Market Insights is a weekly piece in which Kensington’s Portfolio Management team will share interesting and thought-provoking charts that we believe provide insight into markets and the current investment landscape.

Banking on Liquidity

In the wake of the stunning Silicon Valley Bank (“SVB”) crisis in which the bank was ultimately shut down by regulators, there is growing concern that similar issues could spread to other U.S. banks in the coming months. Let’s examine what happened to SVB and the potential for contagion across the banking industry.

Unrealized Gains (Losses) on Investment Securities

Source: FDIC | Note: Insured Call Report filers only

The Backstory

Banks are big investors in assets like Treasury bills because they need safe places to park deposits. Over the past several years, financial institutions have piled into T-bills during a period of historically low interest rates.

The problem this creates for banks is simple: when rates moved higher as the Federal Reserve sought to combat inflation, it lowered the value of existing bonds on banks’ balance sheets. The FDIC in February reported that U.S. banks' unrealized losses on available-for-sale and held-to-maturity securities totaled $620 billion as of Dec. 31, up from $8 billion a year earlier before the Fed's rate push began (above).

This is an issue for all banks to varying degrees. For SVB the problem was particularly acute. Banks don't have to realize losses on bonds that may have gone down in value amid rising rates if client deposits remain sufficient to cover liquidity requirements. But for SVB, being a VC and tech-focused bank, their clients have a high rate of cash burn and the bank needed ongoing deposits to cover the liquidity demands from their clients, particularly with decreasing bond values. When ongoing deposits dried up SVB was forced into selling these securities at significant losses.

The good news is that the biggest U.S. banks are much stronger than they were in the lead up to the last big banking crisis, in 2008, in part because regulators forced them to hold more capital and survive numerous stress test scenarios over the last decade and a half. And the giants have more diverse funding and customer bases than banks such as SVB, which gives them many more options during challenging times.

Liquidity is Key

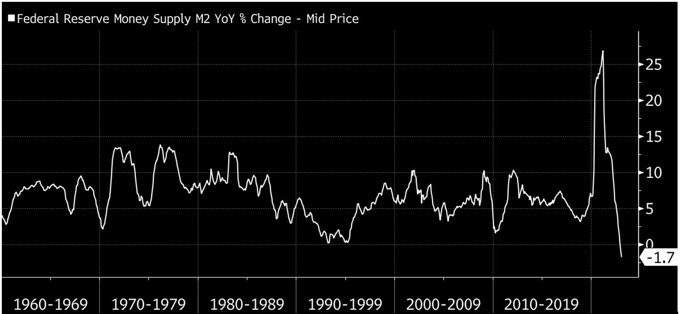

One thing to keep an eye on moving forward is overall market liquidity. Liquidity is key for banks. Unfortunately, we’ve been steadily seeing the money supply decline. M2 data for January 2023 was at -1.726% YoY; December 2022 was -1.31% YoY. There hasn’t been a negative M2 print (prior to now) in modern history (dating back to at least 1959), so we’re in somewhat uncharted territory in that regard.

Source: Bloomberg

Other Banking Concerns

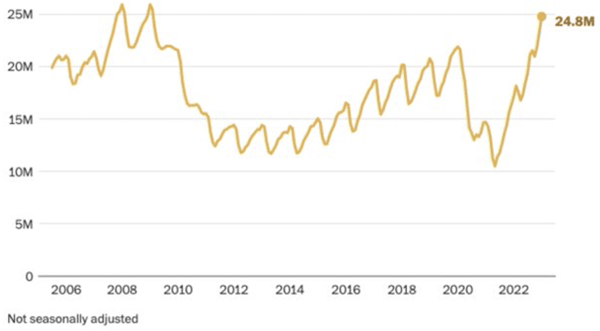

It’s not just the unrealized losses on their bond portfolios that may cause further stress in the banking sector. We discussed growing concerns in the real estate market in last weeks’ Market Insights piece, which most certainly impacts banks. We may also be facing a corporate and consumer loan default issue. As seen below, delinquencies on consumer loans have skyrocketed in recent months, reaching levels we haven’t seen since the Great Financial Crisis.

Total Delinquent Consumer Loans in the United States

Includes credit card, auto loans and consumer finance loans

Source: Moody's Analytics, Equifax | The Washington Post

With the upcoming Federal Reserve Board meeting scheduled for March 22, it will be interesting to see how the Fed views these risks against their broader mandate to fight inflation. While it seems unlikely at this time that the broader banking system will face anything close to the issues SVB was faced with, further challenges are likely to surface. Incorporating more nimble investment strategies that can seek to sidestep the fallout from future disruptions may be appropriate.

Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. This market insight is for informational purposes only and should not be construed as a solicitation to buy or sell, or to invest in any investment product or strategy. Investing involves risk including loss of principal.

Click below to subscribe to our Insights!

Receive email notifications when new articles are published