Market Insights is a weekly piece in which Kensington’s Portfolio Management team will share interesting and thought-provoking charts that we believe provide insight into markets and the current investment landscape.

Stagflation Risks in Focus

Federal Reserve Chairman Powell announced on Wednesday that the Federal Open Market Committee (“FOMC”) would raise the Effective Federal Funds Rate 25bps to a target rate of 5.00-5.25% with a forecast to hold rates at this level through the remainder of the year. The market, however, is pricing in approximately 3 rate cuts in the second half of the year in anticipation of a potential recession. This impasse is a perfect opportunity to discuss the central banks’ least favorite word: stagflation.

Stagflation is a condition in which slow economic growth (stagnation), rising prices (inflation), and rising unemployment all occur simultaneously. While uncommon in the US, it has occurred before, most notably during the 1970s oil crisis, which caused a recession that included five consecutive quarters of negative GDP growth, inflation doubling and the unemployment rate reaching 9% in May 1975.

The problem with stagflation for the Federal Reserve is that the ways to fight either one of those two primary problems – high inflation, low growth – usually end up making the other one even worse. Central Banks can increase interest rates to reduce inflation or cut interest rates to reduce unemployment. It can’t do both at the same time.

Current Conditions

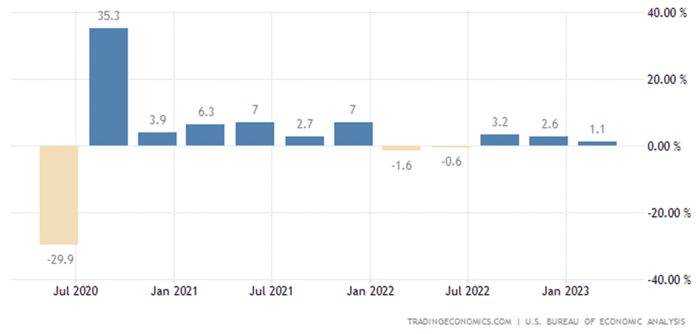

Gross Domestic Product (“GDP”) (Q1 2023): The US economy grew by an annualized 1.1% in Q1 2023, slowing from a 2.6% expansion in the previous quarter and missing market expectations of 2% growth. It was the weakest pace of expansion since Q2 2022, as business investment growth slowed down, inventories declined, and rising interest rates continued to hurt the housing market.

United States GDP Growth Rate

The negative trend for GDP is concerning and forecasts going forward are not much better, with the Federal Reserve Bank of Atlanta’s GDPNow forecast for Q2 currently sitting at 1.8%. GDP does not have to be negative for stagflation to occur, it just requires stagnation, which current and forecasted levels qualify.

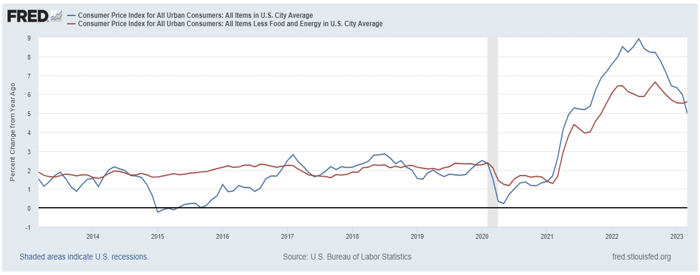

Inflation: For March 2023, the US Consumer Price Index came in at 4.98% YoY, compared to 6.04% in February and down from a high of 9.1% in June 2022. The so called “sticky” CPI, which strips out more volatile components like food and energy came in at 5.6% for March, marginally below its peak of 6.6% in September 2022.

