Market Insights is a weekly piece in which Kensington’s Portfolio Management team will share interesting and thought-provoking charts that we believe provide insight into markets and the current investment landscape.

The last two weeks have produced a whirlwind of news that will likely impact markets for the foreseeable future. Given the relative turmoil, it’s interesting how varying segments of the market have reacted, particularly the disparity between equity and fixed income markets.

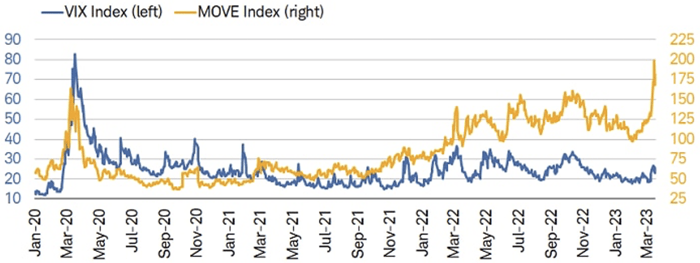

As shown below, equity volatility, at least as measured by the VIX Index, has been fairly muted. The same can't be said about bond market volatility (MOVE Index), which nearly eclipsed the 200-level last week – a height not seen since the Great Financial Crisis in 2008. Historically, these measures have been in relative synchronicity, but a divergence has clearly occurred recently. This could be the result of several factors, including the increased use of ODTE options for the S&P 500 in recent months, which we discussed in our February 23rd Market Insights piece.

Source: Charles Schwab

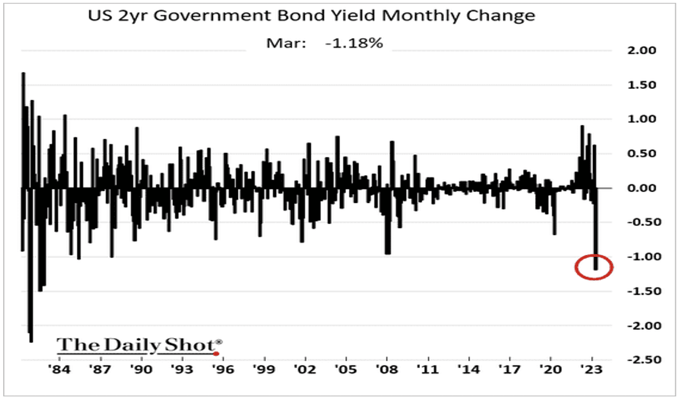

Additionally, the rise in bond market volatility clearly resulted in (or was a biproduct of) one of the most dramatic swings in treasury yields in recent memory. Two-year Treasuries Notes in particular saw a remarkable swing last week with yields dropping over 100bps last Monday alone (the largest one day move in 3 decades) and ending the week at 3.84% (after being over 5% the week prior).

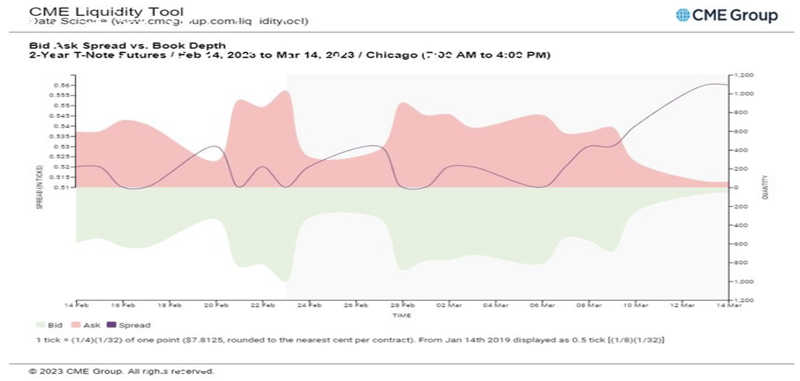

The cause of the increased volatility and drop in yields is multi-faceted. A shift in Fed expectation going forward and significant short covering played major roles. Another cause, and one that is likely to be more persistent, is a lack of liquidity in these markets. Last week the liquidity in 2-yr Treasury futures vanished, and bid/ask spreads widened considerably (below). We wrote about the causes and impact of limited market liquidity last year in our July 2022 Kensington Brief, and this will likely continue to be a driver of volatility across market segments.

Regardless of the cause, heightened volatility across markets is likely to persist until there is more clarity on not just the banking system, but Fed policy and the economy. Adding fuel to the fire, signs continue to point to an inevitable recession, which will only exacerbate market volatility. The latest indication for recession came last week from the Conference Board, who published their Leading Economic Index (LEI) for February, which has now fallen on a month-over-month basis for 11 consecutive months—a streak that has never occurred (back to 1960) without the U.S. economy already being in a recession (below).

Source: Charles Schwab

If and when a recession comes is unknown, but volatility has arrived and is not likely to exit the market any time soon. Navigating these environments can be challenging, but we believe a disciplined, tactical approach makes sense in this environment as part of a portfolio’s overall asset allocation plan.

Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. This market insight is for informational purposes only and should not be construed as a solicitation to buy or sell, or to invest in any investment product or strategy. Investing involves risk including loss of principal.

Click below to subscribe to our Insights!

Receive email notifications when new articles are published