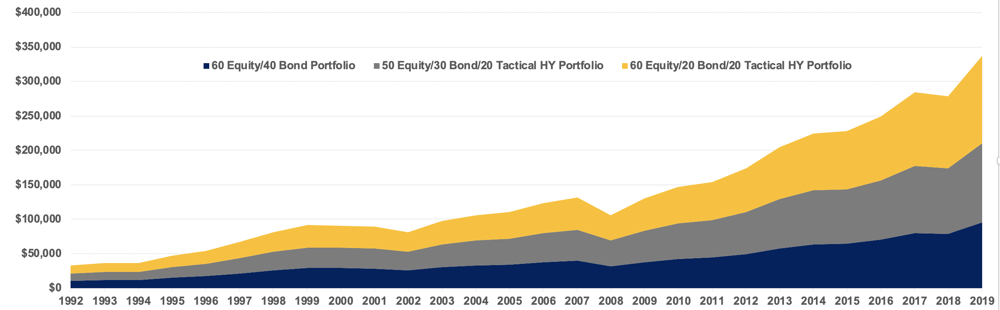

Figure 2. Portfolio constructions with a Tactical High Yield Bond strategy utilizing Kensington’s proprietary trend following approach. Tactical allocation decisions are applied to Morningstar’s US High Yield Bond Fund Category and Intermediate US Treasury Indices from 1992 through the end of 2019. These category indices represent average performance of all US High Yield Bond Funds and all Intermediate US Treasury Funds, respectively. The 60/40 portfolio is constructed with the S&P 500 Total Return Index and Bloomberg Barclays US Aggregate Bond Total Return Index as proxies for the equity and fixed income markets, respectively. Portfolios are rebalanced quarterly. It is not possible to invest directly in an index, and indices do not include management fees.

As shown here, adding a Tactical High Yield strategy into a traditional 60/40 allocation provides increased annualized returns with lower drawdowns. Looking at the annual returns in another way, Figure 2 depicts the returns of a typical 60/40 portfolio alongside portfolios which incorporate tactical high yield investing. As shown below, the traditional 60/40 portfolio achieved the best return only four years since strategy inception, compared to the 50/30/20 portfolio (five years) and 60/20/20 portfolio (19 years).

During stable conditions in the equity markets, investors are likely to give up some upside returns by substituting a portion of the equity portfolio for a Tactical High Yield strategy. However, the potential benefits are apparent over longer time periods due to the possibility of avoiding drawdowns by incorporating trend-following as a fundamental component of portfolio allocations. For long term investors seeking to limit periods of significant loss, as well as participate in upward market movements, Kensington believes a tactical, trend-following strategy should be strongly considered.

Important Risk Information

The S&P 500 Total Return Index (“S&P 500 Index”) is a capitalization weighted index of 500 stocks representing all major domestic industry groups. The S&P 500 Index assumes the reinvestment of dividends and capital gains. The Bloomberg Barclays US Aggregate Bond Total Return Index (“Bloomberg Barclays Agg Index”) is a market capitalization-weighted intermediate term index which tracks the performance of investment grade rated debt publicly traded in the United States. It is not possible to invest directly in an index, and indices do not include management fees.

Hypothetical Results Limitations. Performance illustrations herein reflect hypothetical, back-tested results, that were achieved by means of the retroactive application of a back-tested portfolio and, as such, the corresponding results have inherent limitations, including: (1) the portfolio results do not reflect the results of actual trading using client assets, but were achieved by means of the retroactive application of each of the referenced portfolios, certain aspects of which may have been designed with the benefit of hindsight; (2) back-tested performance may not reflect the impact that any material market or economic factors might have had on the adviser’s use of the hypothetical portfolio if the portfolio had been used during the period to actually manage client assets; and, (3) for various reasons (including the reasons indicated above), clients may have experienced investment results during the corresponding time periods that were materially different from those portrayed in the portfolio. The hypothetical results do not reflect the deduction of applicable transaction and/or custodial fees, the impact of which would decrease hypothetical results.