Kensington Brief: Achieving True Portfolio Diversification

Ever since Harry Markowitz introduced the concept of Modern Portfolio Theory in his 1952 paper “Portfolio Selection”, for which he won a Nobel Prize, the idea of utilizing diversification as means for constructing an effective portfolio has been the centerpiece of modern portfolio management. The Modern Portfolio Theory argues that any given investment's risk and return characteristics should not be viewed alone but should be evaluated by how it affects the overall portfolio's risk and return. That is, an investor can construct a portfolio of multiple assets that will result in greater returns without a higher level of risk.

The purpose of this Kensington Brief is not to challenge the premise of Modern Portfolio Theory. The practical effectiveness of the theory is without question a sound one. Diversification of assets in a portfolio absolutely reduces overall portfolio risk. The issue is not so much the theory, but how investors attempt to implement it. The key ingredient to diversification is identifying investments that demonstrate low correlation to each other.

Correlation, in the finance and investment industries, is a statistic that measures the degree to which two securities move in relation to each other, computed as the correlation coefficient, which has a value that must fall between -1.0 and +1.0. If two investments have a -1.0 correlation, they are considered to have perfect negative correlation, which means they move in exactly opposite directions. Alternatively, if two investments have a 1.0 correlation, they have perfect positive correlation. This implies that as one security moves, either up or down, the other security moves in lockstep, in the same direction. A correlation of 0.0 implies no linear relationship at all. The closer to 1.0 investments are to each other, the less diversification they provide to an overall portfolio.

The Style Box Problem

Traditionally, investors have attempted to achieve portfolio diversification by allocating across “style boxes”, a concept introduced by Morningstar in 1992 to help investors distinguish between different categories of investments. The Style Box is a nine-square grid that classifies securities by size along the vertical axis and by value and growth characteristics along the horizontal axis.

The premise is that “different investment styles often have different levels of risk and lead to differences in returns.” In theory, by investing across different “styles” an investor could achieve sufficient diversification to optimize a portfolio because they would have lower correlations to each other than multiple investments within the same “box”. This approach to diversification has worked with varying degrees of success over time, but the continued globalization of economies and investment markets correlations across different styles have increased and the value that this type of diversification provides has diminished, if it ever really existed at all.

The Analysis

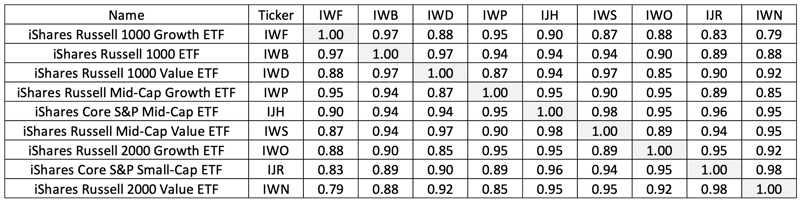

To demonstrate this, let’s evaluate the correlation between asset classes using broad based indices across each of the U.S. Equity Morningstar Style Boxes:

Source: Portfolio Visualizer. Calculations performed by Kensington Asset Management.The analysis period is from September 2001 to October 2022, measuring a

12-month rolling correlation using monthly returns. For this analysis we used the Russell indices, but any broad-based index group would yield similar results.

As you can see from the chart above, the simple fact is that allocating across different styles of investment provide very little actual diversification, with correlations ranging from a low of 0.79 to a high of 0.98 and an average correlation across the group a staggering 0.92.

This is not what Dr. Markowitz had in mind.

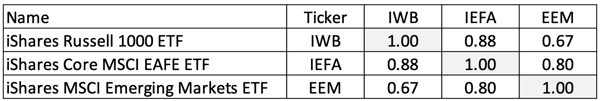

Even incorporating international securities does not improve the dynamics much (below). Measuring from November 2012 to October 2022 the correlation between the Russell 1000 and the MSCI EAFE Index, an index composed of large-, mid- and small-capitalization developed market equities, excluding the U.S. and Canada, yields a correlation of 0.88 to the Russell 1000 (US Large Cap Equities). While Emerging Markets provides slightly more diversification (0.67), this asset class typically represents a smaller piece of investors’ portfolios (if any), muting some of the benefits its diversification might provide.

Kensington’s Quantitative Approach

Trend following strategies are not uncommon and have been employed with varying levels of success for decades. There are several potential risks to trend following strategies, with the most common referred to as a “whipsaw trade,” whereby the price of a security abruptly reverses direction against the prevailing trend, leaving a strategy susceptible to missing out on gains by being out of the market, or suffering losses by being invested as the market turns down. There is a simple reason this occurs. Traditional trend-following strategies rely on an observable trend to develop before investing, but not all trends persist for the same amount of time, and many external factors can influence the direction of the market. This can lead to a strategy getting out of sync with the market direction and suffering losses.