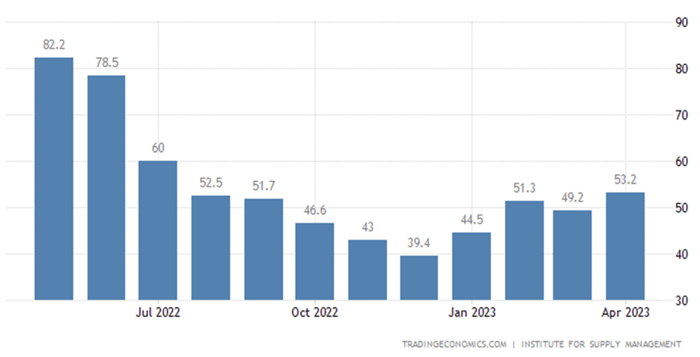

Fed action over the last 12 months has tempered inflationary pressures, but inflation remains significantly above the Federal Reserve’s target of 2%. Perhaps most concerning is that the stickier components of inflation have leveled off but are yet to see any real movement down. Adding to the concern, the most recent ISM (Institute of Supply Management) report showed the ISM Manufacturing Prices Paid Index, as seen below, moved up to 53.2 (from 49.2 in March), an expansionary reading, and one that could make getting inflation rates lower significantly more difficult.

United States ISM Manufacturing Prices Paid

Employment

The U.S. job market has remained healthy despite other weak spots in the broader economy. The unemployment rate was 3.5% in March, a tick above January’s half-century low of 3.4%. While positive for workers, Federal Reserve policymakers worry that a tight job market puts upward pressure on wages — and on overall prices, something that may influence future rate decisions.

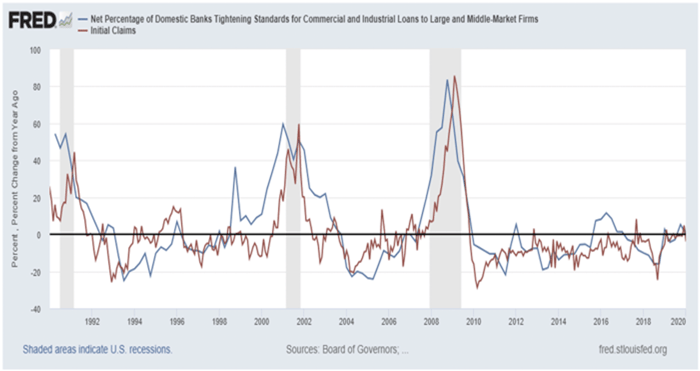

While currently strong, labor markets may soon be under pressure. As noted in our April 13th Market Insights piece, bank lending standards have continued to increase, something that has historically had a very high correlation to layoffs (below). If lending standards don’t dissipate, weakness in the labor market could be on the horizon.

Stagflation Impact on Markets

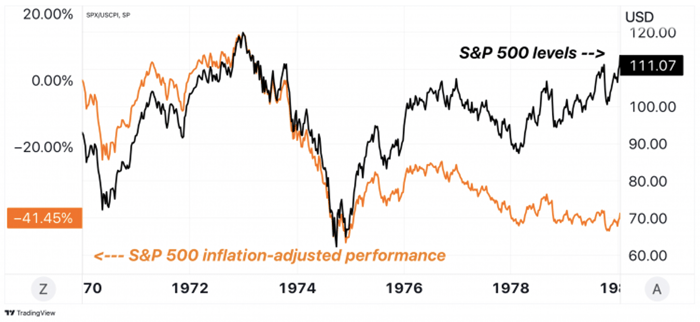

As you would expect, both stocks and bonds tend to underperform when stagflation occurs, particularly in terms of real return (nominal return less inflation). Stocks are hampered by slow economic growth while high inflation erodes bond returns. As you can see from the chart below, the last period of US stagflation (1970s) brought significant drawdowns to the market and a negative 41.45% real return for the S&P 500 for the entire decade.

Between a Rock and a Hard Place

If economic growth continues to stall and unemployment rises, the Fed will be faced with a challenging decision. Do they lower rates as the market predicts or hold steady on rates to combat inflation and risk elevated interest rates crippling growth? For what it’s worth, Powell has consistently indicated his aim is to avoid a scenario like the 1970’s, when interest rates were eased too soon, leading to another bout with inflationary pressures. When push comes to shove, does the Fed fight slow growth or inflation? As noted previously, it can’t do both at the same time, which is what makes the possibility for stagflation so concerning.

Forward-looking statements are based on management’s then current views and assumptions and, as a result, are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. This market insight is for informational purposes only and should not be construed as a solicitation to buy or sell, or to invest in any investment product or strategy. Investing involves risk including loss of principal.

Click below to subscribe to our Insights!

Receive email notifications when new articles are published