Kensington Brief: The Importance of Limiting Drawdowns

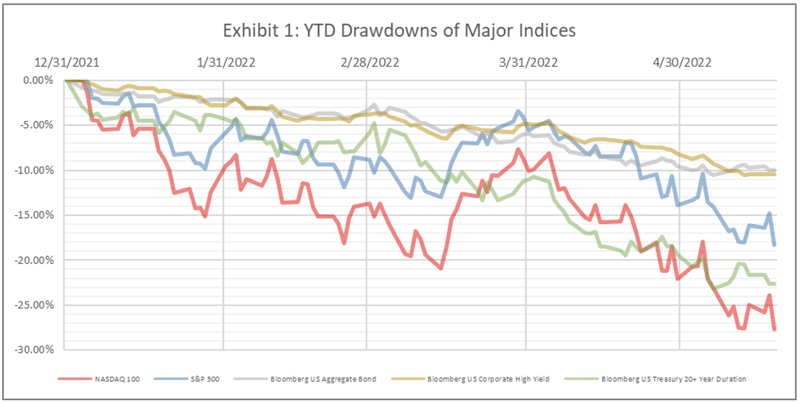

As noted in our April 2022 Monthly Market Commentary, the S&P 500 is off to its worst four-month start to a calendar year for the Index in over 80 years, down 13.3% through April. Meanwhile, according to Edward McQuarrie, in a recent Wall Street Journal article, the broad bond market has performed worse through the first four months of 2022 than in any complete year since 1842! With a historically difficult start to the year for both stocks and bonds (Exhibit 1), and uncertainty still ahead, it’s as important as ever to consider the importance of avoiding significant drawdowns in client portfolios and, more importantly, identify strategies that may help to combat them.

Data provided by Bloomberg Financial L.P.

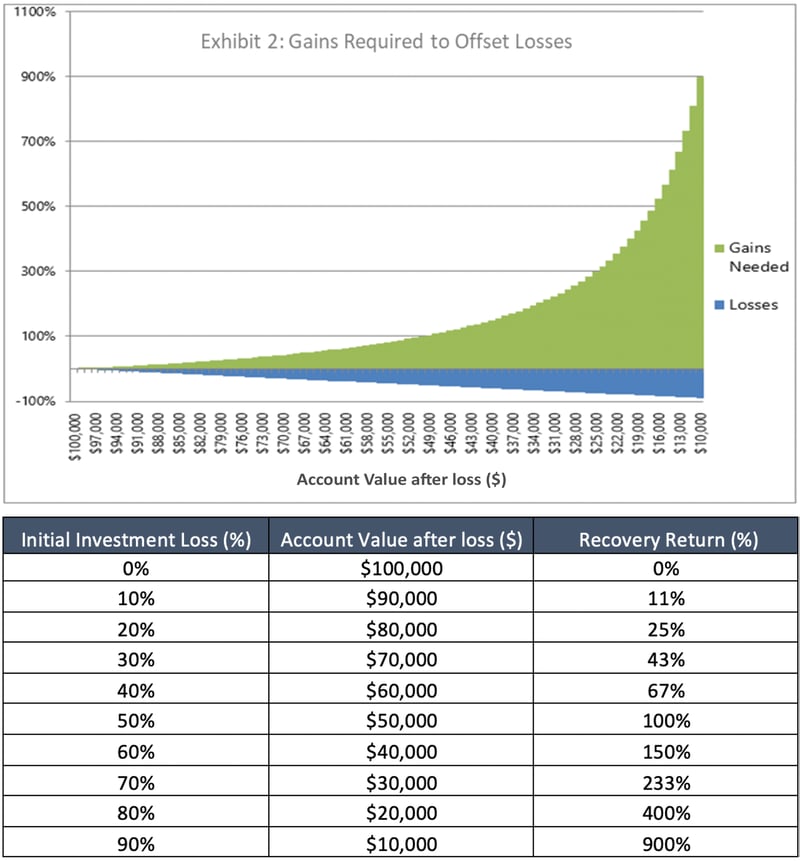

Warren Buffett famously said, “The first rule of investing is to not lose money, and the second rule is to not forget the first rule.” Although most investors instinctively focus on their portfolio’s upside performance, it is their ability to mitigate downside risk that defines their long-term investment success. This is because steep market declines create large holes from which investors must recover. As losses grow ever larger, so too does the subsequent return needed to get back to the pre-decline starting point.

Source: Kensington Asset Management, LLC

No doubt you’ve seen the above chart, or one like it, many times. It is commonly used because it speaks to the fundamental importance of limiting drawdowns. Recovering from portfolio losses can set clients back from achieving their goals, and the impact of a loss to a portfolio can be far more impactful than the same corresponding gain. We accept this to be true, but let’s break down why this is in fact the case. It comes down to two primary components: compounding interest and the percentage illusion.