The simple fact is there is no single indicator or group of indicators that can accurately assess every market environment. Low volatility market environments behave very differently than markets with persistently high volatility, and the most effective indicators to assess each of these types of markets may be vastly different. This is where we believe the Kensington approach is unique. At Kensington we employ an “adaptive” investment approach intended to identify and match the “speed of the market” by systematically adjusting model inputs and indicator parameters predicated on the environment prevalent at the time.

Source: Portfolio Visualizer. Calculations performed by Kensington Asset Management.

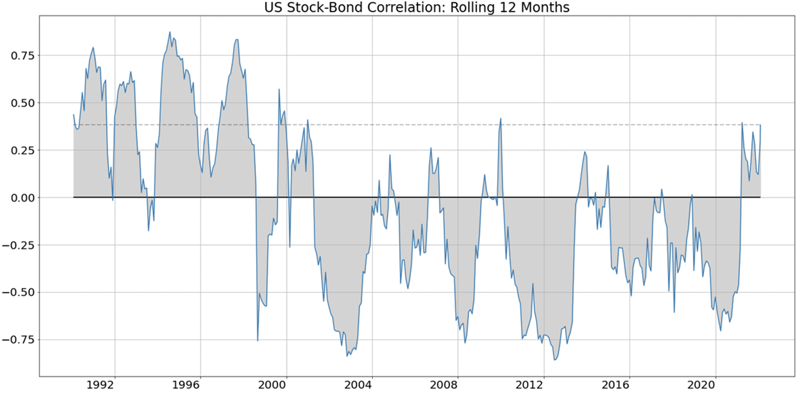

Even the most basic diversification principle, stock-bond diversification, has principally failed in 2022. While historically stocks and bonds have moved in inverse to each other, exhibiting a negative correlation (and natural hedge to each other), they have recently been increasing, diminishing the diversification benefits of paring the investments together, and questioning the effectiveness of a passive balanced approach all together.

Source: Norgate Data Calculations performed by Kensington Asset Management. Stock returns are represented by the S&P 500

and bond returns are represented by the par-weighted average of Bloomberg US Treasury Bond Index Data as of 9.30.2022.

Is Modern Portfolio Theory Dead?

Despite the above analysis, reports of Modern Portfolio Theory‘s death have been greatly exaggerated. The principles and benefits of diversification are as true as ever. What must be challenged is how we achieve true diversification within investment portfolios. Investing across style boxes may provide some diversification benefits, but perhaps more meaningful diversification can be achieved by distinguishing investments in different manners.

One alternative way to evaluate investments is by investment methodology as opposed to investment style box. At Kensington we employ a tactical investment strategy which seeks to tactically shift our market exposure based on our quantitative assessment of the current market environment. While we invest in many securities with the same “style” characteristics as shown above, our tactical methodology has historically delivered meaningfully lower correlation to our benchmarks than passive investment methods. See the correlation matrix below for our equity strategy, Dynamic Growth:

Source: Portfolio Visualizer. Calculations performed by Kensington Asset Management.

From the period of January 2015 to October 2022, Dynamic Growth has achieved a 0.52 correlation to its benchmark, the S&P 500 TR Index, well below any of the different equity “styles” shown above. Similarly, our fixed income strategy, Managed Income, has produced a much lower correlation coefficient to its benchmark, the Bloomberg Aggregate Bond Index (Analysis from January 2008 to October 2022), than typical fixed income investments, regardless of style category:

Source: Portfolio Visualizer. Calculations performed by Kensington Asset Management.

While our primary mandate as a firm is to generate steady, above average, positive returns with low volatility and downside protection, a byproduct of our tactical methodology is historically lower relative correlation to traditional, passive managers and indices. That is not an indictment on passive investments, as they can serve a meaningful role in a sufficiently diversified overall portfolio. The two approaches, at least historically, make a compelling partnership by diversification standards. Additionally, there are many types of investment styles and methodologies beyond passive and tactical, that may provide even further value to portfolio diversification when incorporated together.

Make no mistake, correlation is not the end all be all to portfolio construction. The risk and return of investments will ultimately drive portfolio performance and should be evaluated when determining portfolio construction. After all, an investment with low correlation, but low return and high risk is of little use to the end goal of wealth creation. However, the ability to incorporate a multitude of investments that meet an investor’s risk/return profile while also demonstrating lower correlation to each other is an effective path to true diversification in the manner that Modern Portfolio Theory intended.