Kensington Brief: Dynamic Growth - A Core Compliment

In our November 2022 Kensington Brief, Achieving True Portfolio Diversification, we discussed the concept of true portfolio diversification, Modern Portfolio Theory and how incorporating investments with low correlation to the market (and each other) may benefit investment portfolio performance. In this Brief we dive deeper and explore specifically where Kensington’s tactical equity strategy, Dynamic Growth, best fits in a portfolio and what impact it may have on overall performance.

A Case for Core Equity

In a Morningstar Style Box world, one of the challenges of incorporating tactical strategies like Dynamic Growth in portfolios is they do not fit neatly into one of the pre-defined boxes most investors use as a framework for diversification. Often this results in tactical strategies being labeled as an “alternative” investment or placed in some type of “other” bucket. While every investor portfolio is unique, and Dynamic Growth may make sense as an “alternative” investment for some, we believe a more appropriate allocation may be as a Core Equity allocation, complementing existing passive allocations across the equity spectrum. Let’s explore why.

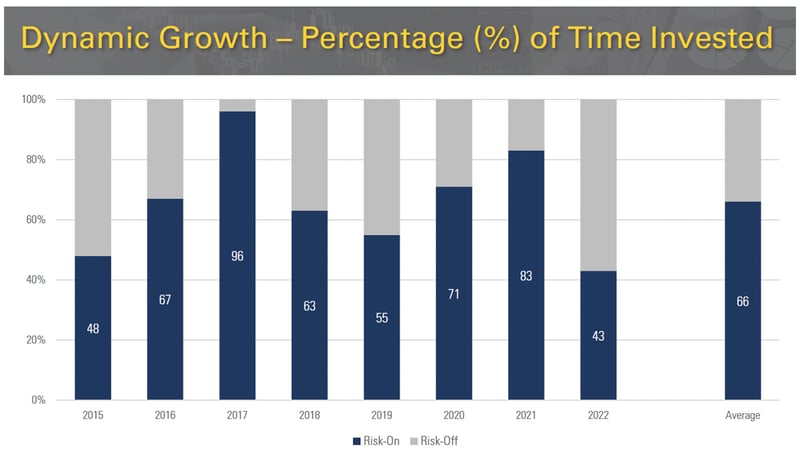

Dynamic Growth operates on a Risk-On and Risk-Off basis, shifting its portfolio offensively and defensively based on Kensington’s quantitative assessment of the market opportunity, positive or negative. The strategy has a bias toward being Risk-On and has historically been in that posture approximately 2/3rds of the time, although this can vary based on the prevailing market environment.

Risk exposure calculations are based upon calendar days. Average is calculated as of 12/31/22

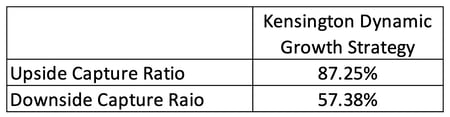

When Risk-On, Dynamic Growth primarily invests in ETFs that track broad-based U.S. equity market indices. So, despite its flexible mandate to shift defensively, its base posture is that of a Core Equity strategy typically allocating to both growth and value stocks with an emphasis toward large cap. The Strategy can also be adaptive, tilting the allocation more towards growth or value or even down the capitalization stack to include exposure to small and mid-capitalization companies to take advantage of prevailing market conditions. Conversely, Dynamic Growth shifts to Risk-Off, moving to cash and/or U.S. Treasuries, when our quantitative system determines there is weakness in markets with the goal of sidestepping volatility and avoiding drawdowns. This is perhaps best illustrated by evaluating the Strategy’s upside and downside capture ratios, which determines how much the Strategy participates in the upward and downside movement of its stated benchmark. For Dynamic Growth that benchmark is the S&P 500 TR Index.

Calculated through Dec 2022 since inception

Historically, Dynamic Growth has participated in over 87% of the S&P 500’s upward movement, while avoiding over 40% of the benchmark’s downside movement. In short, the Strategy acts more like a Core Equity strategy when you want it to (upside) and less so when you don’t want it to (downside).