Principle of Compounding Interest

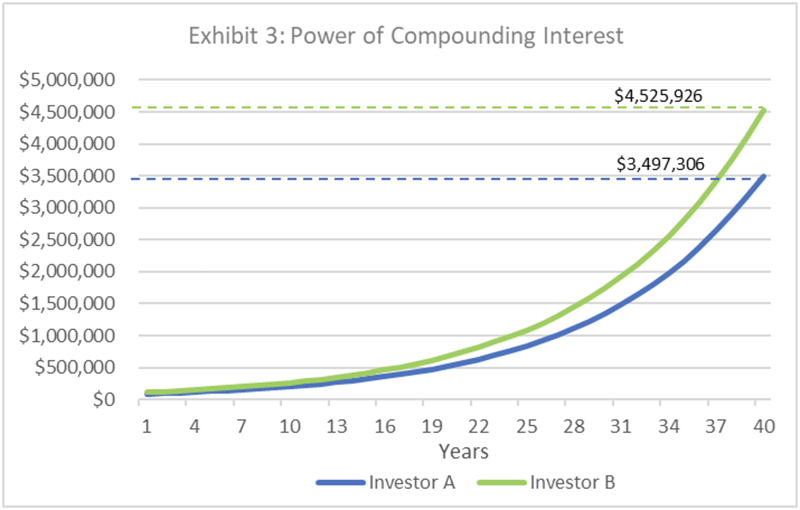

The benefit of compounding is maximized when a portfolio can feed on itself or, as Ben Franklin once said, "Money makes money. And the money that money makes, makes money". Portfolio losses take away from the ability to compound prior gains and force an investor to compound future growth from a lower dollar balance.

To highlight this point, suppose there are two investors, A and B, each with $100,000 portfolios. In year 1, investor A loses 15% and then goes on to earn 10% every year thereafter. Investor B earns 10% every year (avoiding the 15% drawdown in year 1). After 40 years, investor B will have amassed over $1 million more than investor A, solely because of investor A's initial $15,000 setback. This is the power of compounding.

Source: Kensington Asset Management, LLC

Percentage Illusion

Percentage Illusion refers to the phenomenon that even when positive and negative percentage returns are identical (-10% and +10%), they do not have the same corresponding impact on an investment. As shown in the graphic above, a 10% loss to a portfolio will require an 11.1% gain, not 10%, to make the investment whole again. The greater the loss, the greater the impact of this phenomenon. A 30% loss requires a 43% gain, a 50% loss requires a 100% gain, and on and on. Perhaps the most significant aspect of this reality is that the required corresponding gain needed to offset a loss grows parabolically the larger the loss gets. Simply put, the larger the drawdown, the larger the corresponding required climb.

Methods to Combat Drawdowns

The easy part is identifying the problem. We all know portfolio losses are bad. The hard part is doing something about it. For the past two decades, the most commonly employed tactic to drawdown avoidance has been through traditional stock/bond diversification. However, as discussed in our April 2022 Kensington Insights piece, and highlighted by the parallel declines in both equity and fixed income markets to start the year, the traditional 60/40 portfolio is not effective in limiting losses when stock-bond correlations are high, as they are today. In today’s landscape, a different approach may be needed, and there are several to consider, each with their own strengths and weaknesses:

Hedging Strategies

Made popular by hedge funds over the past several decades, hedging is a risk management strategy employed to offset losses in investments by taking an opposite position in a related asset. Hedging strategies typically involve derivatives, such as options and futures contracts. These strategies can be effective in limiting losses but can be complicated to employ and monitor for an average investor.

Risk Parity Allocation

The risk parity approach to portfolio construction seeks to allocate investment capital on a risk-weighted basis to optimally diversify investments, viewing the risk and return of the entire portfolio as one. Unfortunately, risk parity requires a great deal of quantitative calculation, which makes its allocations more advanced than simplified allocation strategies and are less effective when correlations across portfolio assets rise.

“Non-traditional” Investments

Looking beyond stocks and bonds for more complete diversification is another popular approach to combat drawdowns as more and more “alternative” investments move downstream. Allocations to non-marketable assets such as real estate, infrastructure and private equity can provide additional diversification to a portfolio, but can also be expensive, illiquid and difficult to access.

Kensington’s Approach

At Kensington, we take a different approach to limiting losses in our investment vehicles. The core of Kensington’s quantitative strategies is centered around downside protection by tactically shifting our market exposures based on proprietary models that employ trend following principles in order to identify and act upon prevailing market trends.

Rather than seeking to limit the impact of drawdowns through any of the strategies outlined above, we employ a methodology that seeks to avoid significant drawdowns in the market while participating in uptrends through the use of our risk-on and risk-off indicators. This philosophy is enacted through a methodology we refer to as "risk pivoting". We've designed each of our strategies to have the flexibility to dial up or down exposure to markets based on model signals, and when deemed appropriate exit markets completely until a more favorable environment is perceived to exist.

You can find a deeper dive into this methodology and how it can be effective in avoiding significant drawdowns in our Kensington Insights piece from April 2020 titled Trend Following and Tail Risk. Ultimately, sometimes the best way to win is by not losing. Market fluctuations and periods of drawdown are a certainty in the investing world, but an investor’s effectiveness in combatting them could make the difference in achieving long-term investment goals.