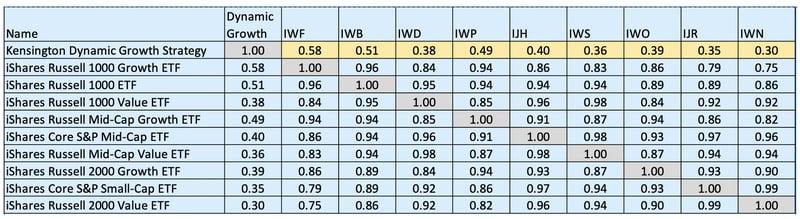

When evaluating Dynamic Growth as a Core Equity holding, it can operate on a stand-alone basis, but may be best utilized as a complement to other passive equity allocations, given its low correlation to the US stock market, regardless of style category. As seen below, Dynamic Growth maintains a 0.58 correlation or less to the below assortment of equity classifications, with an average correlation of 0.42, compared to an average correlation of 0.90 amongst all other pairings.

Source: Portfolio Visualizer. Calculations performed by Kensington Asset Management. The analysis period is from January 2015

to December 2022, measuring a 36-month rolling correlation using monthly returns. For this analysis we

used the Russell indices, but any broad-based index group would yield similar results.

Portfolio Impact – Fortifying the Core

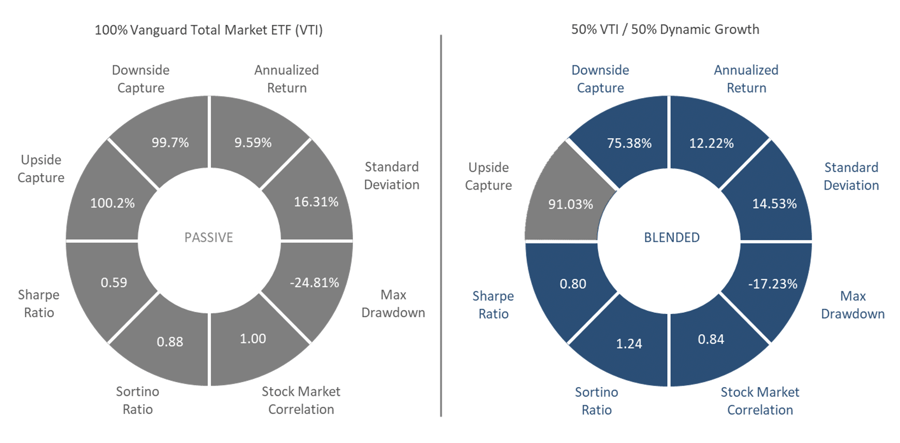

As mentioned in our previous brief, while correlation is important, it is not the end all be all to portfolio construction. The risk and return of investments will ultimately drive portfolio performance and should be evaluated when determining portfolio allocations. So, let’s evaluate how Dynamic Growth impacts a portfolio when utilized as a complement to an otherwise diversified (Large/Small/Value/Growth) equity portfolio. For this analysis we will use the Vanguard Total Stock Market ETF (Ticker: VTI) as a proxy for an overall US stock allocation, as the ETF spans across the Large-Small, Value-Growth spectrum. Comparing a portfolio made up solely of VTI versus a portfolio split evenly between VTI and Dynamic Growth for the time period beginning January 2015 to December 2022 yields the following results across numerous portfolio statistics:

The Blended Portfolio, which incorporates both a passive (VTI) and active (Dynamic Growth) strategy outperformed the 100% passive portfolio in virtually every statistical category including annualized return, standard deviation, max drawdown and each of the risk adjusted return metrics (Sharpe, Sortino). It is for this reason we believe utilizing Dynamic Growth as a complement to existing Core Equity allocations makes sense for most investors. Ultimately however, what bucket Dynamic Growth is placed in is irrelevant to its impact on a portfolio. Investors should consider this strategy, and all strategies, by their impact on overall performance of a portfolio, not by style boxes.

This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact the professional advisor of their choosing.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Kensington Asset Management, LLC (“KAM”). No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by KAM or any other person. While such sources are believed to be reliable, KAM does not assume any responsibility for the accuracy or completeness of such information. KAM does not undertake any obligation to update the information contained herein as of any future date.

There is no guarantee that the investment objectives will be achieved. Moreover, the past performance is not a guarantee or indicator of future results.

Investing in securities involves risk, including loss of principal. The risks associated with this Strategy include general market risk, credit risk, interest rate risk or risk of the portfolio not performing as expected.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular strategy. For example, a strategy may typically hold substantially fewer securities than are contained in an index.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.